The correlation between Bitcoin and gold prices has surged to unprecedented levels in the past months, following a bullish finish to 2023 and the green light for a spot Bitcoin ETF.

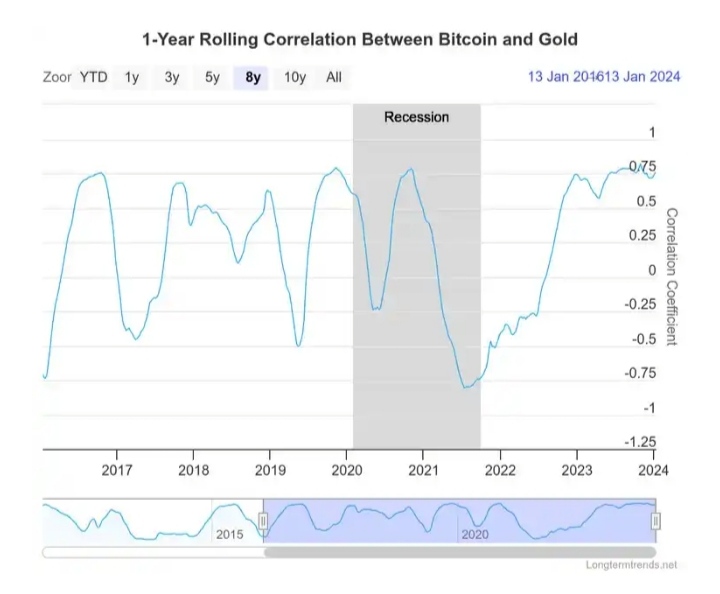

Bitcoin and gold have historically exhibited fluctuating correlation, with their prices often moving independently. However, the correlation tightened notably after the 2020 market crash at the onset of the COVID-19 crisis and is now approaching historical levels.

Currently standing at 0.76 (or 76%), this correlation signifies a growing connection between Bitcoin and gold prices, edging closer to historical highs.

The dynamics between Bitcoin and traditional financial markets are in a constant state of evolution, as highlighted in a recent report by cryptocurrency exchange Binance. Presently, Bitcoin’s correlation with the S&P 500 is at its lowest in over three years. Additionally, the correlation between Bitcoin and gold experienced a significant upswing, reaching around 75% by the close of 2023, as reported by Long Term Trends. This surge aligned with global central banks implementing interest rate hikes, indicating a temporary shift in stock market behaviours.

The recent introduction of Bitcoin ETFs in the U.S. signifies a pivotal moment, marking Bitcoin’s shift toward being treated more like a stock.

Interestingly, despite this development, Bitcoin’s correlation with gold has strengthened, with the current bitcoin-gold correlation standing at 76%, just a few points shy of the all-time high of 79%. This indicates a closer relationship between the two assets, both hailed as robust stores of value by their proponents, even as Bitcoin becomes more integrated into mainstream finance.

Examining the charts reveals a notable ascent in Bitcoin’s ratio to gold throughout 2023, peaking towards the year’s end. However, there was a slight retracement earlier this month, possibly as the excitement surrounding ETFs diminished. The Bitcoin to gold ratio, obtained by dividing the price of Bitcoin by that of gold, offers insights into approximately how many ounces of gold can be acquired with a single Bitcoin.

At its peak, the ratio reached an impressive 22.5, signifying that 1 BTC could purchase 22.5 ounces of gold. This figure underscores Bitcoin’s purchasing power relative to gold, reinforcing the belief among Bitcoin enthusiasts that BTC serves as a dependable store of value.

Despite Bitcoin entering the stock market through ETFs, indicating a potential correlation with equities, it seems that investors are still drawn to Bitcoin’s gold-like attributes. This divergence raises the question of why Bitcoin is aligning more closely with gold.

The answer may lie in the U.S. inflation rate exceeding the Federal Reserve’s target of 3.35%, coupled with Bitcoin’s remarkable 155% surge in 2023. It suggests that investors, beyond pursuing growth, are also seeking stability amid economic uncertainty. Bitcoin, with its gold-like performance, provides a semblance of this sought-after stability.

The connection between Bitcoin and gold underscores the intricate, evolving nature of Bitcoin as both a digital currency and an asset class. As it matures, Bitcoin appears to retain certain gold-like qualities while assimilating characteristics of stocks and commodities.