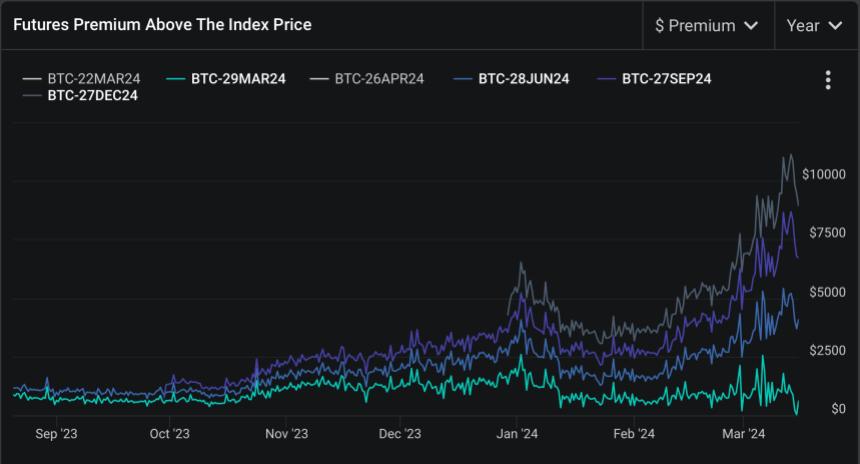

The current landscape of Bitcoin’s futures market is marked by intriguing developments that have historically signaled an upsurge in bullish sentiment among market participants. Analysts are now directing their focus towards a pivotal metric known as the Bitcoin futures basis. This metric essentially encapsulates the disparity between the futures price of Bitcoin and its prevailing spot price, serving as a barometer for gauging market sentiment and investor expectations.

What recent data has brought to light is nothing short of remarkable: the Bitcoin futures basis has skyrocketed to unprecedented levels, particularly in the wake of Bitcoin’s monumental all-time high of $69,000, which was attained back in November 2021. This surge in the basis serves as a compelling testament to the evolving dynamics within the cryptocurrency market, with its implications extending far beyond mere numerical fluctuations.

Indeed, this pronounced escalation in the basis has become the focal point of intense scrutiny and speculation among industry experts and market observers alike. It represents more than just a statistical anomaly; rather, it signifies a profound shift in market sentiment and investor behavior, offering valuable insights into the underlying factors driving the ongoing narrative surrounding Bitcoin’s trajectory.

The implications of this surge in the Bitcoin futures basis are manifold, suggesting a confluence of factors that may be influencing market dynamics in ways that are both intricate and multifaceted. From the influx of institutional interest to the evolving regulatory landscape and the broader macroeconomic backdrop, there exists a myriad of variables that could potentially contribute to this notable divergence between futures and spot prices.

Moreover, the significance of this development cannot be overstated, as it underscores the growing maturity and institutionalization of the cryptocurrency market. What was once considered a niche asset class has now firmly entrenched itself within the realm of mainstream finance, with Bitcoin serving as a bellwether for the broader digital asset ecosystem.

As market participants grapple with the implications of this surge in the Bitcoin futures basis, one thing remains abundantly clear: the cryptocurrency market continues to defy conventional wisdom and chart its own course, driven by a potent mix of innovation, speculation, and investor sentiment. And while the future may remain uncertain, one thing is for certain: the journey of Bitcoin and its accompanying derivatives market promises to be a captivating saga, replete with twists, turns, and unforeseen developments that will continue to captivate the imagination of investors and enthusiasts alike.

Bullish Indications From Bitcoin Futures

In a detailed analysis provided to their esteemed clientele, analysts Gautam Chhugani and Mahika Sapra of Bernstein have emphatically reaffirmed their conviction regarding Bitcoin’s potential trajectory, boldly predicting an exponential surge to new all-time highs of approximately $150,000 by the middle of 2025. This resolute stance echoes their earlier prescient forecast articulated in November 2023, during which they astutely foresaw Bitcoin’s ascent to the same lofty price point.

