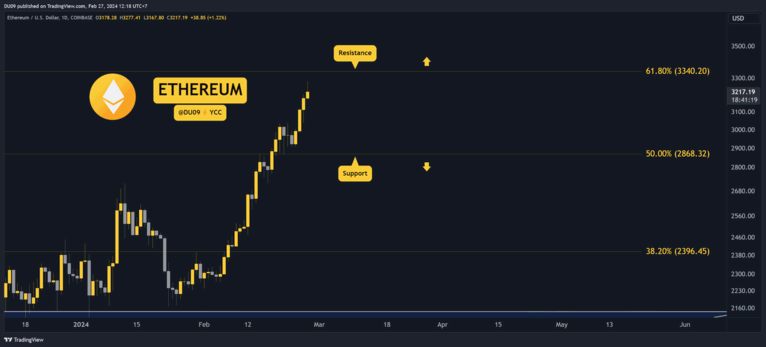

1. New Yearly High

The upward momentum of the ETH rally shows no signs of abating. Today, the price surged beyond $3,200, marking another milestone in its upward trajectory. However, this surge was followed by a brief pullback. Notably, the key resistance level at $3,340 looms close, presenting a potential opportunity for sellers to re-enter the market. Observers are advised to monitor this critical level closely, as it could determine the direction of ETH’s movement in the near future.

2. Momentum Indicators Remain Bullish

The prevailing bias regarding this price action remains bullish. Nevertheless, it’s worth noting that the recent surge to a new yearly high lacked the same level of trading volume seen in previous instances. This discrepancy suggests a potential cause for concern. If the buying volume fails to pick up and match the pace of previous rallies, there is a risk that sellers could regain control of the market. It underscores the importance of closely monitoring trading volume dynamics to gauge the sustainability of the current bullish trend.

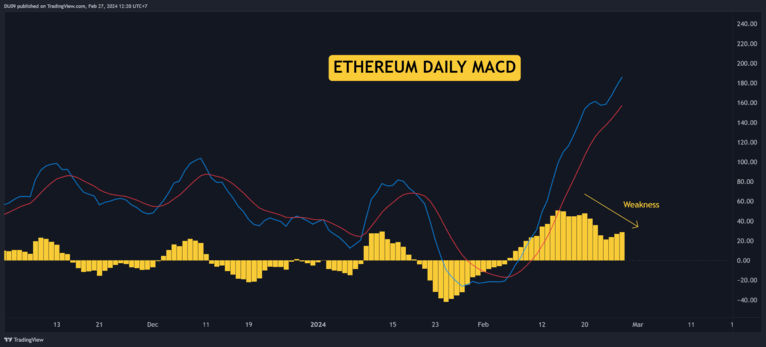

3. Daily MACD Shows a Bearish Divergence

The price has recently reached a new high, yet an interesting observation emerges when analyzing the daily MACD histogram, which shows a lower high. This phenomenon, known as a bearish divergence, suggests a potential weakening in the momentum of buyers. For this divergence to be validated, it would require sellers to intervene and halt the ongoing rally, particularly at the critical resistance level. This scenario underscores the importance of monitoring market dynamics closely to assess the strength and sustainability of the prevailing trend.