In the build-up to the imminent Bitcoin halving event, the cryptocurrency market finds itself engulfed in a maelstrom of speculation and volatility. The anticipation surrounding this pivotal event has created a palpable sense of unease among traders and enthusiasts alike, as they navigate through the turbulent waters of price fluctuations and market dynamics.

Bitcoin (BTC), the undisputed heavyweight champion of the crypto world, has been unable to shake off the shackles of its mid-March losses, a recurring narrative that has become woven into the fabric of its history. With each passing day, the tension mounts as the community eagerly awaits the outcome of this highly anticipated halving, which is poised to alter the course of Bitcoin’s trajectory.

Amidst the backdrop of uncertainty, however, there exists a glimmer of hope in the form of bullish projections put forth by certain analysts. These individuals, undeterred by the current market conditions, dare to dream of a future where Bitcoin surges to unprecedented heights, with a staggering price target of $100,000. Such audacious predictions serve as a beacon of optimism for investors, signaling the potential for substantial gains should the halving event unfold as anticipated.

But the ramifications of this impending halving extend far beyond the realm of Bitcoin alone. The entire altcoin ecosystem stands on the precipice of transformation, bracing itself for the inevitable ripple effect that will emanate from Bitcoin’s actions. As the market waits with bated breath, the fate of altcoins hangs in the balance, poised to either thrive in the wake of Bitcoin’s ascent or succumb to the ensuing turbulence.

Adding fuel to the fire is the recent Federal Reserve meeting, which has cast a long shadow over the crypto landscape. With every word uttered by policymakers, the market reacts with heightened sensitivity, as traders dissect and analyze the implications for digital assets. The outcome of this meeting has only served to intensify the prevailing sense of uncertainty, further amplifying the significance of the impending halving event.

Yet, amidst the chaos and apprehension, there exists a silver lining for some altcoins. In a remarkable display of resilience, a select few have managed to defy the odds and soar to unprecedented heights. Their meteoric rise serves as a testament to the inherent unpredictability of the crypto market, where fortunes can be made or lost in the blink of an eye.

As the countdown to the halving event continues, the crypto community finds itself at a crossroads, grappling with the uncertainty of what lies ahead. Will Bitcoin emerge triumphant, paving the way for a new era of prosperity? Or will the market be plunged into chaos, sending shockwaves throughout the entire ecosystem? Only time will tell, as the world watches with bated breath, eager to witness the next chapter in the tumultuous saga of cryptocurrency.

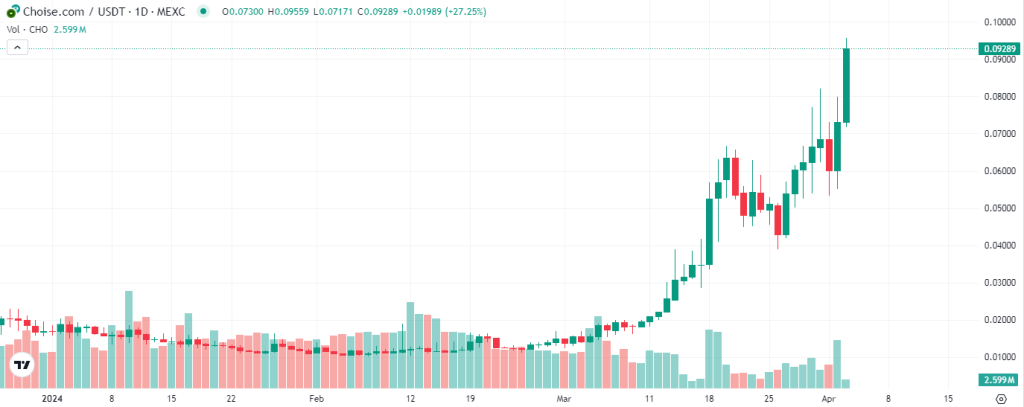

1. Choise.com (CHO)

The CHO token has undoubtedly become the talk of the town, captivating the attention of both seasoned investors and newcomers alike, courtesy of its recent meteoric rise in value. What began as a relatively subdued period for the token in February has swiftly transformed into a spectacle of unprecedented growth, with CHO boasting an astonishing surge of over 400% throughout the month of March alone. Such exponential gains have naturally sparked intense speculation and intrigue, as market observers scramble to decipher the underlying catalysts propelling this remarkable ascent.

