How is Binance Nigeria Navigating Regulatory Compliance in Setting Price Caps for USDT Tokens?

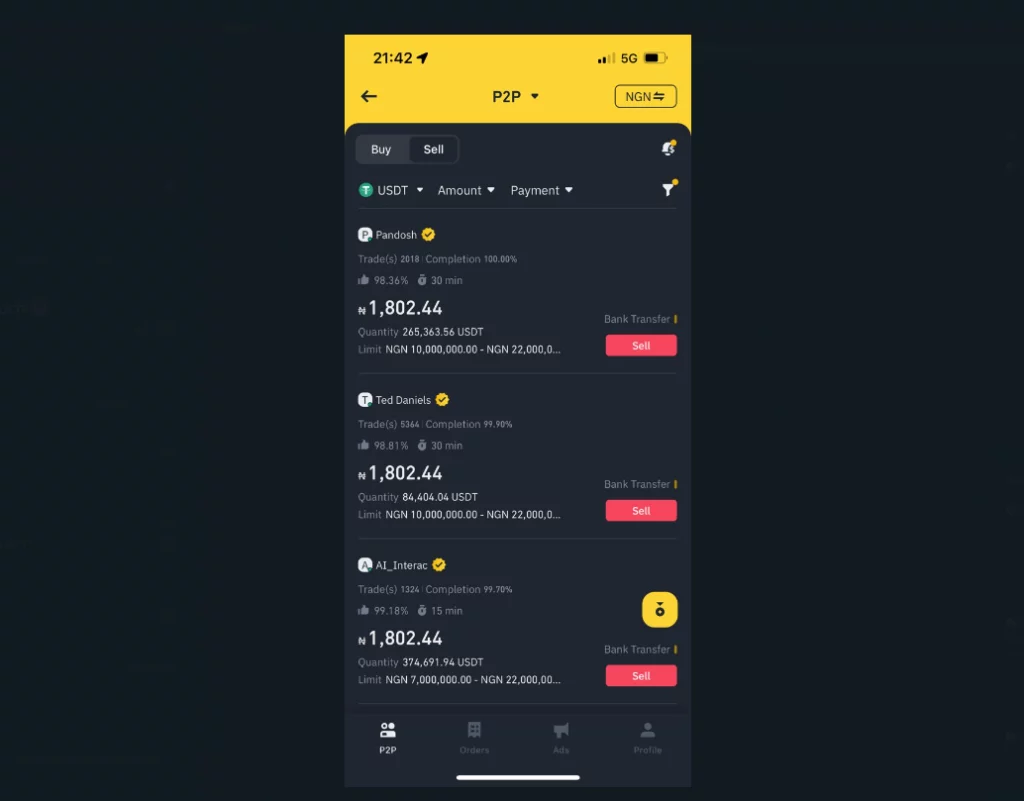

Binance Nigeria has implemented a price cap of 1,802 naira per USDT token on its P2P platform, aligning with local regulatory requirements. This move ensures compliance with directives from Nigerian authorities, emphasizing the exchange’s commitment to working collaboratively with local regulators, lawmakers, and authorities. By setting a limit on the selling price of USDT tokens, Binance aims to mitigate potential risks associated with non-compliance and maintain a market-driven platform for users. However, this action has led to the blocking of accounts of traders attempting to sell above the prescribed cap, prompting some traders to seek alternative P2P options on other exchanges.

What Factors Have Contributed to Nigeria’s Economic Instability and Forex Speculation?

The collaboration between the Nigerian National Security Adviser’s Office and the Central Bank of Nigeria (CBN) underscores efforts to address forex speculation and economic instability in the country. Forex speculators, operating domestically and internationally through various mechanisms, have significantly impacted the depreciation of the naira, exacerbating inflation and economic instability. The unification of forex windows in mid-2023 resulted in a substantial devaluation of the naira against the dollar, highlighting the challenges faced in maintaining currency stability amidst speculative activities.

How Has Nigeria’s Regulatory Environment Impacted the Cryptocurrency Market and P2P Trading?

Nigeria’s cryptocurrency market has experienced regulatory scrutiny and shifts in policy, influencing P2P trading dynamics. Despite the Nigerian Securities and Exchange Commission’s (SEC) warning against using Binance due to its unlicensed operations, the lifting of the crypto ban on Nigerian banks in December 2023 signaled a potential shift in regulatory stance. The ban on institutions from buying and selling crypto in 2021 led to the emergence of Nigeria as the largest P2P market globally. The attractiveness of P2P transfers lies in their lower fees compared to traditional banking and Bureau de Change channels, providing an alternative avenue for Nigerians navigating foreign exchange transactions.