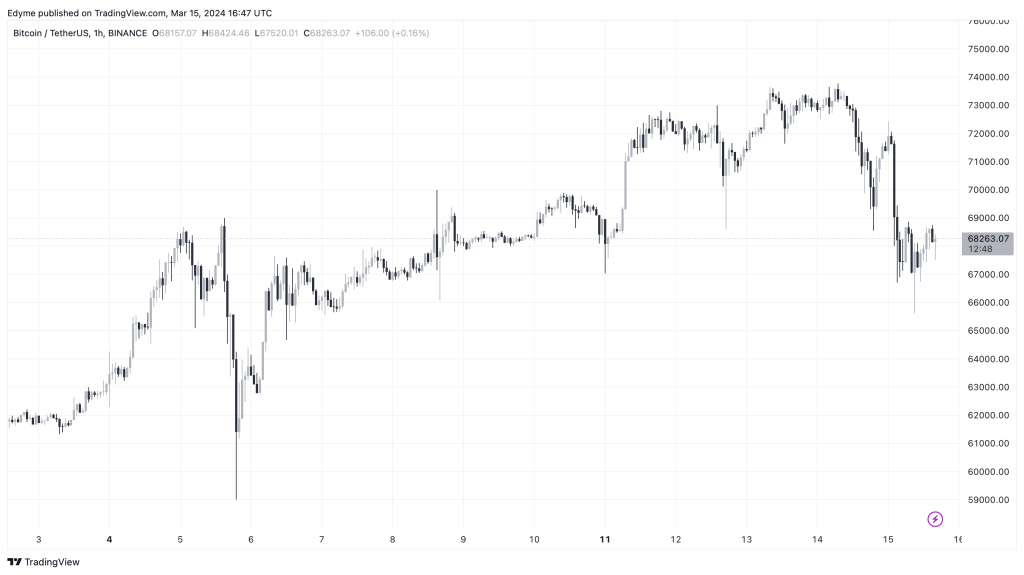

It’s worth revisiting the context in which their initial prediction was made: Bitcoin, at the time, was trading at around $35,000, rendering their prognostication nearly quintuple the prevailing value of BTC. Fast forward to the present, and Bitcoin has recently demonstrated remarkable resilience and upward momentum, breaching the $71,000 threshold for the first time in its history. Such remarkable price action only serves to bolster the credibility of the analysts’ prognostication, rendering their forecast increasingly plausible and deserving of serious consideration.

Coming from a reputable private wealth investment firm, these analysts have meticulously outlined a myriad of factors that they believe could serve as catalysts for Bitcoin’s bullish trajectory. Among these factors, they place particular emphasis on the burgeoning success and surging demand for Spot Bitcoin Exchange Traded Funds (ETFs), positing that substantial inflows into these vehicles could exert significant upward pressure on Bitcoin’s valuation.

The analysts’ conviction is further underscored by their precise estimations, indicating anticipated inflows of $10 billion for 2024 and an additional $60 billion for 2025. Notably, the meteoric rise in Bitcoin ETF inflows, which have already surpassed $9.5 billion within a mere 40 trading days since the ETF’s launch on January 10, attests to the burgeoning investor interest and confidence in Bitcoin’s potential as a lucrative investment vehicle.

In line with the prevailing sentiment echoed by numerous cryptocurrency analysts, the Bernstein analysts anticipate a potential resurgence in Bitcoin’s price trajectory following the highly anticipated halving event scheduled for April 2024. As of the latest market data, Bitcoin is currently trading at $68,218, experiencing a marginal price correction of approximately 6.96% over the past 24 hours, according to CoinMarketCap.

