summary

- Solana faces network congestion amidst surging investor interest.

- Discrepancy in TPS raises doubts about network capabilities.

- Market resilience tested as SOL continues trading actively.

- Solana’s DeFi TVL has climbed by over 80% in the last month.

- Demand for SOL persisted despite the general market downturn

In the ever-evolving landscape of decentralized finance (DeFi), the Solana (SOL) platform is currently navigating through a period of unprecedented growth and transformation, marked by a surge in network congestion amidst soaring investor interest. This surge has been accompanied by a remarkable rally in SOL, the platform’s native token, which has catapulted to new all-time highs. Adding to the fervor, the recent introduction of meme coins on the Solana network has intensified attention and engagement among users, further fueling the platform’s meteoric rise.

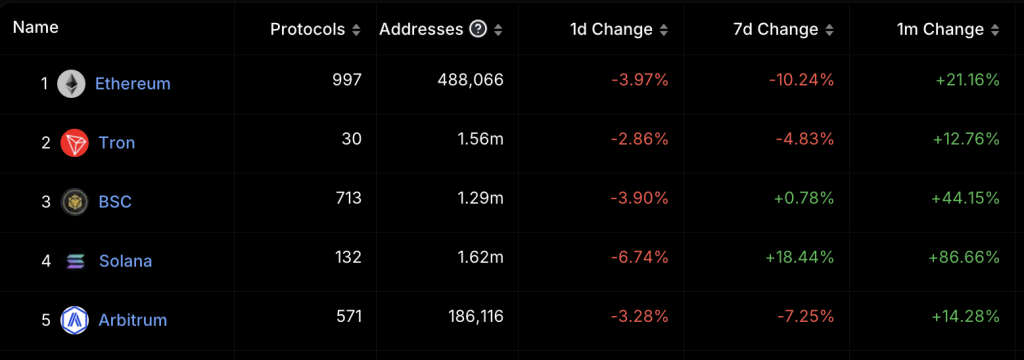

Data sourced from DefiLlama underscores the magnitude of Solana’s ascent, revealing a staggering surge of over 80% in the decentralized finance (DeFi) total value locked (TVL) over just the past month. This monumental growth trajectory has propelled Solana’s DeFi TVL to reach its highest echelon witnessed in the past two years, a testament to the platform’s rapid expansion and maturation within the DeFi ecosystem.

As of the latest data available, Solana’s DeFi TVL stands at an impressive $3.8 billion, firmly establishing its position among the top-tier DeFi networks on a global scale. Notably, Solana emerges as the blockchain with the most pronounced growth trajectory in terms of TVL over the past month, affirming its stature as a formidable force in the decentralized finance arena.

In essence, Solana’s remarkable ascent exemplifies its resilience, innovation, and unwavering commitment to pushing the boundaries of decentralized finance, setting the stage for a future defined by unprecedented opportunities and transformative possibilities within the digital financial landscape.

Network congestion challenges Solana

In a recent revelation drawing from on-chain data analysis, the Solana network finds itself embroiled in a dire predicament characterized by severe congestion, thereby precipitating profound implications for transaction processing and the overarching performance of the network at large.

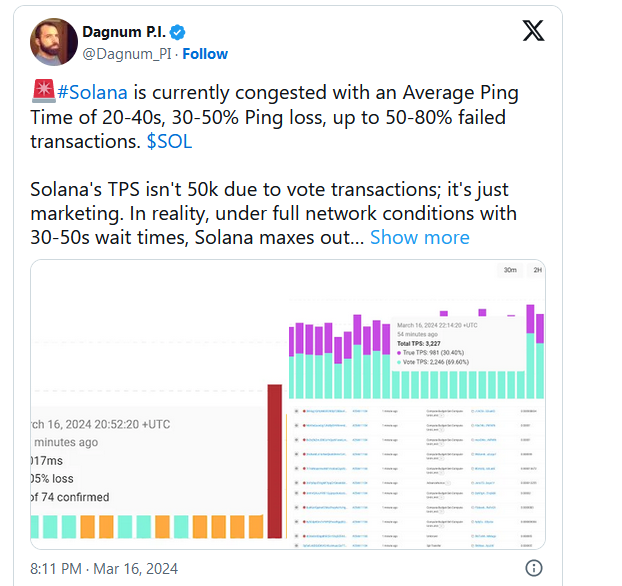

The gravity of the situation becomes palpably evident through insights shared on social media platform X, formerly known as Twitter, by Dagnum_PI, a reputable and authoritative figure within the blockchain sphere. According to these disclosures, the average ping time experienced within the Solana network has ballooned to a troubling range spanning between 20 to 40 seconds. Such protracted latency spells outcries of distress, delineating substantial delays in the exchange of information among the network’s nodes, thereby posing formidable obstacles to the seamless functioning of its operations.