Fueling the prevailing optimism surrounding CHO is its unwavering resilience in the face of market volatility, showcasing a remarkable degree of independence from the broader market trends. This notable characteristic has positioned CHO as a standout performer, garnering considerable attention and admiration from investors seeking refuge from the unpredictable ebbs and flows of the cryptocurrency landscape.

Adding to the enigma surrounding CHO’s surge is the emergence of a cryptic placeholder page ominously titled “CHO Revolutionary Update” on the Choise.com platform. Accompanied by a tantalizing countdown and promises of “the biggest airdrop in history,” this mysterious development has sent shockwaves rippling through the Choise.com community, igniting fervent speculation and anticipation about the impending revelation.

The anticipation only intensifies with cryptic allusions from the platform’s enigmatic founder, who has tantalizingly hinted at forthcoming benefits for CHO holders as the company sets its sights on a bold new frontier in the realm of business-to-business (B2B) ventures. With murmurs of potential revenue streams reaching a staggering $180 million and whispers of strategic maneuvers underway in the realm of tokenomics, the stage is set for an epoch-defining moment in the history of CHO and Choise.com.

In light of CHO’s steadfast resilience amidst the tumultuous fluctuations of Bitcoin and the unwavering commitment of Choise.com to innovation and industry expertise over its illustrious seven-year tenure, expectations are sky-high for the imminent unveiling of these transformative updates. As the countdown to the highly anticipated announcement draws ever closer, the fervor and anticipation surrounding CHO and its boundless potential continue to reach dizzying new heights, leaving investors and enthusiasts alike eagerly poised on the edge of their seats, eagerly awaiting the dawn of a new era in the world of cryptocurrency.

2. Goldfinch (GFI)

In the wake of BlackRock’s groundbreaking revelation regarding the initiation of its inaugural tokenized fund on the Ethereum network, the DeFi project Goldfinch, along with its native governance token, GFI, has emerged as a beacon of significance within the ever-evolving landscape of decentralized finance (DeFi).

Goldfinch has indisputably solidified its standing as a prominent player in the DeFi sector, proudly touting an extensive portfolio that exceeds a staggering $326 million in active loans. This impressive figure underscores the platform’s robustness and efficacy in facilitating lending activities within the decentralized ecosystem.

The reverberations of this development have resonated deeply within the investment community, sparking a palpable surge in interest surrounding GFI. The value of this native token has experienced an exponential doubling since the dawn of the year, a testament to the heightened appeal and allure of Goldfinch’s offerings.

This meteoric rise in GFI’s valuation can be largely attributed to the burgeoning trend of tokenizing Real-World Assets (RWAs), a phenomenon that continues to captivate the imagination of investors and innovators alike. By bridging the gap between traditional finance and the blockchain realm, Goldfinch has positioned itself at the vanguard of this transformative movement, redefining the contours of asset ownership and financial inclusion in the process.

However, amidst the fervor surrounding GFI’s ascent, it is imperative to tread cautiously and acknowledge the nuances that accompany its burgeoning popularity. It is worth noting that only a fraction—approximately a quarter—of GFI tokens are currently available for trading, a factor that could potentially introduce unforeseen volatility into the market dynamics.

For seasoned investors, this inherent volatility may present both opportunities and risks. While the prospect of capitalizing on price fluctuations to secure quick profits may be enticing, it is essential to exercise prudence and foresight in navigating the intricate landscape of decentralized finance. The allure of rapid gains must be tempered by a sober recognition of the inherent uncertainties and risks that accompany such endeavors.

In conclusion, as Goldfinch continues to chart new territories and redefine the contours of decentralized finance, investors would be well-advised to approach the burgeoning ecosystem with a judicious blend of enthusiasm and circumspection. By embracing innovation while remaining cognizant of the potential pitfalls, stakeholders can position themselves to harness the transformative potential of tokenization while mitigating the associated risks.

