The upcoming week presents a busy economic calendar, with several Federal Reserve officials providing insights into last week’s interest rate decision. Concurrently, the cryptocurrency markets experienced a cooling trend over the weekend, potentially entering a phase of pre-halving consolidation.

The Kobeissi Letter, a macroeconomics outlet, outlined key economic events in the United States for the week starting February 5. This follows a weekend of declines in both Bitcoin and the broader crypto markets. Notably, these markets seem to be gearing up for a period of consolidation ahead of the halving.

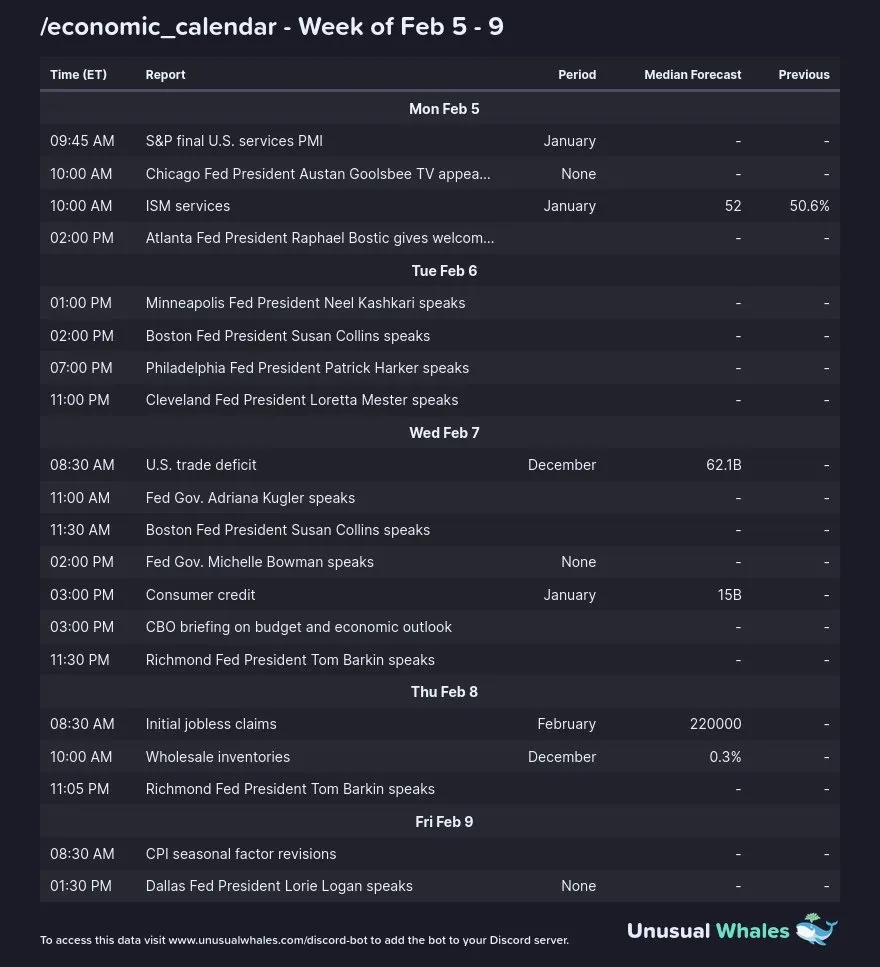

Economic Calendar Highlights:

On Monday, February 5, the release of S&P Services PMI and ISM non-manufacturing PMI data is scheduled, providing crucial economic indicators for market and economic trends.

Thursday will witness the release of initial jobless claims data, but the focus will be on speeches from Federal Reserve speakers.

Friday brings the Bureau of Labor Statistics’ annual recalculation of seasonal adjustment factors for the consumer price index (CPI).

Over half a dozen US Central Bank members are set to speak during the week, offering insights into the bank’s perspectives and commenting on the implications of recent economic reports. Key figures like Neel Kashkari, Loretta Mester, Patrick Harker, Adriana Kugler, Michelle Bowman, Tom Barkin, and Lorie Logan will share their remarks.

Last week, Fed Chairman Jerome Powell signaled that a rate cut in March was unlikely, awaiting more evidence of inflation control. Investors eagerly await insights into how recent economic data will influence official opinions on future interest-rate decisions, with the next one scheduled for March 20.

Additionally, Treasury Secretary Janet Yellen is set to testify before the Senate Banking Committee on Thursday, delivering the department’s annual report on US financial stability.

While there are few major economic reports slated for release, investor attention will shift to corporate earnings. Major firms across retail, food and beverage, automotive, entertainment, and pharmaceutical industries will unveil their earnings reports.

The cryptocurrency markets experienced a weekend cooldown, with total capitalization dropping 1.3% to $1.7 trillion during Monday morning’s Asian trading session. Bitcoin faced resistance above $43,000 post last Friday’s options expiry, resulting in a 1.4% decline to $42,437 at the time of the press. The week ahead holds significant economic events that could impact both traditional and crypto markets.