This week, the Solana-based decentralized exchange Jupiter distributed JUP tokens valued at $700 million to early adopters through an airdrop.

Following the distribution of hundreds of millions of dollars’ worth of JUP tokens to early Jupiter users, the project, renowned for its DEX aggregator, faces accusations of exploiting the hype to profit.

The controversy revolves around LFG Launchpad, a platform developed by Solana-based Jupiter, which is facilitating the sale of JUP tokens. The Jupiter team initiated the launch pool with 250 million JUP tokens—approximately 18.5% of the current 1.35 billion tokens in circulation and 2.5% of the total 10 billion JUP supply.

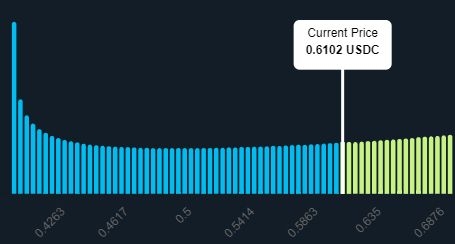

As of now, JUP is trading at approximately $0.61, indicating that once the sale concludes on Feb. 6, the Jupiter team could potentially cash out $100 million in USDC, along with 50 million JUP valued at an additional $33 million.

Some investors express concern over the Jupiter team’s intention to withdraw liquidity post-sale and transfer the proceeds to a team treasury. Questions arise regarding whether investors effectively funded the developers with nine-figure amounts for free tokens, prompting comparisons to a hidden fundraising or ICO. While some traders, such as the pseudonymous Bighead, acknowledge that the information was publicly available, they suggest that better communication could have mitigated confusion. Additionally, criticism emerges regarding the 100 million JUP launchpad fee paid to LFG, with founder Meow clarifying that 75% will be allocated to a decentralized autonomous organization (DAO) for Jupiter, and the remaining 25% will go to the project team.

Mechanisms for Launchpads

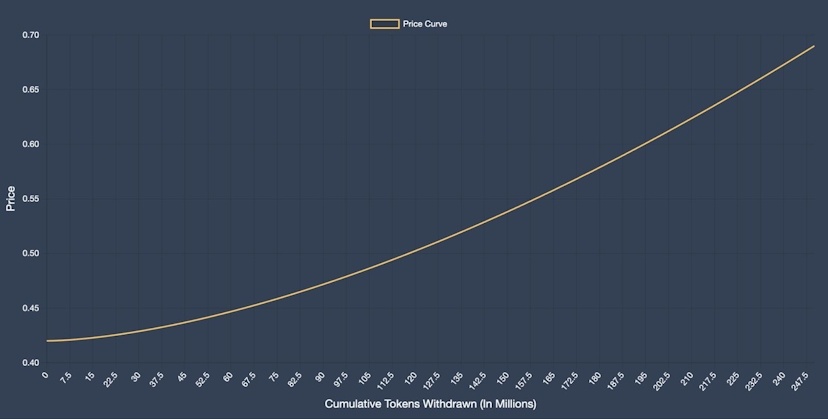

Users can exchange USDC for JUP and vice versa within a set price range of $0.40 to $0.69. If JUP falls below $0.40, the pool would only contain 250 million of the newly minted tokens and no USDC. Conversely, if the price exceeds $0.69, the pool would consist of $131 million USDC and no JUP, as outlined in a chart provided by Jupiter.

The pool remains accessible for seven days following Jupiter’s distribution of an additional 1 billion JUP tokens on Jan. 31. Whatever remains in the pool, whether it comprises USDC, JUP, or a combination of both, will be transferred to the Jupiter team.

Meow, the charismatic founder of Jupiter, stated on X that there are no plans for further sales beyond the seven-day period.

The founder clarified that the team did not secure funding from private investors, a practice sometimes viewed as predatory in crypto. This practice allows investors to acquire tokens at lower prices than those available on the open market. Additionally, Meow stated that users have the option to sell their airdropped JUP tokens into the LFG pool during the seven-day period, emphasizing the pool’s purpose in buffering airdrops. Despite attempts to contact team members on Discord regarding LFG, Jupiter’s website lacks a press email, and The Defiant did not receive responses.

Meow did, however, respond to a message from The Defiant asking about the tokens from LFG by saying, “hehe, I got an idea for a chad move.”

The founder went on to talk about JUP gaining in value and generally rallied an extremely active Discord server.