3. Boson Protocol (BOSON)

In the exciting month of March, the Boson Protocol team unleashed a highly anticipated and meticulously crafted updated roadmap, sending ripples of enthusiasm throughout its vibrant community. The fervor and anticipation were palpable as stakeholders eagerly awaited the unveiling of the strategic plan that would shape the trajectory of Boson’s future endeavors. What followed was nothing short of extraordinary, as the reception to the roadmap was nothing less than spectacular, igniting a fervent wave of support that reverberated across the ecosystem.

This palpable excitement manifested itself in the form of a remarkable 70% surge in the value of BOSON, the protocol’s esteemed governance token. Such a significant leap in value not only underscored the community’s unwavering confidence in Boson’s vision and leadership but also served as a resounding validation of the protocol’s fundamental value proposition. It was a testament to the faith and trust placed in the project by its dedicated community members, whose unwavering support propelled BOSON to new heights.

At the heart of this revamped roadmap lay a singular, overarching objective: to accelerate the adoption of cryptocurrency within the burgeoning decentralized commerce (dCommerce) sector. This strategic imperative underscored Boson’s unwavering commitment to ushering in a new era of digital commerce, one where blockchain technology would serve as the cornerstone of innovation and progress. By laying out a comprehensive roadmap aimed at fostering greater acceptance and integration of cryptocurrency within the dCommerce landscape, Boson reaffirmed its position as a trailblazer in the realm of decentralized finance (DeFi).

The tangible impact of this strategic initiative was unmistakable, as evidenced by the staggering surge in the value of BOSON. This monthly upswing not only bolstered the token’s short-term performance but also laid the groundwork for a truly remarkable long-term trajectory. Indeed, the cumulative effect of this surge translated into an impressive 199% rally in BOSON’s value over the course of the year, a feat that few could have predicted but one that speaks volumes about Boson’s enduring appeal and market potential.

Central to Boson’s meteoric rise is its innovative technology, which continues to captivate the imagination of investors and industry observers alike. At its core, Boson’s groundbreaking technology enables the seamless conversion of real-world goods and services into redeemable Non-Fungible Tokens (NFTs), thereby revolutionizing the digital shopping experience and unlocking new avenues for value creation. This transformative approach not only enhances the efficiency and transparency of transactions but also democratizes access to the benefits of cryptocurrency, making it more accessible and practical for everyday consumers.

However, amid the euphoria and excitement surrounding Boson’s unprecedented success, it is important to acknowledge the challenges and obstacles that lie ahead. Chief among these is the issue of accessibility and liquidity, as BOSON currently faces hurdles in terms of listing on reputable cryptocurrency exchanges and acquiring liquidity through traditional fiat channels. While this may present challenges for some investors, it also underscores the untapped potential and inherent value of BOSON as an investment opportunity.

In conclusion, the unveiling of Boson Protocol’s updated roadmap in March marked a pivotal moment in the project’s evolution, igniting a groundswell of enthusiasm and support that reverberated throughout the ecosystem. With its unwavering commitment to driving adoption and innovation within the dCommerce sector, Boson continues to chart a course toward a future where blockchain technology reigns supreme, and decentralized finance (DeFi) becomes the new standard. As investors and enthusiasts alike eagerly await the next chapter in Boson’s journey, one thing remains abundantly clear: the future is bright, and the possibilities are limitless.

4. pSTAKE Finance (PSTAKE)

In a bold strategic maneuver, pSTAKE Finance embarked on a transformative journey by integrating with DYDX liquid staking, a move that sparked a phenomenal 200% surge in the value of the PSTAKE token. This seismic shift in the crypto landscape unfolded against the backdrop of DYDX, a notable player in the decentralized exchange (DEX) realm, making waves with its migration to a native application chain within the Cosmos network. This strategic relocation was meticulously orchestrated to fortify the platform’s security and decentralization, setting the stage for a new era of possibilities.

As DYDX charted its course towards heightened resilience and decentralization, pSTAKE Finance seized the opportunity with unwavering determination. With DYDX preoccupied with its transitional phase, pSTAKE strategically pivoted its focus towards engaging the vast community of DYDX token holders. Leveraging its innovative protocol, pSTAKE empowered these holders to stake their tokens and reap lucrative rewards denominated in USDC. Remarkably, this pioneering approach shattered the traditional barriers associated with staking, eliminating the customary 30-day lock-up periods and ensuring a seamless flow of liquidity for staked assets.

