summary

- Drake posted a snippet of Michael Saylor’s CNBC interview discussing Bitcoin to his vast Instagram following of 146 million, emphasizing Bitcoin’s superiority over gold as an asset.

- This share signifies significant celebrity involvement with cryptocurrency, potentially swaying public attention towards digital assets.

- MicroStrategy persists in its assertive investment approach towards Bitcoin, acquiring an extra 12,000 BTC, thereby elevating its total Bitcoin holdings to 205,000 BTC.

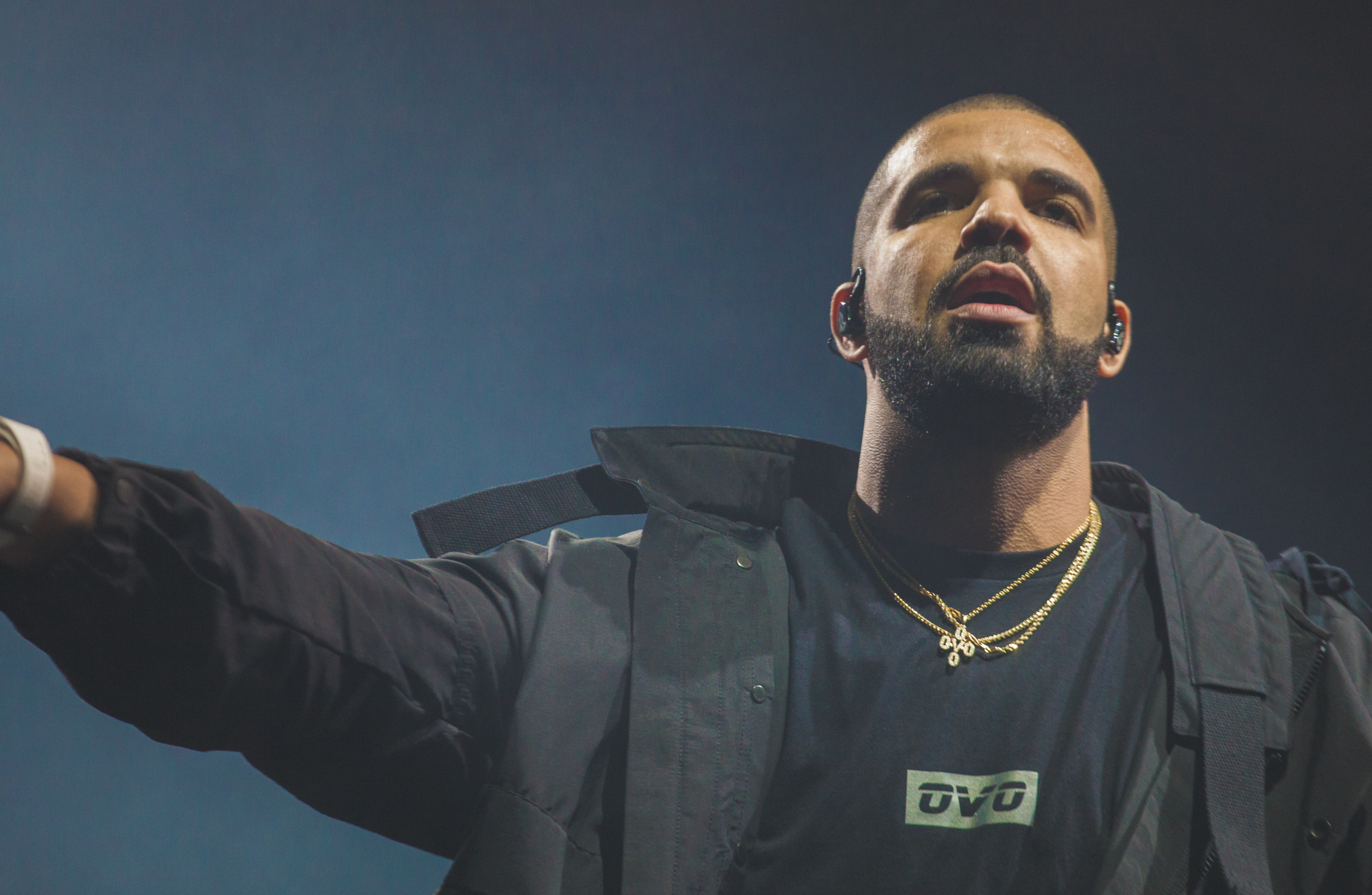

Drake, the esteemed Canadian rapper and cultural icon, commands an impressive following of over 146 million on Instagram, making him one of the most influential figures in the realm of social media. Recently, amidst the fervor surrounding cryptocurrency, Drake shared a noteworthy clip of Michael Saylor’s appearance on CNBC, where Saylor expounded on the virtues of Bitcoin as a superior store of value compared to gold. The clip, originally posted by the account bitcoin_memes_daily and captioned “Michael Saylor on Bitcoin,” captured Saylor’s compelling insights into the potential of Bitcoin to outshine traditional assets like gold in terms of investment value and security.

Drake, known by his Instagram handle “champagnepapi,” is renowned not only for his musical prowess but also for his keen eye for emerging trends and cultural phenomena. His decision to share Saylor’s interview clip underscores a notable moment of celebrity engagement with cryptocurrency content, particularly within the context of the ongoing bull market in the crypto space. By leveraging his vast platform and reach, Drake effectively amplifies the conversation surrounding Bitcoin and elevates its visibility among his legion of followers, many of whom may be curious or intrigued by the prospects of digital assets.

The significance of Drake’s endorsement of Saylor’s insights cannot be overstated, as it represents a convergence of mainstream celebrity culture with the burgeoning world of cryptocurrency. In an era where influencers wield considerable sway over public opinion and consumer behavior, Drake’s nod towards Bitcoin through the dissemination of Saylor’s commentary holds the potential to catalyze increased interest and adoption of digital currencies among a broader audience. Moreover, Drake’s endorsement serves as a testament to the growing legitimacy and mainstream acceptance of Bitcoin as a viable investment vehicle and store of value.

