As we peer into the vast expanse of the crypto cosmos, a prevailing sentiment pervades the community—a notion that altcoins, often relegated to the shadows in the formidable presence of Bitcoin, merely dance to the erratic rhythms dictated by their dominant elder sibling. However, in a paradigm-shifting revelation, the illustrious on-chain analytics firm, Santiment, offers a beacon of enlightenment, illuminating the altcoin landscape with newfound clarity.

In a magnum opus of data-driven analysis, Santiment presents a thesis that reverberates through the corridors of digital finance: a seismic shift may be looming on the horizon for these alternative digital assets. Drawing from the depths of their unparalleled data reservoirs, Santiment unveils a revelation that resounds with profound implications—the majority of altcoins find themselves ensconced within a historic “opportunity zone.”

This proclamation serves as an epiphany, challenging the entrenched notions that relegate altcoins to the periphery of crypto discourse. No longer mere satellites orbiting the Bitcoin behemoth, altcoins emerge as vibrant constellations in their own right, pulsating with latent energy and teeming with untapped potential. Positioned within this hallowed “opportunity zone,” altcoins beckon investors, traders, and enthusiasts alike to cast off the shackles of preconceived notions and embrace the boundless possibilities that await.

In this era of unprecedented disruption and transformation, Santiment’s revelation serves as a clarion call—a call to action that implores us to recalibrate our perspectives, realign our strategies, and embark on a journey of exploration and discovery into the uncharted realms of the altcoin universe. For within this realm of possibility lies the promise of innovation, the allure of prosperity, and the inexorable march towards a future defined not by the shadows of the past, but by the radiant light of opportunity.

Santiment’s Report on the MVRV Ratio

The Market Value to Realized Value (MVRV) ratio stands as a venerable metric wielded by cryptocurrency analysts to illuminate the market condition of digital assets. At its core, this metric provides a comparative analysis between the market cap, representing the current market valuation of an asset’s circulating supply, and the realized cap, signifying the aggregate cost basis of the asset held by investors.

In essence, the MVRV ratio serves as a compass, guiding market participants through the labyrinthine landscape of cryptocurrency valuations. It offers a nuanced perspective, allowing analysts to discern the interplay between market sentiment and underlying asset fundamentals.

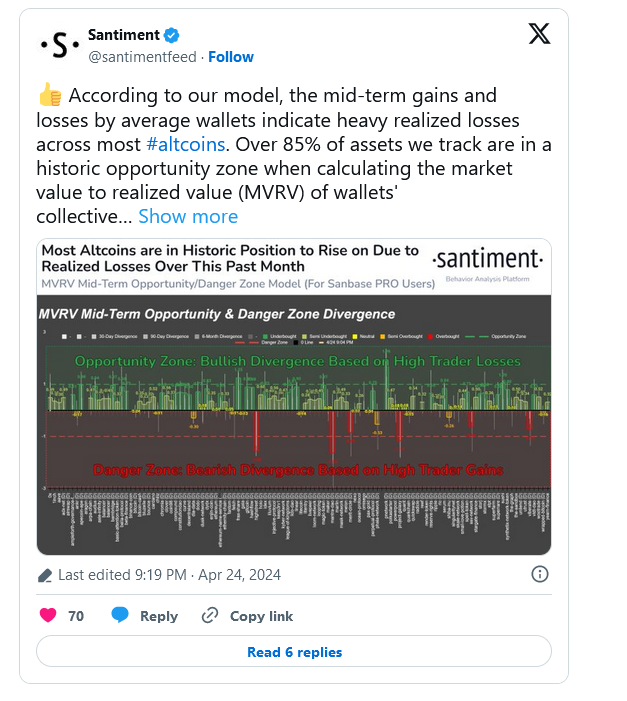

Santiment, a stalwart in the realm of on-chain analytics, lends its voice to this discourse, unveiling insights gleaned from its MVRV ratio model. According to the firm’s findings, a staggering 85% of altcoins presently find themselves nestled within an intriguing domain—the “opportunity zone.”

This delineated zone, sculpted by the MVRV metric, serves as a beacon of potential, illuminating periods where the prospect of price escalation is heightened. Such periods are characterized by a perceived market undervaluation relative to historical data—a phenomenon that ignites the imagination of investors and traders alike.

In essence, the MVRV-derived opportunity zone beckons forth an invitation—an invitation to delve into the depths of market dynamics, to unearth hidden gems amidst the sea of digital assets, and to seize upon the tantalizing prospects that lie therein. As the crypto landscape continues to evolve and mature, the MVRV ratio stands as a testament to the ingenuity of market analysis, offering a lens through which to navigate the ever-shifting tides of the cryptocurrency market.

Indications for Investors

The findings of the analysis paint a picture of resilience and potential prosperity among the majority of altcoins, hinting at the imminent arrival of what is colloquially referred to as an ‘altseason’ within the crypto community. This phenomenon, characterized by a notable uptick in altcoin prices, often surpassing the growth of Bitcoin and disrupting traditional market correlations, stands poised to take center stage.

Santiment, drawing upon its wealth of data and insights, echoes this sentiment, suggesting that the prevailing atmosphere of apprehension among investors may present an opportune moment for action. As fear begins to permeate the market amidst the recent downturns in market capitalization, Santiment’s analysis hints at a compelling rationale for contrarian investment strategies.

This sentiment finds validation in the MVRV data, which serves as a beacon of hope amid the prevailing uncertainty. The metrics indicate a potential resurgence on the horizon, as investors increasingly recognize the undervalued nature of many assets within the altcoin sphere. This realization, coupled with a growing sense of confidence, sets the stage for a potential resurgence in altcoin prices, offering astute investors an opportunity to capitalize on the prevailing market sentiment.

In essence, the analysis underscores the dynamic nature of the cryptocurrency market, wherein periods of adversity often pave the way for opportunities ripe with potential. As the crypto landscape continues to evolve, savvy investors stand poised to navigate the tumultuous seas of volatility, leveraging insights gleaned from data analysis to chart a course toward prosperity amidst uncertainty.

Strategic Investment Approaches

For investors eager to seize upon these valuable insights, Santiment offers an extensive array of analytics through their Sanbase PRO platform, which can be accessed through an exclusive trial offer. This platform serves as a comprehensive hub, providing in-depth data analysis and market intelligence tailored to the needs of discerning investors.

Furthermore, enthusiasts and analysts alike can delve deeper into this wealth of data by leveraging the tools and models provided by Santiment, including their Sansheets plugin and API services. These resources empower users to conduct thorough analyses, gain actionable insights, and make informed decisions in the ever-evolving landscape of digital assets.

As the digital asset ecosystem continues to mature, sophisticated tools like the MVRV ratio emerge as indispensable aids, offering invaluable insights to navigate the inherent volatility of the market. With a significant portion of altcoins currently residing within the opportunity zone, the stage appears set for a potential uptrend, attracting the attention of both seasoned traders and curious investors alike.

In essence, the utilization of advanced analytical tools not only serves to demystify the complexities of crypto investments but also illuminates timely opportunities for market entry. By harnessing the power of data-driven insights, investors can navigate the intricate nuances of the cryptocurrency market with confidence, positioning themselves for success in the ever-evolving landscape of digital finance.