Findings from Bybit’s research shed light on an increasing sense of optimism among institutional investors regarding Ether, buoyed by the anticipated favorable outcomes of the forthcoming Dencun upgrade on the Ethereum blockchain.

Scheduled for implementation on March 13, Dencun is poised to introduce a range of Ethereum Improvement Proposals (EIPs), with a notable focus on proto-danksharding. This particular proposal is designed to mitigate Layer-2 transaction costs, as detailed by developers familiar with the upgrade.

“While the upcoming upgrade may not have the same transformative impact as the Merge, its successful execution is expected to provide a supportive tailwind for ETH and other Layer 2 tokens,” as stated in the report.

The most recent significant update to Ethereum, referred to as Shapella, occurred in April 2023. This milestone upgrade allowed users and validators to withdraw their staked ether from the network, representing a pivotal advancement in Ethereum’s development trajectory.

Institutional Shift from Bitcoin to Ether

As per Bybit’s analysis, optimism regarding Ether emerged as early as September 2023, gaining significant traction by January 2024, where it accounted for approximately 40% of institutional portfolios. The team further highlighted that positive expectations surrounding the Securities and Exchange Commission’s (SEC) potential approval of a Spot Ether Exchange-Traded Fund (ETF) by the end of 2024 are contributing to the buoyant sentiment surrounding Ether.

Bybit observed that institutions commenced reducing their Bitcoin holdings in early December 2023, coinciding with the asset’s testing of a critical resistance level at $40,000. Subsequently, this trend of diminishing Bitcoin holdings persisted. However, it remains uncertain whether this transition from Bitcoin to Ether reflects a short-term tactical adjustment or a more medium-term strategic reallocation strategy.

As the Bitcoin halving event looms in April 2024, Bybit cautioned against adopting a pessimistic stance towards the cryptocurrency. Historically, the Bitcoin halving has been viewed positively within the crypto community, as it tends to stimulate upward price movements. Therefore, despite the ongoing shift in institutional sentiment, it is prudent to consider the potential impact of this significant event on Bitcoin’s trajectory.

Retail vs. Institutional Investment Styles

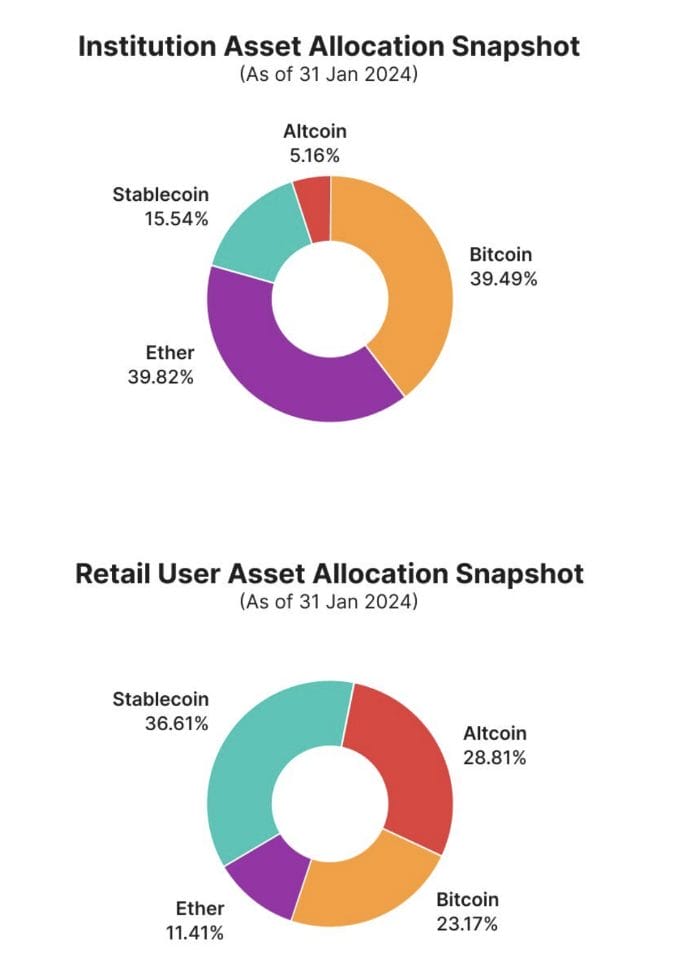

The report also presented a detailed breakdown of asset allocations, revealing that institutions distributed approximately 40% of their portfolios to Bitcoin, another 40% to Ether, while allocating 15% to stablecoins, and 5% to altcoins, spanning from July 2023 to January 2024.

Bybit’s analysis indicates a notable shift in institutional portfolio composition, with a significant increase in focus on Bitcoin and Ether, rising from 50% to 80%. In contrast, retail users exhibit a different investment strategy, maintaining a lower concentration in Bitcoin and Ether, which collectively constitute around 35% of their total portfolios.

Bybit’s report underscores the distinct investment styles between retail users and institutions. Retail investors tend to display a higher inclination towards altcoins and maintain a more significant cash position, reflected in a higher proportion of stablecoins within their portfolios.

Retail Users Show Greater Confidence in Bitcoin vs. Ether

In a noteworthy contrast, retail users exhibited a relatively greater degree of optimism towards Bitcoin when compared to Ether. Bybit’s findings suggest that during the research period, retail investors did not allocate funds to Ether to the same extent as institutions.

Moreover, unlike institutions, retail users have not decreased their holdings in Bitcoin since the period spanning from December 2022 to September 2023.

Bybit attributed this distinct investment behavior among retail users to their higher leverage levels, necessitating a greater allocation of portfolio assets as collateral. Institutional investors typically maintain an average leverage level of around 12, whereas retail users operate with a higher leverage level, approximately at 20. This heightened leverage requirement likely influences retail investors’ asset allocation decisions, contributing to their differing investment preferences compared to institutional counterparts.

Retail Investors Maintain Higher Altcoin Exposure

The report highlighted that retail users maintain larger positions in altcoins compared to Bitcoin and Ether, indicating a continued interest in alternative cryptocurrencies. However, there appears to be a prevailing cautious sentiment towards altcoins among most users.

Institutions, on the other hand, notably reduced their overall exposure to altcoins by half in percentage terms. Particularly, they were observed to have significantly divested from highly volatile token categories, including meme, AI, and BRC-20 tokens, with the exception of L1, DeFi, and metaverse tokens.

Bybit remarked, “Despite witnessing jaw-dropping returns in 2023, institutions have exhibited a reluctance towards high-risk, high-return bets throughout the year. Notably, there was only a discernible increase in holdings for meme tokens observed from the beginning of September until October.”

Moreover, Bybit’s analysis revealed that despite Solana’s impressive performance, both institutions and retail users did not maintain prolonged holdings in SOL.

During the third quarter of 2023, Solana occupied a significant position in the portfolios of both institutions and retail users. However, as Solana experienced a rebound and reached the $40 mark, both groups opted for profit-taking, resulting in a reduction of SOL holdings.