The reverberations of this latency crisis reverberate far and wide, exacting a toll on crucial facets such as transaction confirmation times and the overall responsiveness of the network. Of particular note is the revelation that the data underscores a disconcerting ping loss, hovering between a staggering 30 to 50 percent. This exacerbates the congestion conundrum, magnifying the incidence of transactional failures and delays that pervade the network’s operations.

Perhaps most alarming of all is the startling statistic indicating that a disconcerting percentage, ranging from 50 to 80 percent, of transactions are reportedly failing within the Solana network. This alarming revelation serves as a clarion call, sounding the alarm bells on the foundational issues bedeviling the network’s transactional processing capabilities and its overarching stability.

In the face of this unfolding crisis, urgent action is imperative to rectify the congestion quagmire and fortify the resilience of Solana’s infrastructure. It is paramount that swift and decisive measures be undertaken to alleviate congestion woes, thereby safeguarding the integrity of the network and restoring confidence among its users. Failure to address these pressing concerns in a timely manner risks undermining the credibility of Solana’s ecosystem and jeopardizing its long-term viability as a leading player in the blockchain landscape.

Solana’s TPS discrepancy adds to network woes

Despite lofty claims asserting a transaction processing system (TPS) capable of handling 50,000 transactions per second (TPS), empirical evidence starkly contrasts this narrative under full network conditions. This glaring incongruity, as meticulously underscored by Dagnum_PI, stems, in part, from the inclusion of vote transactions in the touted TPS metric, which may not accurately reflect the actual throughput available for non-vote transactions. Such discrepancies are not merely trivial; they risk breeding disillusionment among users and perpetuating a deceptive portrayal of the network’s authentic capabilities, which could have far-reaching consequences.

At the heart of this quandary lies the proliferation of spam and Miner Extractable Value (MEV) originating from meme coin activities, acting as the primary agitators exacerbating the strain on the network’s capacity. This deluge of activities, akin to a torrential downpour, not only inundates the network’s resources but also compounds existing congestion woes, engendering a vicious cycle of transactional failures and protracted delays that threaten to undermine the very fabric of Solana’s operational integrity.

Moreover, Solana’s stratospheric ascent in value, while a testament to its potential, has also cast a glaring spotlight on its susceptibility to network outages, with the current congestion predicament serving as an ominous harbinger of the challenges ahead. Persistent elevated rates of transactional failures loom ominously, akin to storm clouds on the horizon, poised to unleash a tempest of frustration among users and developers alike. This tumultuous climate risks eroding confidence in the network’s reliability and resilience, casting a pall over assets tethered to Solana, including its prized native token SOL.

Consequently, the ongoing congestion debacle represents a multifaceted threat, not merely impeding the seamless functioning of the Solana blockchain, but also imperiling its standing within the broader blockchain ecosystem. Urgent and decisive action is imperative to navigate these treacherous waters, lest Solana finds itself adrift in a sea of uncertainty, buffeted by the tempests of user discontent and investor skepticism.

Solana’s Endurance Navigating Network Trials Amid Market Surge

Solana, touted as the potential ‘Ethereum (ETH) killer,’ has long been lauded for its lightning-fast transaction speeds and cost-effectiveness, positioning itself as a formidable competitor in the blockchain arena. However, its lofty reputation has been marred by persistent concerns surrounding exorbitant transaction fees, casting a shadow over its otherwise promising trajectory. Despite these challenges, SOL, Solana’s native cryptocurrency, continues to command significant attention and trading activity, currently valued at $194, reflecting a marginal uptick of 1% over the past 24 hours. Notably, SOL has witnessed an astonishing surge of over 35% in the past week alone, underscoring its enduring allure among investors seeking high-growth opportunities in the burgeoning crypto market.

Yet, Solana finds itself standing at a critical inflection point, grappling with severe network congestion amidst an unprecedented surge in investor interest. This confluence of factors presents a daunting challenge for the platform, exacerbating the glaring disparity between its advertised and observed transaction processing capabilities. Compounding these concerns are lingering doubts stemming from historical instances of network outages, further eroding confidence in Solana’s ability to deliver on its promises of scalability and reliability.

As Solana navigates through this tumultuous period, the stakes have never been higher. The ramifications of its ability to address these pressing issues with alacrity and efficacy cannot be overstated, as they hold the key to shaping its long-term viability and competitive standing in the fiercely contested blockchain landscape. Indeed, the coming days will serve as a litmus test for Solana, determining whether it can weather the storm of challenges and emerge stronger and more resilient, or succumb to the weight of its shortcomings, jeopardizing its position as a leading player in the digital asset ecosystem.

