On March 25, blockchain investigator firm Arkham Intelligence revealed that the fifth-richest Bitcoin whale had transferred 94,504 BTC, valued at $6.05 billion, to three fresh addresses. Notably, the Bitcoin wallet, known as 37X, had remained inactive since 2019.

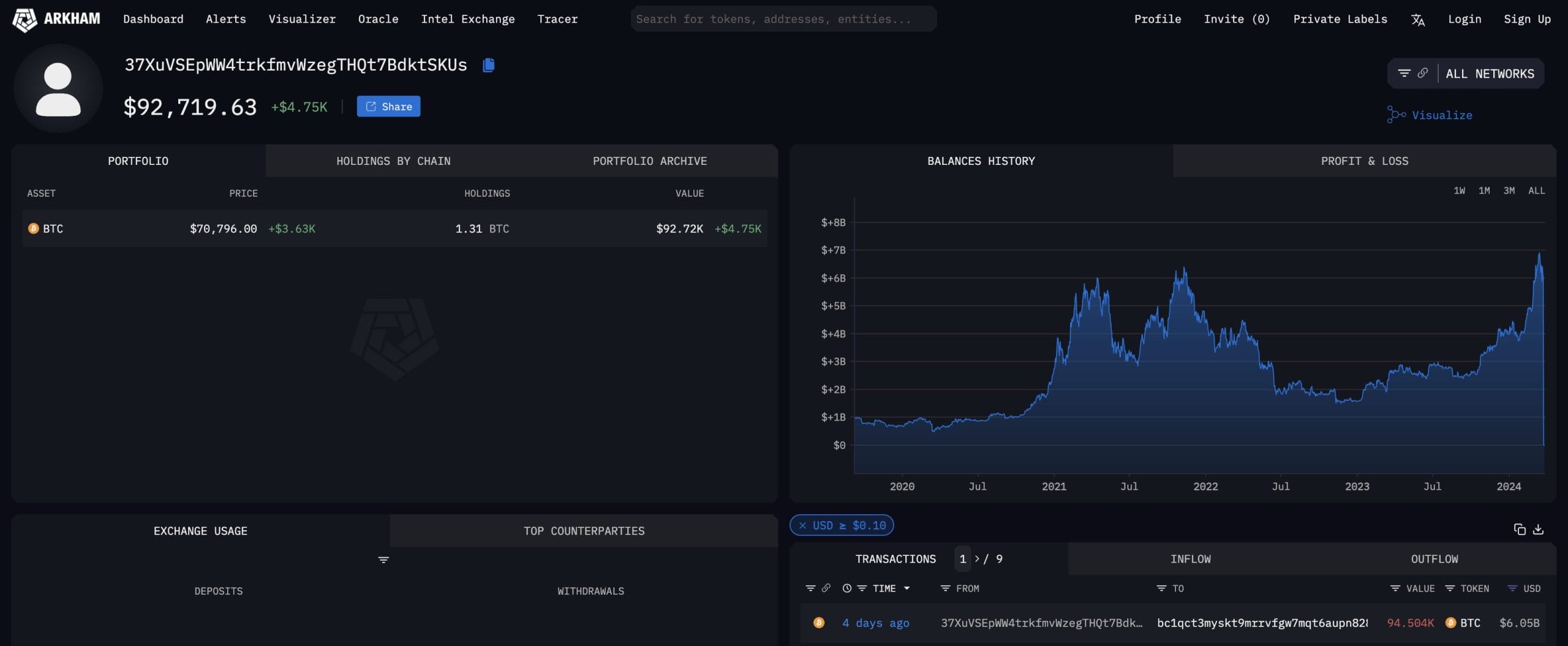

Following its recent transfer activity, the Bitcoin whale associated with address 37X now holds 1.31 BTC.

In an announcement on X, Arkham Intelligence disclosed that the Bitcoin whale initiated the transfer process on March 23. The whale transferred a total of 94,504 BTC, distributing $5.03 billion, $561.46 million, and $488.40 million worth of BTC to three newly created wallet addresses.

The 5th richest Bitcoin address just moved over $6 BILLION in BTC to three new addresses.

37X moved almost its ENTIRE BALANCE of 94.5K BTC ($6.05B) in the early hours of Saturday 23rd March, leaving only 1.4 BTC in the address.

The 94.5K BTC had not been moved since 37X… pic.twitter.com/mAjpg0oqnD

— Arkham (@ArkhamIntel) March 25, 2024

Additionally, the on-chain intelligence company revealed that the Bitcoin wallet address currently holds 1.31 BTC, with a total value of $92.7K.

