in brief

- Jamie Dimon maintains skepticism regarding Bitcoin, even as its price soars to $72,000.

- He critiques Bitcoin’s volatility and its connection with illicit activities.

- However, Dimon acknowledges people’s right to purchase Bitcoin.

- Dimon’s perspective mirrors a wider skepticism among financial figures regarding the fundamental value of cryptocurrencies.

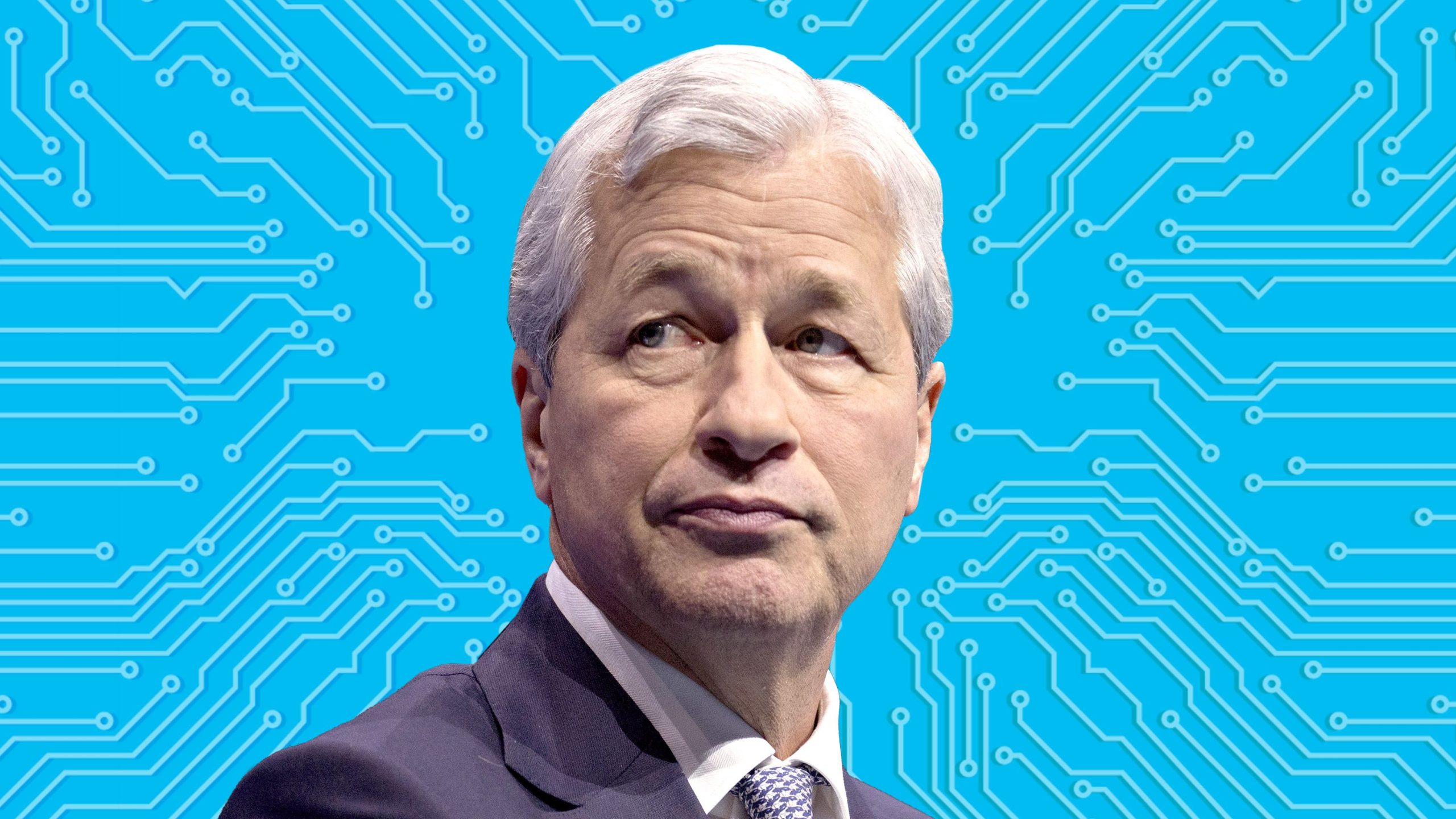

In the realm of cryptocurrency, the atmosphere is electric, akin to a hive in overdrive, with Bitcoin reigning as the queen bee commanding everyone’s attention. Its price has surged to an astonishing $72,000, breaking records with the fervor of a rock star smashing guitars. However, amidst the frenzy, Jamie Dimon, the formidable leader of JPMorgan Chase and the highest-paid CEO on Wall Street, remains unswayed by the hype. Contrary to expectations, Dimon stands firm, refusing to join the throngs of investors flocking to digital coins.