In essence, the Bernstein analysts’ comprehensive analysis not only reflects their astute understanding of market dynamics but also underscores their unwavering belief in Bitcoin’s potential to redefine traditional notions of value and investment. As investors and market participants navigate the ever-evolving landscape of cryptocurrency, the insights provided by these analysts serve as invaluable guideposts, offering a glimpse into the potential future trajectory of Bitcoin and its profound impact on the broader financial ecosystem.

Market Sentiment And Halving Cycles

In the intricate tapestry of Bitcoin’s market dynamics, the current landscape presents a fascinating narrative that demands careful examination. Despite the recent downturn, wherein Bitcoin’s price experienced a 3.9% dip, settling at $68,203, seasoned market analysts, exemplified by the revered figure of Rekt Capital, urge against hasty interpretations of this movement as a harbinger of negative trends. Rather, they offer a nuanced perspective, characterizing the recent price correction as a “positive adjustment” in anticipation of the upcoming Bitcoin halving event slated for April.

The concept of halving events, which entail a reduction in the block reward for miners and consequently diminish the rate of new Bitcoin entering circulation, holds profound significance within the cryptocurrency ecosystem. Historically, these events have served as catalysts for substantial price rallies, driven by the ensuing supply constraints and heightened investor sentiment.

Rekt Capital’s analysis delves deep into the intricate interplay between current market movements and the historical patterns observed during previous halving cycles. What emerges is a compelling narrative of continuity, wherein despite the swift pace of these cycles, a discernible pattern unfolds: a pre-halving rally followed by a retracement phase. It is this very sequence that echoes Bitcoin’s current trajectory, lending credence to the notion that the recent dip is merely a transient blip on the radar, poised to pave the way for the next bullish phase post-halving.

Indeed, the notion of cyclicality pervades Bitcoin’s narrative, imbuing it with a sense of rhythm and predictability amidst the ever-changing tides of market sentiment. By embracing this cyclical perspective, investors can navigate the complexities of Bitcoin’s price movements with greater clarity and confidence, recognizing that short-term fluctuations are but ephemeral manifestations within the broader context of Bitcoin’s long-term growth trajectory.

In essence, while the current market downturn may elicit apprehension and uncertainty, particularly against the backdrop of global economic turbulence, Rekt Capital’s insights offer a beacon of clarity and reassurance. They serve as a reminder of the enduring resilience inherent within Bitcoin’s ecosystem, emboldening investors to weather the storms of volatility with steadfast resolve and unwavering conviction in the transformative potential of the world’s preeminent cryptocurrency.

Miners To Become Top Beneficiaries Of BTC Surge

In their meticulous analysis, Bernstein analysts underscore the paramount significance of delving into Bitcoin miners as an unparalleled avenue for gaining exposure to the dynamic cryptocurrency landscape. With a discerning eye, they unveil a profound insight: Bitcoin mining entities exhibit a remarkable propensity to soar during periods of bullish exuberance, while weathering comparative downturns during bearish market phases.

As Bitcoin catapults to unprecedented zeniths, eclipsing the monumental milestone of $71,000, the analysts at Bernstein prognosticate an imminent deluge of institutional interest inundating the realm of Bitcoin-associated equities. Within this burgeoning landscape, they posit that Bitcoin miners stand poised as veritable colossi, poised to reap bountiful rewards amidst the fervent market fervor.

Despite the chorus of cautionary voices resonating from certain quarters, expressing trepidation regarding the looming specter of the next Bitcoin halving, particularly its purported potential to spell the demise of smaller-scale mining ventures and lone miners, Bernstein’s analysts present a resolute counterpoint. They espouse an alternative perspective, contending that the ascendant trajectory of Bitcoin’s valuation and the concomitant surge in transaction fees will serve as a formidable bulwark for miners during the impending halving event, effectively tempering the anticipated adverse ramifications.

In essence, Bernstein’s exhaustive analysis offers a profound testament to the unparalleled potential inherent in investing in Bitcoin miners, positioning them as veritable linchpins within the tumultuous yet tantalizing realm of cryptocurrency investment.