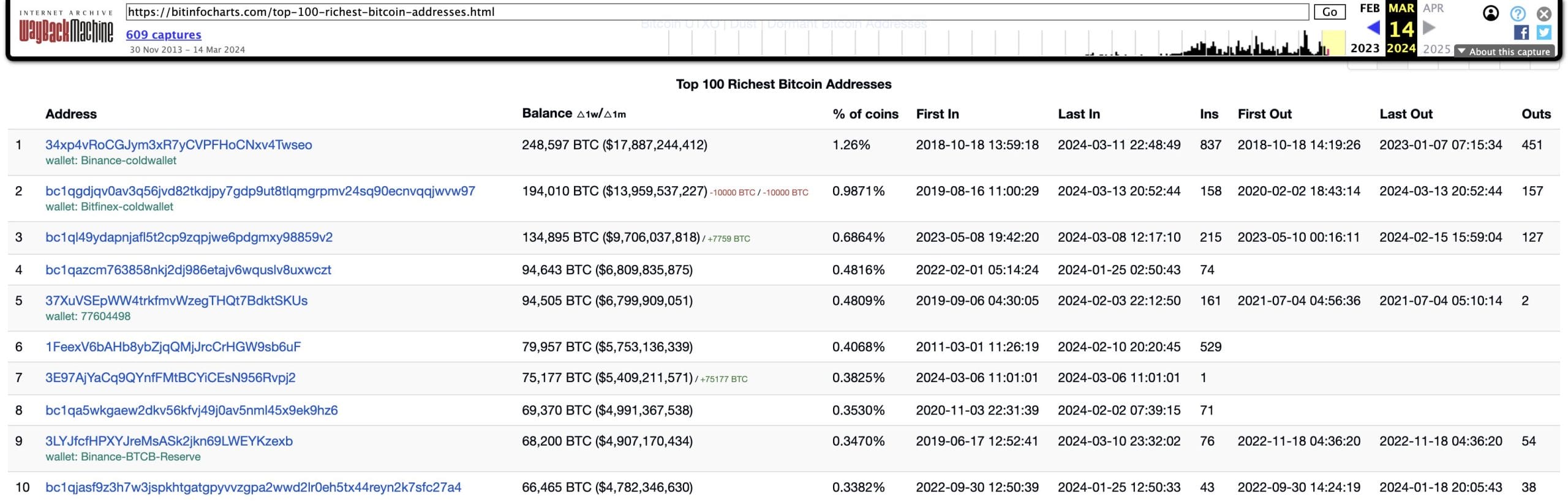

The Bitcoin whale in question has exhibited minimal on-chain activity since October 8, 2019, suggesting a prolonged period of dormancy. Notably, there are no discernible signs indicating any association with cryptocurrency exchanges. As per data archived by Bitinfocharts, this wallet address ranks as the fifth-richest Bitcoin address based on historical records.

This extended period of inactivity raises intriguing questions about the intentions behind the recent transfer activity. Given the substantial value of Bitcoin involved in the transfers, speculation abounds regarding potential motives or underlying strategies guiding the whale’s actions. The absence of any clear link to exchanges adds to the mystery surrounding the whale’s behavior, leaving analysts and observers to ponder the significance of these developments within the broader cryptocurrency landscape.

Furthermore, the fact that this wallet address ranks among the top five richest Bitcoin addresses underscores its considerable influence within the cryptocurrency ecosystem. Such whales often wield significant power to influence market dynamics through their transactions, making any movement of funds by them a subject of keen interest and scrutiny among traders and investors.

As the cryptocurrency community closely monitors these developments, the fate of the 1.31 BTC now stored in the wallet address remains uncertain. Whether this represents a strategic move by the whale or merely a routine reshuffling of funds remains to be seen. Nonetheless, the saga of the fifth-richest Bitcoin wallet address continues to intrigue and captivate the imagination of enthusiasts and analysts alike, highlighting the enduring allure and intrigue of the world’s leading cryptocurrency.

Anonymous BTC address ranked as the fifth-richest Bitcoin wallet.

In the interim, the wallet address which received $5.03 billion worth of BTC from this Bitcoin whale has ascended to become the sixth-richest Bitcoin address, now holding 78,317K BTC.

It’s worth noting that significant transfers from dormant wallets are not unprecedented in recent times. On January 5, an unidentified whale moved 26.9 BTC (valued at $1.17 million at that time) from Binance to the public address of the Bitcoin Genesis Block. Similarly, in November 2023, another substantial BTC transfer from an inactive wallet saw 6,500 BTC being sent to new addresses.

Interest in Bitcoin intensifies with the introduction of a Spot Bitcoin ETF and the imminent Halving Event.

Both retail and institutional investors are showing increased interest in Bitcoin, spurred by the approval of spot Bitcoin ETFs and the impending Bitcoin halving event slated for April 2024.

The Bitcoin halving event, occurring every four years, reduces the rate at which new coins enter circulation, thereby making the existing supply of BTC increasingly scarce over time and potentially driving prices higher. Typically, a price retracement accompanies the lead-up to the Bitcoin halving.

Many market analysts speculate that the proliferation of spot Bitcoin exchange-traded funds (ETFs) could mitigate the expected price decline associated with the halving. Additionally, there’s a consensus among analysts that the approval of spot Bitcoin ETFs could diminish the influence of large-scale investors (whales) and contribute to market stability.

According to a recent report by Dune Analytics, Bitcoin ETFs have amassed a total of $58.3 billion in on-chain holdings, representing approximately 4.17% of the current BTC supply.

In the previous month, the renowned crypto analysis firm Rekt Capital elaborated on the five phases constituting the upcoming Bitcoin halving event. The initial phase, known as the pre-halving downside, is characterized by bearish price movements attributed to investors’ anticipation of the impending halving event.

5 Phases of The Bitcoin Halving

1. Pre-Halving Downside phase

Approximately 70 days remain until the Bitcoin Halving in April 2024

Historically, any deeper retraces that occur during this orange period tend to generate fantastic Return On Investment for investors in the… pic.twitter.com/I2F7EkBqYa

— Rekt Capital (@rektcapital) February 5, 2024

The subsequent phase, termed the pre-halving rally, witnesses significant surges in BTC prices driven by short-term traders and investors eager to capitalize on the mainstream hype surrounding the halving.

Following this is the pre-halving retracement, identified as the current phase by analysts. During this stage, investors are observed liquidating their positions in response to selling pressures.

The subsequent phase, referred to as re-accumulation, is projected to commence post-halving and is characterized by stagnant BTC price movements. This phase is anticipated to be succeeded by the final phase, known as the parabolic uptrend.