Solana’s DeFi ecosystem so far this month

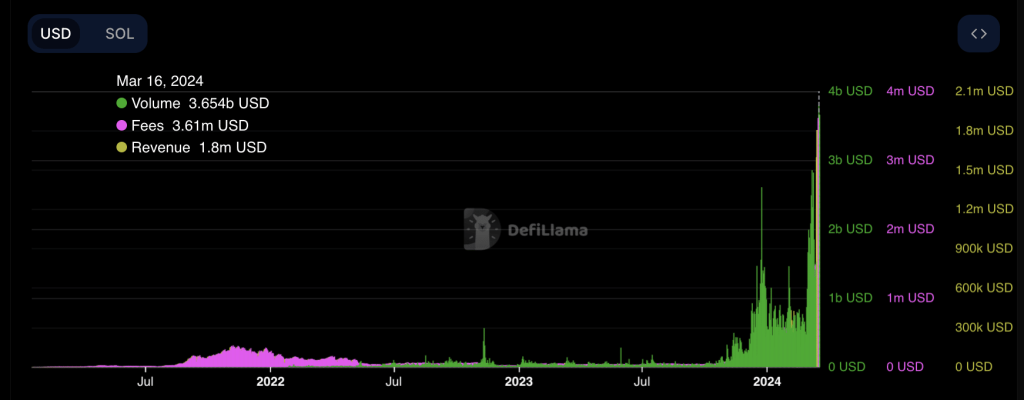

The surge witnessed in Solana’s Total Value Locked (TVL) over the past month stands as a testament to the platform’s meteoric rise within the decentralized finance (DeFi) sector. This remarkable upswing can be chiefly attributed to a significant uptick in trading activity observed across the myriad of DeFi protocols nested within the Layer 1 network (L1). The surge in trading volume within these protocols has been nothing short of staggering, with daily total trading volumes registering an awe-inspiring ascent of 125% since the dawn of the month.

Indeed, the 15th of March emerged as a watershed moment for Solana’s DeFi ecosystem, witnessing a monumental rally in trading activity that propelled the total volume to a multi-year pinnacle of $3.7 billion. Such an unprecedented milestone underscores not only the surging momentum but also the palpable maturation and expansion of Solana’s DeFi landscape, positioning it as a formidable force within the broader DeFi ecosystem.

Furthermore, the 16th of March heralded yet another significant milestone for the Solana network, as network fees skyrocketed to an unprecedented high of $3.61 million. This notable surge in network fees signifies a burgeoning demand for Solana’s blockchain infrastructure, serving as a tangible indicator of its growing prominence and utility within the crypto sphere.

Of paramount importance is the staggering revenue derived from these fees, which tallied an impressive $1.6 million on the same day, marking the network’s highest daily revenue to date. This substantial influx of revenue underscores Solana’s burgeoning economic viability and underscores its potential to generate significant value for network participants and stakeholders alike.

In essence, the recent surge in Solana’s TVL and network activity serves as a compelling testament to the platform’s rapid ascent and increasing adoption within the DeFi landscape. As Solana continues to solidify its standing as a leading blockchain platform, it is poised to play a pivotal role in shaping the future of decentralized finance and catalyzing transformative change within the broader crypto ecosystem.

SOL defies market trajectory

As of the most recent update, SOL, the native cryptocurrency of Solana, commands a price of $187, showcasing a remarkable surge of 72% in value over the course of just one month, according to CoinMarketCap’s latest data.

In stark contrast to the prevailing market dynamics characterized by price volatility and reversals, SOL shines as a beacon of stability and bullish sentiment. This exceptional performance has not gone unnoticed, with investors flocking to capitalize on the promising prospects presented by Solana’s robust ecosystem.

A meticulous examination of SOL’s daily chart movements by AMBCrypto unveils a compelling narrative of sustained upward momentum. Notably, the On-Balance-Volume (OBV), a pivotal metric tracking the coin’s buying and selling pressure, paints a vivid picture of escalating demand for SOL. Presently standing at a formidable 591.42 million, SOL’s OBV has surged by a noteworthy 16% since the inception of March, signaling a palpable surge in buying activity and underpinning the cryptocurrency’s bullish trajectory.

Moreover, SOL’s Chaikin Money Flow (CMF), a key indicator gauging the flow of capital into and out of an asset, corroborates this bullish sentiment with resounding clarity. Registering above the crucial threshold of zero and currently resting at an impressive 0.27, SOL’s CMF underscores a substantial influx of liquidity into the market, further bolstering confidence in the cryptocurrency’s upward momentum.

In essence, SOL’s exceptional performance underscores its resilience and attractiveness to investors seeking refuge from the volatility pervading the broader market landscape. With both OBV and CMF signaling robust bullish momentum, SOL appears poised to continue its ascent, propelled by a confluence of factors including growing demand, robust fundamentals, and unwavering investor confidence. As Solana continues to carve out its niche as a leading blockchain platform, its native cryptocurrency SOL stands as a testament to the platform’s enduring potential and steadfast resilience in the face of market turbulence.