Earlier this month, the high-performance smart contract platform Solana ($SOL) experienced a significant network outage lasting five hours, marking its first outage since February 2023. During this outage, the network faced downtime before eventually being restored.

Despite this setback, the price of Solana’s native token witnessed a remarkable surge of more than 6% over the past 30 days and has soared over 300% in the last six months. Following a dip to around $93, the token managed to rebound and is currently trading at approximately $104.

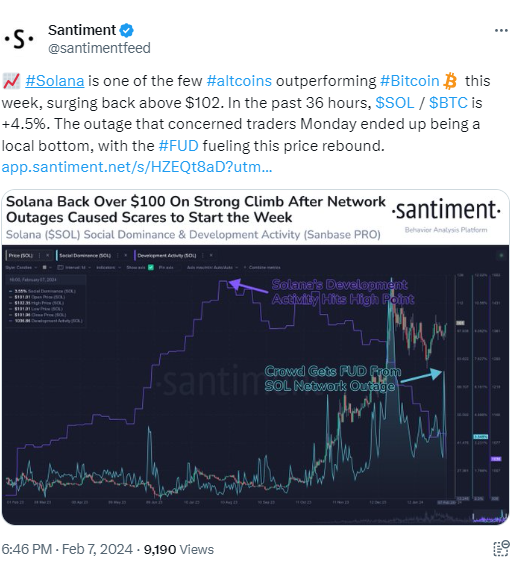

According to insights from on-chain analytics firm Santiment, Solana has emerged as one of the standout performers among alternative cryptocurrencies, outshining the leading cryptocurrency Bitcoin. The recent network outage, while causing concern among traders, surprisingly acted as a local bottom, contributing to the token’s price rebound. The resulting Fear, Uncertainty, and Doubt (FUD) surrounding the outage fueled this upward momentum.

In terms of investment trends, Solana attracted notable attention, with investment products offering exposure to the cryptocurrency witnessing inflows of $3 million over the past week. This stands in contrast to the broader cryptocurrency market, which experienced approximately $500 million in outflows. Notably, outflows were primarily attributed to investors divesting from Grayscale’s GBTC, which transitioned into a spot Bitcoin ETF.

Grayscale’s funds saw significant outflows totaling $2.23 billion, while inflows were observed in BlackRock’s spot Bitcoin ETF, bringing in $744 million, and Fidelity’s fund, which attracted $643 million. In the altcoin space, investment products focusing on Litecoin, XRP, and Cardano witnessed outflows of $200,000 each. However, Solana-focused investment products stood out with inflows, contributing to the $7.1 million in total inflows observed in products focusing on multiple cryptocurrencies.