Are you experiencing a surge in bullish sentiment? Today, the landscape of the cryptocurrency market has undergone a remarkable transformation as traders eagerly seized upon buying opportunities, propelling a staggering 90% of the top 100 coins by market capitalization to soar in price over the past 24 hours.

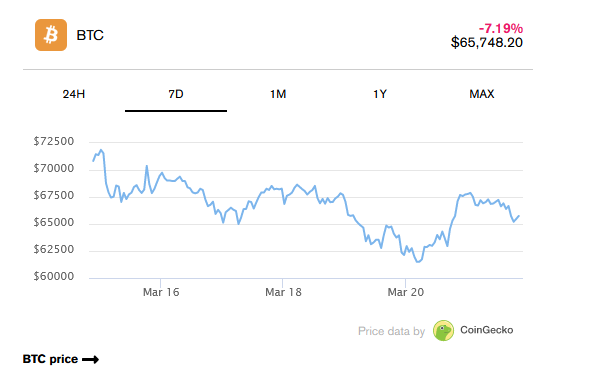

In the wake of recent turmoil, characterized by a brief but intense period of panic, the resilience of crypto assets shines through. Bitcoin and Ethereum, the two giants of the digital currency realm, stand tall amidst the tumult, showcasing gains of approximately 5% and 7% respectively. This resurgence comes on the heels of a turbulent episode where Bitcoin, in particular, weathered its most severe one-day decline since November 9, 2022, staggering under a 14.4% loss.

However, amidst the tumult, a beacon of strength emerges in the form of ONDO, which has spearheaded the charge among alternative cryptocurrencies (altcoins), boasting an astonishing surge of 36.51% within the past day. Acting as the governance token for the Ondo DAO, ONDO is instrumental in fortifying the Flux Finance ecosystem, a bastion of decentralized finance (DeFi) innovation that empowers users to leverage tokenized U.S. Treasury bonds for lending purposes.

Furthermore, a slew of other altcoins have rallied magnificently today. Conflux (CFX), with its innovative Tree-Graph consensus mechanism blending proof of work and proof of stake, has surged by a commendable 27%. JasmyCoin (JASMY), the native token of IoT juggernaut Jasmy Corporation, has seen an impressive uptick of 21.78%. Not to be outdone, Kaspa (KAS), propelled by its GhostDAG protocol’s promise of unparalleled efficiency and speed, has surged by a noteworthy 16.32%.

Even amidst this jubilant rally, the underdog Render, though labeled as the worst-performing token among the top 100, has mostly remained in the green today. Nonetheless, a minor intraday correction has nudged its price down by a modest 3.5%. Render, serving as the token for a distributed GPU rendering network atop the Ethereum blockchain, underscores the broader resilience and buoyancy within the market.

It’s worth noting that all tokens residing in the green zone have witnessed price hikes exceeding a remarkable 1% today, underscoring the widespread optimism and renewed vigor coursing through the cryptocurrency space.

This dramatic rebound follows a tumultuous period marked by a short-lived panic episode, triggered by a momentary flash crash that saw Bitcoin plummet by a jaw-dropping 80% on BitMEX, catalyzing a frenzy of selling. However, Bitcoin has since staged a remarkable recovery, surging by over 5.7% in the past 24 hours, reclaiming its ground and soaring to its current price of $66,539.

Ethereum, the stalwart of the altcoin realm, has not been left behind, experiencing a substantial upswing of nearly 7%, with its current price hovering just above $3,400.

Furthermore, the meme coin market has mirrored the broader resurgence, with Floki emerging as a standout performer, boasting a staggering growth of 26.92% to reach its current price of $0.000227. Even Bonk, though trailing behind its peers, has experienced a notable growth spurt of 11.97%, reaching its current price of $0.00002355.

In tandem with this euphoric rally in the crypto space, the overall market capitalization has surged from $2.36 trillion to $2.53 trillion within the last 24 hours, with trading volume consistently surpassing the $150 billion mark, reflecting the fervent activity and robust investor interest that currently pervades the market.

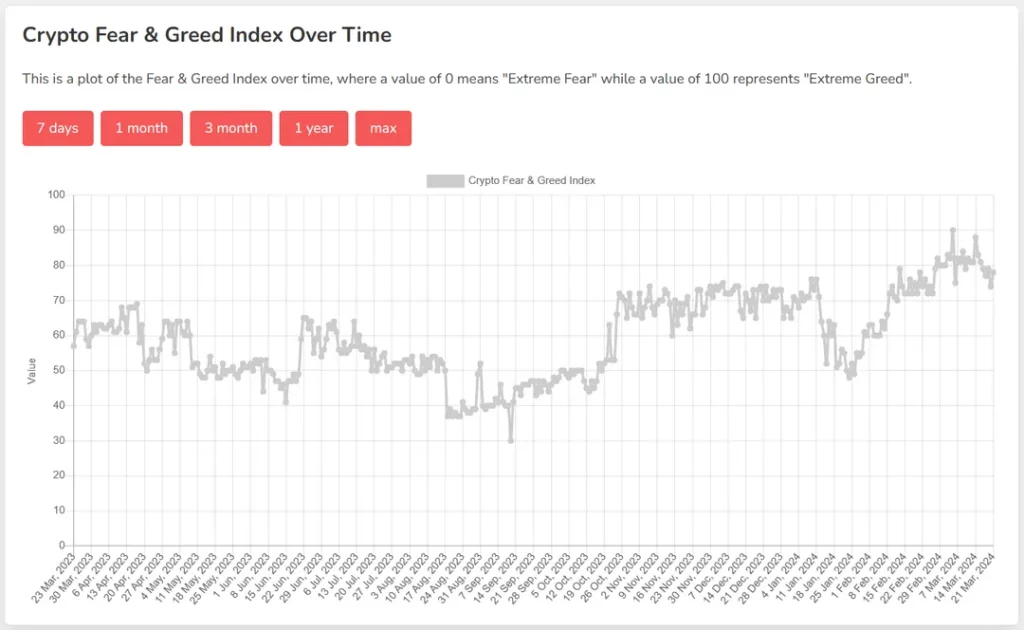

Moreover, the Crypto Fear and Greed Index, serving as a barometer of investor sentiment and emotions, currently points to a state of extreme greed among cryptocurrency enthusiasts. This heightened sentiment underscores the prevailing optimism and risk appetite, which undoubtedly contributes to the ongoing rally.

Beyond the confines of the cryptocurrency market, the broader stock markets also bear witness to a resurgence of optimism and confidence. The Fear and Greed sentiment index reveals a marked shift towards extreme greed, signaling a recovery from the previous week’s status quo. Across the globe, major indices are awash in green, with only marginal declines observed in China and Brazil. In the United States, Europe, and Asia alike, markets have displayed robust performance, indicative of a broader sentiment of resurgence and vitality.