In essence, Drake’s decision to share Michael Saylor’s insights on Bitcoin serves as a powerful endorsement of the cryptocurrency’s potential and relevance in today’s financial landscape. As celebrities like Drake continue to engage with and promote cryptocurrency content, they play a pivotal role in shaping public perception and driving adoption of digital assets, ultimately contributing to the ongoing evolution and maturation of the blockchain ecosystem.

Drake is posting Bitcoin memes on Instagram

Retail is officially back pic.twitter.com/6cmVbRQ19A

— LilMoonLambo (@LilMoonLambo) March 12, 2024

During his interview, Michael Saylor, the CEO of MicroStrategy, underscored Bitcoin’s superiority over gold, suggesting that Bitcoin is poised to surpass gold as the preferred asset for value preservation. It’s worth noting that Saylor’s perspective on Bitcoin emerges at a time when celebrity and influencer endorsements of cryptocurrencies are less frequent, a departure from the previous bull market characterized by numerous high-profile endorsements.

Additionally, MicroStrategy recently garnered attention with its acquisition of an additional 12,000 BTC, amounting to approximately $821.7 million, as reported by Cryptopolitan. This acquisition, funded through convertible notes and excess cash, was executed at an average price of $68,477 per Bitcoin. Following this purchase, MicroStrategy’s total Bitcoin holdings have surged to 205,000 BTC, reflecting an overall investment of about $6.91 billion, translating to an average purchase price of $33,706 per Bitcoin.

Drake’s Instagram post on Bitcoin is poised to attract public attention to the digital asset space.

Simultaneously, MicroStrategy’s steadfast commitment to Bitcoin investment underscores the company’s confidence in the cryptocurrency’s value and its pivotal role in the firm’s treasury strategy.