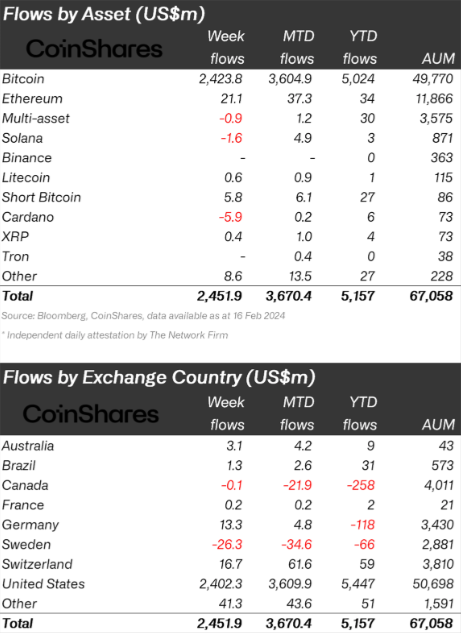

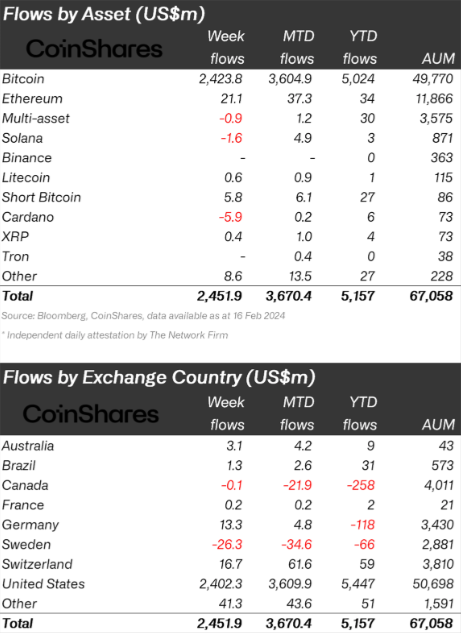

According to a recent report from asset manager CoinShares, crypto investment products saw a significant surge in inflows, totaling $2.45 billion over the past week. This notable increase has propelled year-to-date inflows to an impressive $5.2 billion. The influx of capital, combined with recent upward price movements, has driven total assets under management (AUM) in crypto investment products to $67 billion, marking a peak last observed in December 2021.

Record Inflows of $2.5 Billion Reflect Surging Investor Confidence in Crypto Investment Products

The substantial inflows of $2.5 billion into crypto investment products signify a surge in investor confidence and interest in the digital asset market. These products include a variety of investment vehicles such as cryptocurrency exchange-traded funds (ETFs), trusts, and other investment funds tailored to the crypto market.

Alternative cryptocurrencies like Avalanche, Chainlink, and Polygon also experienced favorable inflows, with each receiving approximately $1 million, sustaining a consistent pattern of weekly capital influxes throughout the year.

Drivers Behind the Surge in Capital Inflows into Crypto Investment Products

Several factors contribute to this significant influx of capital into crypto investment products. One key factor is the increasing mainstream acceptance and adoption of cryptocurrencies, driven by growing institutional interest and endorsement. Additionally, the ongoing market volatility and uncertainty in traditional financial markets have prompted investors to seek alternative investment opportunities, with cryptocurrencies emerging as an attractive option.

Anticipated Impacts of Significant Inflows into Crypto Investment Products

Implications for Investors

For investors, the significant inflows into crypto investment products present both opportunities and challenges. On one hand, it signifies growing confidence in the long-term potential of cryptocurrencies as an asset class. On the other hand, it underscores the importance of thorough research and risk management strategies, given the inherent volatility and uncertainties associated with the crypto market.

Regionally, the bulk of these inflows were centered in the United States, representing 99%, or roughly $2.4 billion, of the total amount. This signifies a notable increase in net inflows across various providers, highlighting a growing interest in spot-based ETFs.

Conversely, outflows from established entities have notably decreased. In contrast, other regions witnessed more modest shifts, with Germany and Switzerland recording inflows of $13 million and $1 million, respectively, while Sweden experienced outflows of $26 million.