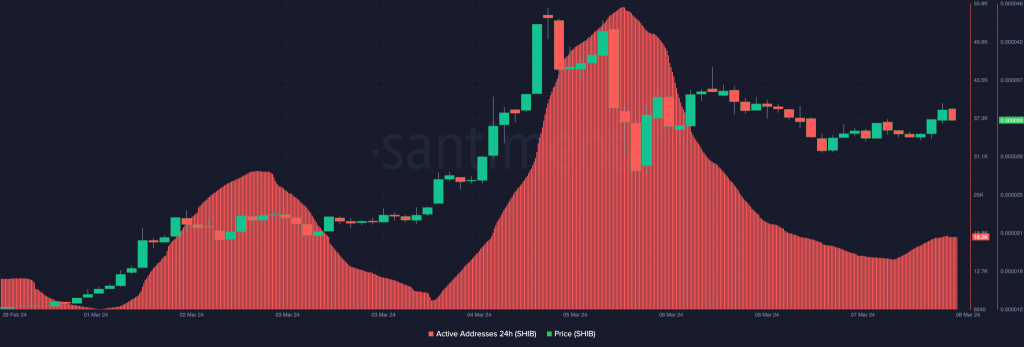

Once again, the remarkable influence wielded by the Shiba Inu (SHIB) community has resurfaced, manifesting in a significant surge in active addresses associated with the project. After soaring to a pinnacle of 55,200 active addresses, the project encountered a transient decline in active addresses between the 5th and 7th of March.

Active addresses serve as a pivotal metric, offering insights into the number of unique users actively participating in transactions within a specified timeframe. This metric stands as a key barometer for assessing the level of speculation and community engagement surrounding a token. Notably, during the period of escalated active addresses, Shiba Inu witnessed an extraordinary 213% surge in its price over the span of just seven days.

However, this meteoric ascent was met with a subsequent downturn, as the metric experienced a dip, coinciding with a 6% decline in Shiba Inu’s price over a 24-hour period. At the latest examination by AMBCrypto, the metric has staged a recovery, rebounding to 18,200 active addresses, accompanied by an impressive 11% surge in the token’s value.

This ebb and flow in active addresses, coupled with the corresponding price fluctuations, underscore the dynamic and influential nature of the Shiba Inu community and its profound impact on the token’s market dynamics. It illuminates the intricate interplay between community sentiment, speculative fervor, and market performance within the vibrant ecosystem of Shiba Inu, underscoring the resilience and volatility inherent in the cryptocurrency landscape.

Meet me at the top,’ SHIB signals

It’s crucial to delve deeply into the complexities of cryptocurrency market dynamics, particularly concerning assets like Shiba Inu (SHIB). While metrics play a pivotal role, it’s essential to recognize that they’re not the sole determinants of price fluctuations. Recent market trends have sparked discussions about SHIB’s potential to replicate its earlier performance, raising intriguing possibilities for investors and enthusiasts alike.

Consider the scenario where SHIB might surge by a staggering 200% within a mere seven days. Such a meteoric rise is indeed within the realm of possibility, given the asset’s history of volatility and rapid price movements. However, the market is not devoid of potential obstacles, and there exists a distinct possibility that SHIB’s value could opt to retest the $0.000040 level.

