Amid the recent upheaval in the US banking sector, various financial experts and notable figures have offered insights into the safest avenues for investors to safeguard their assets. Notably, Robert Kiyosaki, the author of “Rich Dad Poor Dad,” has sounded the alarm about an impending banking crisis and has endorsed Bitcoin as a reliable “parachute” to soften the impact.

Bitcoin, A Parachute For The Banking Crashlanding?

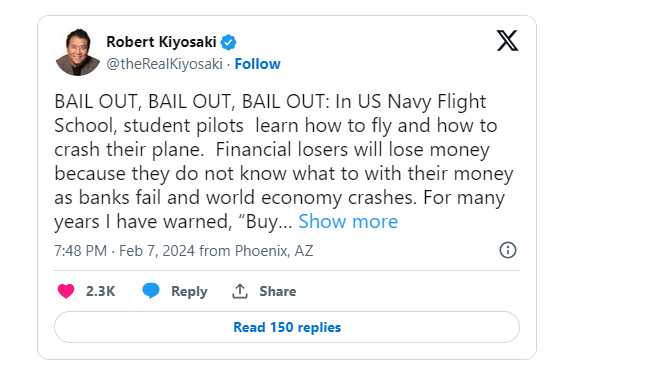

Robert Kiyosaki, addressing his extensive following of 2.5 million on X (formerly Twitter), sounded a cautionary note regarding the potential turbulence looming ahead for both the banking system and global economies.

Employing a vivid analogy, the acclaimed author of “Rich Dad, Poor Dad” drew parallels between the training regimen of the US Navy Flight School and the dynamics of the contemporary financial system. In this comparison, student pilots are adeptly trained to handle and safely navigate aircraft during moments of mechanical failure, ensuring they can successfully land even under adverse conditions.

However, Kiyosaki astutely highlighted a critical contrast: while trained pilots are equipped with the necessary skills to handle crises, many individuals in the financial realm, whom he refers to as “financial losers,” often find themselves ill-prepared and clueless when faced with the aftermath of a banking collapse and subsequent economic downturn.

In response to the uncertain outlook, Kiyosaki advised investors to “bailout,” cautioning against the expectation of a soft landing in the current economic climate. Furthermore, he reiterated his steadfast belief in certain assets that serve as protective shields during economic crises, singling out Bitcoin, gold, and silver as reliable “parachutes” for weathering turbulent times.

Kiyosaki’s latest warning comes amidst heightened concerns surrounding a potential recurrence of the regional banking crisis experienced in 2023. Nearly a year ago, the collapses of Silvergate, Silicon Valley, and Signatures sent shockwaves through the banking sector, triggering economic turmoil across the US.

Presently, apprehensions regarding the stability of the regional banking sector in the US have been significantly amplified following recent reports of substantial losses incurred by New York Community Bancorp (NYCB) in the final quarter of 2023. Notably, NYCB, which acquired Silvergate in the aftermath of the 2023 crisis, witnessed a staggering 45% decline in its share price just a week ago, signaling potential instability within the sector.

A Shield Stronger Than Gold

Other notable figures within the financial sector have recently chimed in on the looming specter of a banking collapse, offering investors potential avenues to safeguard themselves against the impending economic turmoil.

BitMex Co-founder Arthur Hayes made direct commentary on the news surrounding New York Community Bancorp (NYCB), boldly predicting the institution’s future bankruptcy. Hayes also espoused his conviction in Bitcoin’s potential, suggesting that its price could soar to $1 million, underscoring his unwavering faith in the digital asset.

Meanwhile, Ark Invest CEO Cathie Wood weighed in on the evolving narrative surrounding Bitcoin’s role as a “flight to safety,” particularly in light of the recent approval of spot Bitcoin Exchange-Traded Funds (ETF) by the US Securities and Exchange Commission (SEC). Wood expressed optimism about Bitcoin’s trajectory, asserting that it will eventually outshine gold as an investment asset:

“In comparison to gold, Bitcoin’s ascent has been notable. There’s currently a shift towards Bitcoin, and we anticipate this trend to persist, especially now that there are more streamlined avenues to access Bitcoin.”

Bitcoin has been experiencing an overall bullish trend in the early stages of 2024, with the approval of spot Bitcoin ETFs by the US SEC further fueling optimism among investors. However, temporary concerns arose due to outflows from the Grayscale Bitcoin ETF (GBTC), momentarily driving the price below the $40,000 threshold.

Nevertheless, Bitcoin’s resilience has been evident, with its price steadily climbing in recent days. According to data from CoinGecko, BTC has witnessed a 6% increase over the past week, and as of the latest update, it is trading at $44,764.5, marking a notable 4.2% surge in the last 24 hours.