Over the course of approximately the last twelve months, the integration and adoption of scaling solutions have undeniably emerged as pivotal catalysts in augmenting the demand dynamics within the expansive Ethereum (ETH) ecosystem. This transformative trajectory has been propelled by the advent of what are commonly referred to as layer-2 (L2) chains, strategically engineered to surmount the formidable scalability impediments inherent to Ethereum’s foundational infrastructure.

Conceived as adjunct layers atop the Ethereum base, these L2 solutions epitomize a visionary approach aimed at redressing the perennial scalability quandaries that have historically plagued the Ethereum network. The overarching objective envisaged with the deployment of L2 chains is the strategic offloading of a substantial volume of low-value transactions from the primary blockchain layer, while concurrently safeguarding the imperatives of security and decentralization that constitute the bedrock ethos of the Ethereum ecosystem.

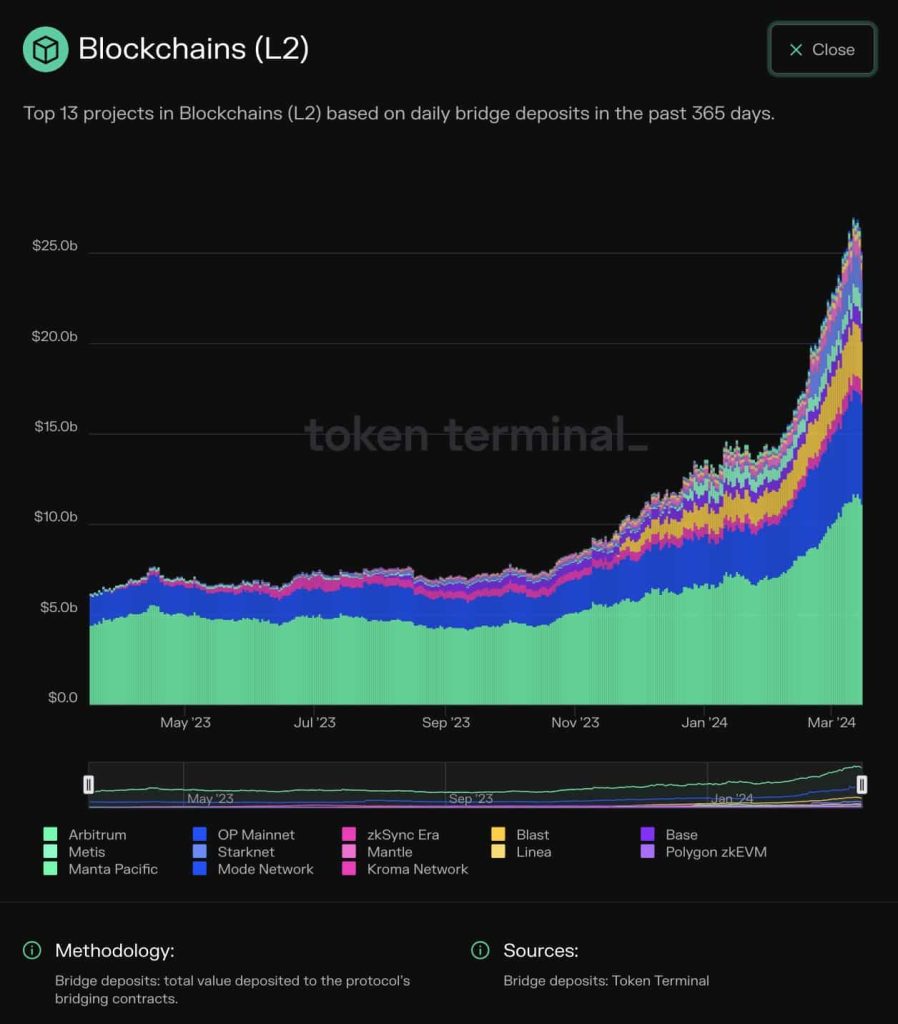

The crystallization of this strategic vision into tangible reality has been discernibly corroborated by recent insights gleaned from the latest analyses furnished by esteemed on-chain analytics firm Token Terminal. Their comprehensive examination has illuminated a pronounced and meteoric escalation in the migration of assets from the Ethereum mainnet to the burgeoning array of L2 solutions during the nascent stages of the year 2024. This discernible surge in adoption signifies a compelling and irrefutable testament to the progressive realization of the envisioned scalability enhancements envisaged within the ever-evolving tapestry of the Ethereum landscape.

Users capitalize on L2 benefits

The concept of bridging, as you might already be familiar with, encompasses the intricate process of seamlessly transferring digital assets from the primary layer (L1) to the secondary layer (L2) within the Ethereum ecosystem. This strategic maneuver is strategically employed to harness the unparalleled benefits offered by L2 solutions, particularly in terms of expedited transaction speeds and significantly reduced transaction costs.

Delving into the quantitative insights gleaned from the aforementioned dataset, it becomes abundantly clear that the cumulative value of assets deposited through the bridging mechanism has remarkably eclipsed the staggering milestone of $25 billion, as meticulously documented up to the precise date of March 16. This extraordinary surge represents an astonishing fivefold escalation when juxtaposed with the corresponding temporal snapshot from the antecedent year, underscoring the burgeoning momentum and heightened traction witnessed within the Ethereum ecosystem’s scaling landscape.

