Crypto currency market climbed by 2.60% to $2.45 trillion

- The US manufacturing sector experienced accelerated contraction in February, as indicated by a decline in the ISM Manufacturing PMI from 49.1 in January to 47.8, significantly lower than the anticipated 49.5.

- Incidents of cryptocurrency losses resulting from hacks and rug pulls have exceeded $200 million in the ongoing year, spanning across 32 distinct occurrences.

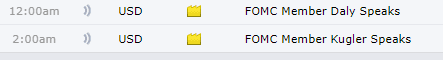

Major Events To Watch

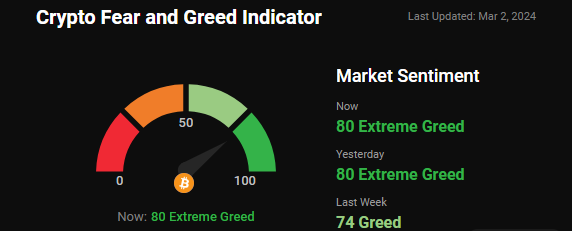

Crypto Fear and Greed Index:

During the last 24 hours, the “Fear and Greed Index” has maintained stability, holding steady at 80 out of 100. However, market sentiment remains distinctly inclined towards optimism, showing no signs of wavering.

Latest Market Update:

- Bitcoin ($BTC) has exceeded the $62,000 milestone, reinforcing its position as the longest-standing and most valuable cryptocurrency in the market.

- Ethereum ($ETH), Bitcoin Cash ($BCH), Ripple ($XRP), and Cardano ($ADA) have observed a significant uptick in market activity, reflecting a notable surge in their respective values.

- Shiba Inu ($SHIB) has emerged as the standout performer, boasting an impressive surge of over 57% within the span of 24 hours.

- Conversely, Jasmycoin ($JASMY) has recorded the most substantial loss, plummeting by nearly 4.65% during the same 24-hour period.

- The total volume of the cryptocurrency market over the past day has amounted to $109.43 billion, indicating a decline of 25.18%.

- Within the decentralized finance (DeFi) sector, the total volume has reached $8.59 billion, constituting 7.85% of the total crypto market’s 24-hour volume.

- Stablecoins have contributed significantly to the overall market volume, accounting for $97.42 billion, which represents 89.03% of the total crypto market’s 24-hour volume.

- Bitcoin dominance currently stands at 52.30%, experiencing a decrease of 0.44% within the day.

Major Worldwide News Update:

- Grayscale, a leading cryptocurrency asset manager, issues a warning regarding the impact of inflation on crypto values amidst Bitcoin’s remarkable 45% surge in February.They highlight the influence of Federal Reserve policies on crypto markets and anticipate potential rate cuts.Despite record inflows into crypto funds and heightened interest in Bitcoin ETFs, caution persists due to macroeconomic uncertainties and forthcoming inflation reports.

- The US Energy Information Administration (EIA) halts the collection of energy consumption data from crypto mining following a lawsuit from industry players like The Texas Blockchain Council and Riot Platforms.EIA agrees to discontinue data collection, destroy received information, and seek public comments, reflecting growing regulatory and environmental concerns in the sector.

- Nvidia surpasses Saudi Aramco to become the third-largest global company by market capitalization, valued at $2.053 trillion.With a dominant role in AI chip manufacturing, Nvidia benefits from increasing demand for AI technologies, consolidating its position in the tech industry.Strategic initiatives, including AI-based applications and expansion into markets like China, contribute to its ongoing success.

- FTX Derivatives Exchange, bankrupt since 2022, appoints Galaxy Asset Management as the sole investment manager for creditors’ asset sales.Unauthorized bids are cautioned against, emphasizing compliance with legal regulations.FTX aims to repay creditors by leveraging asset sales, including a pending $1 billion stake in Anthropic, subject to approval.

- Nigeria refutes claims of a $10 billion fine for Binance, citing misquotation by Premium Times, amidst regulatory scrutiny leading to the ban of major crypto exchanges.Recent events, including the detention of Binance executives, underscore growing tensions with the industry.Binance pledges to resolve issues with Nigeria, denying awareness of the alleged fine.

- A February report reveals a $200 million loss from crypto hacks and frauds, stressing the necessity for enhanced security in DeFi.Hacks dominate the losses, comprising 97.54%, with Ethereum being a prime target.Strengthening security measures is crucial to protect the crypto ecosystem against such risks.

- Solana’s native token, SOL, surges to a 23-month high on March 1, outpacing competitors like BNB, sparking concerns about sustainability.Recent gains coincide with increased demand for Solana SPL memecoins and reports associating SOL with former FTX CEO’s recommendations, though the correlation remains speculative.