Recent on-chain data indicates a noteworthy surge in activity on the Ethereum Proof of Work (ETHW) network, following a prolonged period of decline marked by the chain experiencing its lowest demand levels.

EthereumPoW has Gained Attention Aver the Past Month.

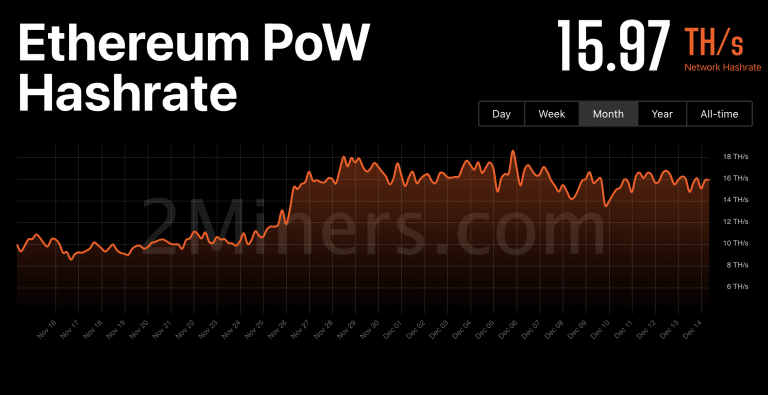

The surge in demand for the EthereumPoW network is notably reflected in its hashrate, which has consistently increased since November 20th. Data from 2Miners.com reveals a 65% decline in the network’s hashrate over the preceding 14 months. Such decreases are often linked to a drop in the native cryptocurrency’s value, making mining less profitable and prompting miners to exit the network. Remarkably, in the 14 months leading up to the hashrate upswing, ETHW’s price had fallen by 98%. However, from November 20th onward, EthereumPoW’s mining hashrate has rebounded, reaching 16.28TH/s at present—a 52% climb.

The consistent rise in the mining hashrate of the network coincided with a surge in the value of its native coin. According to CoinMarketCap data, ETHW’s price has increased by 70% in the last month. As expected, the upswing in mining activity on the blockchain has led to a similar trend in the chain’s mining difficulty. At present, EthereumPoW’s network difficulty stands at 209.59T, marking a 55% growth since November 20th.

Additionally, data from DefiLlama indicates an increase in the Total Value Locked (TVL) by decentralized finance (DeFi) protocols within EthereumPoW. This upward trend began on November 22nd, with the network’s DeFi TVL rising by 90%. However, EthereumPoW’s DeFi TVL remains notably lower than its October 2022 peak of $6 million, standing at $215,294 at the time of writing—a 72% year-to-date decline.