Jamie Dimon’s Cold Shoulder to the Crypto Craze: A Beacon of Caution in a Frenzied Financial Landscape

The cryptocurrency craze has swept across the global financial landscape like a wildfire, igniting fervent discussions, sparking unprecedented price surges, and captivating the attention of investors, pundits, and enthusiasts alike. At the heart of this frenzy stands Bitcoin, the pioneer and poster child of the digital currency revolution. With its meteoric rise to prominence, commanding staggering valuations, and disrupting traditional notions of finance, Bitcoin has emerged as a symbol of both innovation and controversy.

Amidst this whirlwind of excitement and speculation, one figure stands out for his steadfast refusal to embrace the crypto craze: Jamie Dimon, the influential titan of Wall Street and CEO of JPMorgan Chase. Dimon’s position on cryptocurrencies, particularly Bitcoin, is characterized by skepticism, caution, and a notable degree of aversion.

Despite Bitcoin’s stratospheric rise to a jaw-dropping $72,000, smashing through barriers and setting new records with the swagger of a rock star, Dimon remains unmoved. His skepticism is grounded in concerns regarding Bitcoin’s inherent volatility, its association with illicit activities, and its perceived lack of intrinsic value. Dimon, with his extensive experience and deep understanding of the financial landscape, refuses to succumb to the allure of the crypto frenzy, maintaining a cool and calculated approach amidst the chaos.

In the eyes of many, Dimon’s stance represents more than just personal preference; it reflects a broader sentiment among traditional financial institutions and regulatory bodies. The rapid ascent of cryptocurrencies has prompted intense scrutiny and debate, with questions raised about their long-term viability, regulatory oversight, and potential systemic risks. Dimon’s reluctance to embrace the crypto craze echoes the sentiments of many within the established financial establishment who view cryptocurrencies with a mixture of caution and skepticism.

While the allure of quick riches and the promise of a decentralized financial future may captivate the masses, Dimon remains anchored in the principles of prudence and skepticism. His steadfast refusal to join the ranks of crypto enthusiasts serves as a reminder of the complexities and uncertainties surrounding the digital currency revolution. In a landscape characterized by rapid change and relentless innovation, Dimon’s cold shoulder to the crypto craze serves as a poignant reminder that not all that glitters is gold, and that caution and discernment are often the wisest guides in navigating the turbulent seas of finance.

Navigating the Twists and Turns of Cryptocurrency’s Journey

The saga of Bitcoin reads like a gripping Hollywood thriller, replete with dizzying highs, gut-wrenching lows, and adversaries lurking in the shadows in the form of hackers. From its meteoric rise during the years spanning 2011 to 2013, where it captured imaginations and wallets alike with its exponential price surge, to the harrowing descent into chaos in 2014 following the catastrophic collapse of Mt. Gox, Bitcoin has weathered every storm imaginable.

But the drama didn’t stop there. The subsequent years brought a rollercoaster of price fluctuations, characterized by euphoric rallies and gut-wrenching crashes. The year 2018 witnessed the frenzy of initial coin offerings (ICOs), a speculative bonanza that left many investors nursing heavy losses when the bubble burst.

Just as Bitcoin seemed to be on the brink of irrelevance, the narrative took an unexpected twist from 2019 to 2021, with prices resuming their ascent. However, this newfound optimism was short-lived, as 2022 ushered in a period of turmoil marked by the collapse of major cryptocurrency companies like FTX, sending shockwaves through the market.

In the midst of this tumultuous journey, Jamie Dimon stands as a steadfast skeptic, unwavering in his reservations about Bitcoin and its ilk. His stance finds resonance among other titans of finance, such as Warren Buffett, who have cast a skeptical eye on the cryptocurrency craze. Buffett, in his characteristic candor, has likened Bitcoin to a mere casino token, devoid of any intrinsic value, yet strangely alluring to speculators drawn to its allure like moths to a flame.

Dimon’s skepticism extends beyond the realm of cryptocurrency, encompassing broader economic concerns. He has sounded the alarm on the possibility of a looming recession in the United States, cautioning against premature Federal Reserve rate cuts as a panacea. In a landscape rife with uncertainty, Dimon advocates for a measured approach, urging policymakers to closely monitor economic indicators and exercise prudence in their decision-making.

As the United States grapples with the aftermath of the COVID-19 pandemic, Dimon remains a voice of reason, highlighting the distortions in economic data and urging policymakers to exercise caution in their response. In a world gripped by uncertainty and volatility, Dimon’s steadfast skepticism and measured approach serve as a beacon of stability, guiding investors and policymakers alike through the treacherous waters of the modern financial landscape.