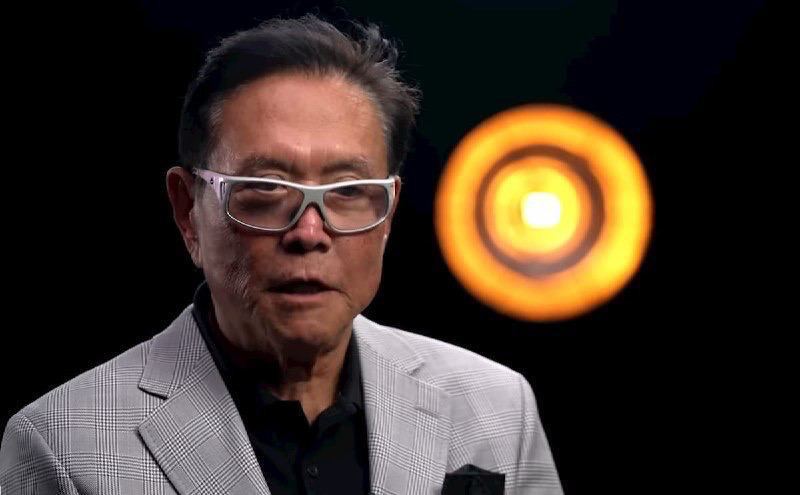

Renowned for his book “Rich Dad, Poor Dad,” Robert Kiyosaki has expressed backing for Bitcoin. In remarks made on March 26, he hailed Bitcoin as “the perfect asset for the present moment,” while acknowledging the possibility of it being construed as a scam or Ponzi scheme.

Despite his enduring bullish perspective on Bitcoin, the best-selling author stressed that the likelihood of Bitcoin being a scam is on par with any other fiat currency, including the US Dollar.

Robert Kiyosaki categorizes the US Dollar and other fiat currencies as “massive Ponzi schemes.”

In a post on platform X, Kiyosaki expressed his apprehensions, suggesting that Bitcoin could potentially resemble a Ponzi scheme and could ultimately plummet to zero. He asserted that Bitcoin shares a similar susceptibility to depreciation as fiat currencies.

Q: Are you a Bitcoin Bull?

A. Yes. Bitcoin is the perfect asset at the right time. I love Bitcoin. Wish I had bought more earlier.

Q: Is it possible that Bitcoin is a scam, a Ponzi scheme?

A: Yes. It is possible Bitcoin is a scam and a Ponzi scheme.

Q: Aren’t you…

— Robert Kiyosaki (@theRealKiyosaki) March 26, 2024

The author reinforced his unwavering backing for Bitcoin by drawing parallels between his optimism regarding the cryptocurrency and Metcalfe’s Law. This principle posits that the value of a network is proportional to the square of the number of its users. In the context of Bitcoin, the “number of users” encompass both retail and institutional traders who actively utilize and integrate Bitcoin into their financial activities, thereby augmenting the value of its network.

This perspective underscores the intrinsic strength of Bitcoin’s network, derived from its expanding user base, which in turn contributes to its increasing value and resilience in the face of market fluctuations. By invoking Metcalfe’s Law, the author underscores the robustness of Bitcoin’s ecosystem and its potential for sustained growth and adoption.

It’s worth noting that Robert Kiyosaki previously prognosticated that the price of Bitcoin could soar to as high as $100,000 by the culmination of 2024. This forecast reflects his profound confidence in Bitcoin’s long-term viability and its capacity to realize substantial appreciation in value over time.

BITCOIN on fire. The biggest mistake you can make is to procrastinate. Important to start, even if only for $500. Next stop $300,000 per BC in 2024

— Robert Kiyosaki (@theRealKiyosaki) March 6, 2024

Amidst these discussions about Bitcoin, the backdrop was set by his recent revelation of plans to acquire an additional 10 BTC before the upcoming Bitcoin halving in April. This event is anticipated to reduce block rewards by half.

I am buying 10 more Bitcoin before April. Why? The “Having.” If you can’t afford a whole Bitcoin you may want to consider buying 1/10 of a coin, via the new ETFs or Satoshi’s.

If the Bitcoin process works as designed you may own a whole Bitcoin by the end of this year.

I…

— Robert Kiyosaki (@theRealKiyosaki) March 25, 2024

The halving event will decrease the daily mined BTC from 900 to 450, aiming to propel the BTC value to astronomical heights.

Furthermore, Kiyosaki holds the viewpoint that a significant portion of digital assets on the Ethereum network will likely fade away, as they do not conform to Metcalfe’s Law, lacking a robust network.

Bitcoin reaches an unprecedented milestone with its all-time high price.

Robert Kiyosaki’s tempered perspectives and the enduring principles of Metcalfe’s Law bolster the burgeoning confidence in Bitcoin’s enduring value as an investment asset, notwithstanding the volatility it presents to both retail and institutional investors.

As of the latest update, Bitcoin is exchanging hands at $69,700 per coin, marking an impressive 30.85% surge in value over the last month.

CoinMarketCap market data on BTC price movement

Notably, the asset has garnered additional momentum courtesy of spot Bitcoin exchange-traded funds (ETFs). Despite recent outflows totaling $942 million, there remains robust inflow activity, amounting to $12.3 billion. The remarkable surge in Bitcoin ETF inflows, coupled with speculation surrounding the impending Bitcoin halving, propelled BTC to an unprecedented price peak of $73,750 on March 14, 2023.

We are here.

At the same spot as in November 2020.

ATH breakout and re-test before Bitcoin printed a real rally.Stop creating so much drama. pic.twitter.com/WRiC2JBrkW

— Bloodgood (@bloodgoodBTC) March 19, 2024

With the ongoing maturation of the cryptocurrency market, Kiyosaki urges traders and investors to seek invaluable guidance from experts regarding how to capitalize on emerging opportunities within the digital asset sphere. Above all, he emphasizes the importance of finding answers.