The convergence of pSTAKE and DYDX within the realm of liquid staking unveiled a vista of tantalizing prospects. The expansive market size of DYDX liquid staking, stretching into the millions of dollars, beckoned as a fertile ground for pSTAKE and its native token to thrive and flourish. Yet, amid the allure of boundless potential, formidable challenges loom ominously on the horizon, casting a shadow over pSTAKE’s ascent to prominence.

Foremost among these challenges is the inherent volatility that plagues the cryptocurrency landscape, casting uncertainty over the trajectory of pSTAKE’s growth. Moreover, the specter of high annual inflation rates presents a formidable obstacle, threatening to undermine investor confidence and stability within the ecosystem. Despite garnering resounding endorsements from leading crypto aggregators, early investors in the PSTAKE token find themselves ensnared in a paradox, grappling with the elusive promise of substantial profit realization.

In navigating this intricate tapestry of opportunities and challenges, pSTAKE Finance stands at a pivotal crossroads, poised to redefine the contours of liquid staking within the crypto sphere. With steadfast resolve and a relentless pursuit of innovation, pSTAKE charts a course towards sustainable growth and enduring success, reshaping the landscape of decentralized finance for generations to come.

5. HOPR (HOPR)

In the tumultuous month of March, the HOPR protocol experienced a seismic surge of an astonishing 140%, a surge that undoubtedly caught the attention of both seasoned investors and newcomers alike. This surge, a staggering figure by any measure, was widely speculated to be strongly influenced by the unprecedented surge in Bitcoin’s value, as the cryptocurrency giant reached new, dizzying heights.

What makes this surge particularly intriguing is the relative silence from the HOPR company during this period of market frenzy. In the absence of significant updates or announcements, it becomes increasingly apparent that the fluctuations in HOPR’s price were not primarily attributable to any specific company-driven developments but rather to the sweeping tides of the overall market dynamics.

Indeed, delving deeper into the intricacies of HOPR’s performance reveals a fascinating correlation with the movements of Bitcoin. The token’s weekly decline mirrors that of Bitcoin, suggesting a symbiotic relationship, wherein HOPR’s fate seems intricately tied to the fortunes of the flagship cryptocurrency. Yet, despite the rollercoaster ride of market volatility, the HOPR community appears resolutely optimistic, with the ‘fear and greed’ index currently indicating a sentiment of ‘greed’ among investors.

Nonetheless, amidst the prevailing optimism, there are whispers of concern echoing through the halls of the cryptocurrency realm. While HOPR’s performance in the current year paints a picture of promise and potential, there are underlying factors that demand a closer scrutiny. Chief among these is the undisclosed circulating supply of HOPR tokens, a factor that adds an element of uncertainty to the token’s valuation and market dynamics.

Furthermore, one cannot overlook the dwindling trading volumes surrounding HOPR. As trading activity decreases, questions arise about the sustainability of the token’s upward trajectory in value. The stark disparity between diminishing trading activity and rising token value raises red flags, hinting at the possibility of manipulative maneuvers aimed at artificially inflating investor demand.

In conclusion, while the recent surge in HOPR’s value undoubtedly captures the imagination and enthusiasm of investors, it behooves us to approach this phenomenon with a critical eye. The interplay between market trends, company developments, and investor sentiment paints a complex picture, one that warrants thorough analysis and cautious consideration as we navigate the turbulent waters of the cryptocurrency market.

Conclusion

These five emerging cryptocurrencies, each currently valued at less than $100 million, have witnessed remarkable triple-digit growth since the onset of this year. With the passage of time, Choise.com (CHO), Goldfinch (GFI), Boson Protocol (BOSON), pSTAKE Finance (PSTAKE), and HOPR (HOPR) stand poised to demonstrate their potential, offering investors opportunities for lucrative returns in a market undergoing significant transformation catalyzed by Bitcoin. While investing in these tokens necessitates thorough due diligence, the recent surge in CHO’s value appears particularly promising. This surge is underpinned by substantial forthcoming changes in the project’s operations, suggesting the likelihood of sustained growth and heightened profitability, akin to its performance in 2022.