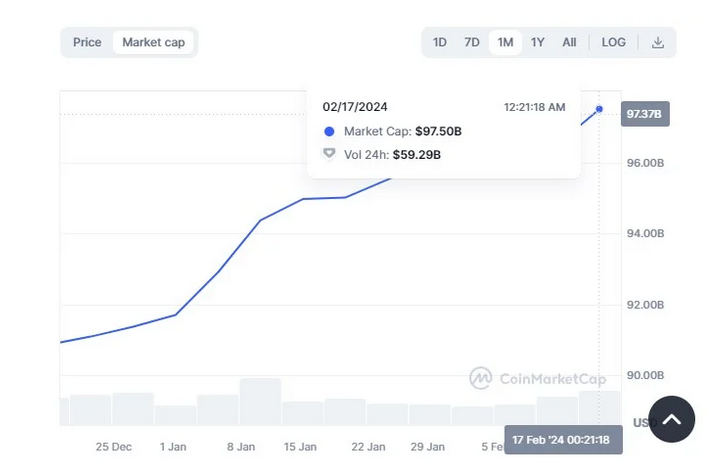

Tether (USDT), the leading stablecoin globally, is on the brink of reaching a remarkable milestone with a market capitalization nearing $100 billion. Since the beginning of the year, Tether’s market cap has surged by approximately 7%, climbing from about $91 billion to nearly $98 billion as of now, as per CoinMarketCap data.

This surge in market capitalization aligns with Tether’s robust financial performance. Recently, the company disclosed profits of almost $3 billion for Q4 2023. Of this, $1 billion was attributed to interest from US Treasury holdings, while the rest was driven by the appreciating values of gold and Bitcoin in its reserves.

Nevertheless, Tether’s growing dominance raises concerns among experts. Bloomberg’s senior commodity strategist, Mike McGlone, has highlighted that widespread adoption of Tether might strengthen the US dollar, potentially exerting downward pressure on traditional assets like commodities and gold.

The surge in Tether’s market cap also occurs against the backdrop of ongoing regulatory scrutiny on stablecoins in the US. While Tether operates beyond US borders, its close ties to the US dollar and potential interactions with US entities could subject it to regulatory oversight from US authorities, particularly through sanctions imposed by the Office of Foreign Assets Control (OFAC).

Meanwhile, Tether’s closest rival, USD Coin (USDC), has seen a 4% growth year-to-date, with a market cap hovering around $28 billion. However, it remains significantly below its all-time high achieved in June 2022, trailing Tether by approximately $70 billion.