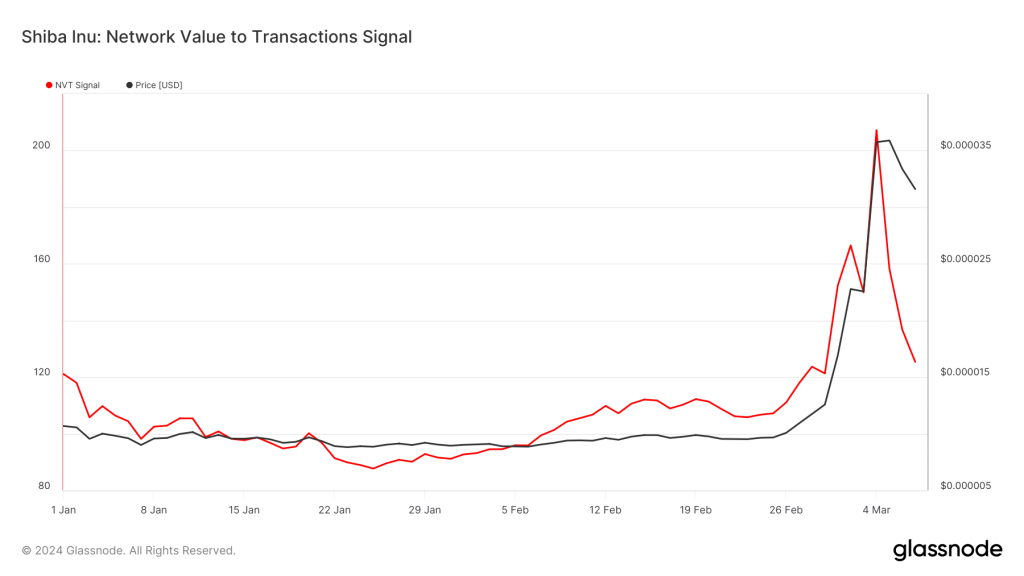

As of the latest update, SHIB is being traded at $0.000033, reflecting the ongoing activity and sentiment within the market. Delving deeper into market analysis, AMBCrypto has meticulously leveraged Glassnode data to conduct a thorough examination of the Network Value to Transaction (NVT) Signal.

The NVT Signal is a critical leading indicator, offering invaluable insights into whether an asset is presently valued at a premium or a discount relative to its underlying fundamentals. In the context of SHIB, historical data suggests that peaks in the NVT Signal have often coincided with subsequent declines in the asset’s value, as evidenced by comprehensive chart analyses.

However, the current reading of the NVT Signal stands at a notable 125.37, significantly lower than its recent peak of 207.19. This intriguing shift suggests that Shiba Inu may be approaching a potential short-term bottom in its price trajectory. Such a development carries significant implications for market participants, as it potentially signifies an opportune moment for a reversal in SHIB’s fortunes.

In summary, while the cryptocurrency market remains inherently volatile and unpredictable, thorough analysis of metrics like the NVT Signal offers valuable insights into potential market trends and opportunities. As investors navigate the intricacies of SHIB’s price movements, staying informed and vigilant is paramount to making well-informed decisions in this dynamic landscape.

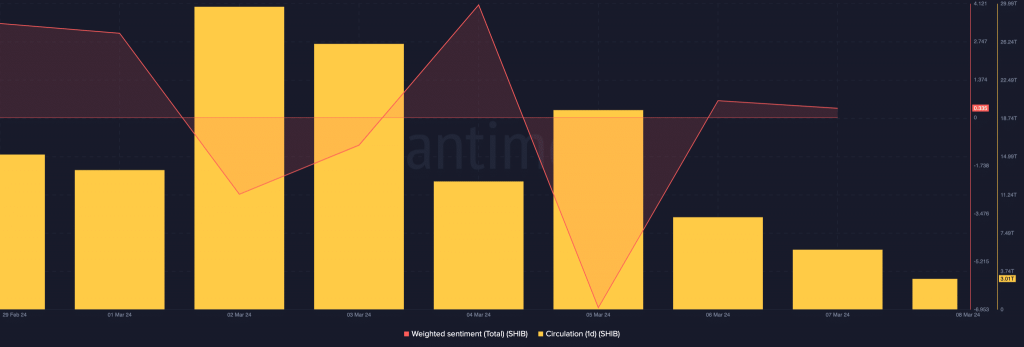

Circulation drops as sentiment remains bullish

In addition to the previously mentioned metric, AMBCrypto also took into account the sentiment surrounding SHIB. As of the latest update, the Weighted Sentiment stands at 0.335, slightly lower compared to previous days.

Weighted Sentiment serves as a valuable indicator, gauging the unique social volume to determine whether market participants are leaning towards a bullish or bearish outlook on a particular project. Despite the slight decrease, the fact that the metric remains in positive territory implies that discussions surrounding Shiba Inu have been predominantly optimistic, with a greater prevalence of positive sentiment compared to negative sentiment.

Furthermore, when examining the one-day circulation using Santiment’s on-chain data, a decline is noted. As of the latest observation, the circulation has decreased to 3.01 trillion. This reduction suggests that fewer tokens have been involved in transactions since the 5th of March.

While this decline in circulation could potentially have a negative impact on activity, it does not necessarily translate to a negative effect on the price of SHIB. In fact, a decreasing circulation may indicate a reduction in selling pressure on the asset.

Consequently, the potential for SHIB to ascend further, possibly towards the $0.000050 mark, remains a viable prospect. With decreasing circulation potentially alleviating selling pressure, the path for SHIB to experience further upward movement is open, presenting an enticing opportunity for investors.