Of particular note is the noteworthy prominence achieved by Arbitrum (ARB), which has emerged as the undisputed frontrunner in this dynamic arena, capturing an impressive 42% share of the total deposits channelled through bridging mechanisms. Following closely behind is the OP Mainnet (OP), which has also garnered substantial attention and adoption, further accentuating the diversified array of L2 solutions vying for prominence within the Ethereum ecosystem.

This discernible trend serves as a poignant testament to the resounding efficacy and tangible benefits afforded by these innovative L2 networks, which are progressively reshaping the contours of Ethereum’s scalability paradigm. Indeed, as the Ethereum ecosystem continues to evolve and mature, the strategic integration of L2 solutions is poised to assume an even more pivotal role in fostering sustainable growth, enhancing user experience, and fortifying the network’s resilience against the ever-escalating demands of a burgeoning user base and burgeoning transaction volumes.

Dencun was the main driver

The palpable surge in demand experienced throughout the vibrant landscape of Ethereum in the year 2024 undoubtedly finds its roots intertwined with the fervent anticipation surrounding the epochal Dencun upgrade, a monumental leap forward that recently made its much-heralded debut, officially going live just last week. This eagerly awaited deployment has heralded a seismic shift in the dynamics of the Ethereum ecosystem, particularly evident in the substantial and precipitous drop in gas fees witnessed across a plethora of L2 chains.

The magnitude of this transformation is nothing short of remarkable, with gas fees plummeting by an astounding margin of up to 90% in select instances, effectively shattering previous barriers and opening floodgates of opportunity for Ethereum users worldwide. Such a profound reduction in transaction costs has ignited a veritable frenzy among users, who are fervently seizing upon this opportune moment to expeditiously transfer their assets to these newly revitalized L2 networks, eager to bask in the newfound realms of affordability and efficiency that the Dencun upgrade has bestowed upon them.

Indeed, this flurry of activity underscores the undeniable significance and impact of the Dencun upgrade, which has swiftly emerged as a beacon of progress and innovation within the Ethereum community, reshaping paradigms and redefining possibilities in its wake. As users scramble to capitalize on the tangible benefits afforded by this transformative development, the Ethereum ecosystem stands poised on the precipice of a new era, characterized by unprecedented accessibility, scalability, and resilience in the face of evolving challenges and burgeoning demands.

Win-win for ETH?

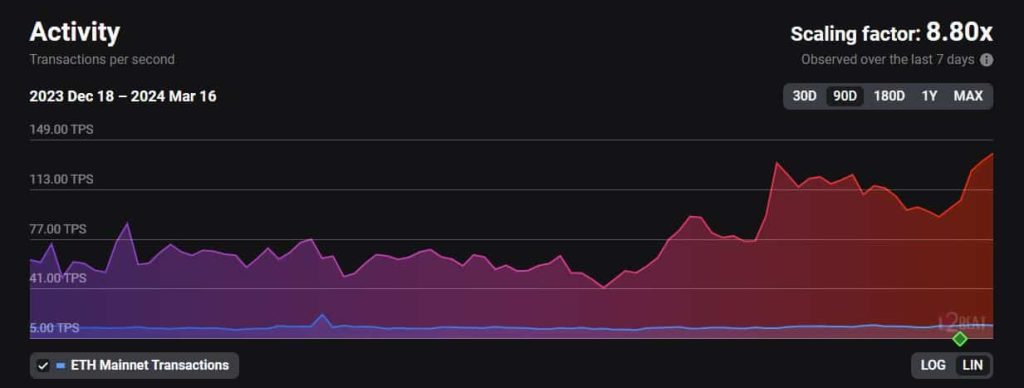

The burgeoning demand within the Ethereum ecosystem has ignited a veritable explosion of on-chain activity, a phenomenon underscored by the latest revelations from AMBCrypto, which meticulously analyzed data from L2Beats. According to their findings, the transactional throughput on Layer-2 (L2) solutions has soared to unprecedented heights, eclipsing the volume settled on the base layer by a staggering factor of more than eight times, marking a paradigm shift in Ethereum’s operational dynamics.

Delving deeper into the mechanics of L2 transactions unveils a fascinating process. Post-validation, L2 networks aggregate individual transactions into meticulously curated batches before transmitting a compressed rendition to the Ethereum base layer for the final settlement. What’s particularly noteworthy is the symbiotic relationship between L2 transactional activity and the underlying Ethereum (ETH) ecosystem. Each transaction initiated on an L2 network triggers the burning of a fractional percentage of the total ETH supply, thereby augmenting the intrinsic value of ETH itself, a captivating phenomenon that underscores the interconnectedness and mutual reinforcement inherent within Ethereum’s multifaceted architecture.

As the pulse of the Ethereum ecosystem beats fervently, the market sentiment oscillates in tandem, as evidenced by the latest market data from CoinMarketCap, which reveals Ethereum (ETH) trading at $3,570, reflecting a modest decline of 4.56% over the preceding 24-hour period. This dynamic interplay between transactional velocity, network valuation, and broader market dynamics underscores the pivotal role played by Ethereum’s burgeoning ecosystem in shaping the trajectory of decentralized finance and the broader blockchain landscape. Indeed, as Ethereum continues to evolve and mature, the boundless possibilities and transformative potential it harbors are poised to revolutionize the very fabric of our digital economy.