The decision by HKVAEX, a cryptocurrency exchange with ties to Binance, to withdraw its application for a virtual asset trading platform license from the Hong Kong Securities and Futures Commission (SFC) carries significant implications within the cryptocurrency industry. This move comes in the wake of the SFC’s stringent regulatory framework, which requires crypto exchanges and firms operating within Hong Kong to obtain the necessary licenses to continue their operations legally.

The Hong Kong regulatory landscape has been evolving rapidly, with authorities aiming to establish clear guidelines and standards for crypto-related activities. The requirement for licensing is part of these efforts, intended to enhance investor protection, mitigate financial risks, and ensure compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations.

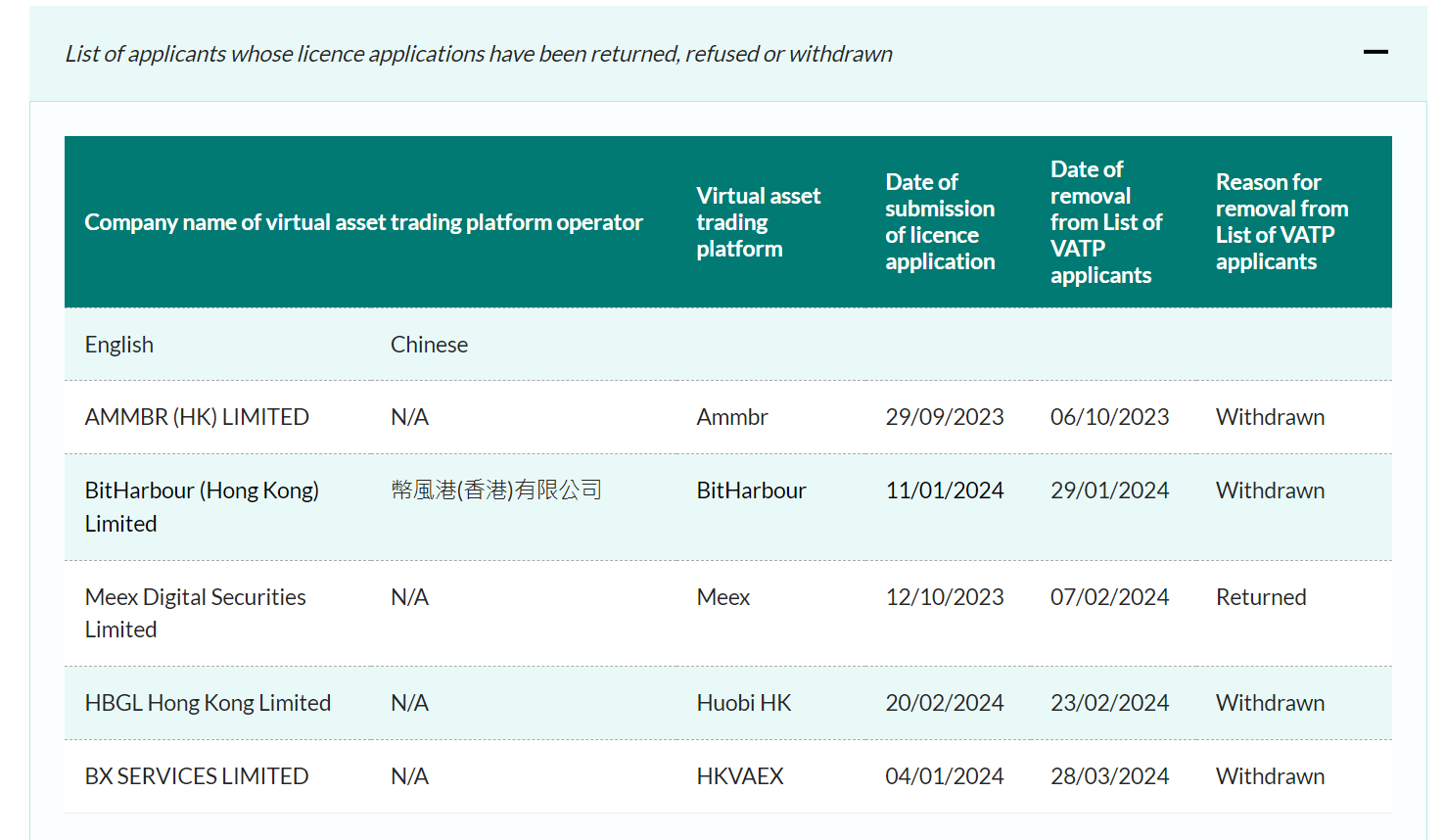

HKVAEX has withdrawn its application for a virtual asset trading platform license in Hong Kong.

The Virtual Asset Trading Platform (VATP) license is a regulatory requirement issued by the Hong Kong government, enabling cryptocurrency exchanges to conduct operations within the region’s jurisdiction.

Despite the existence of this license for a number of years, it has remained relatively exclusive, with only two exchanges, namely HashKey and OSL, having successfully obtained it. HashKey secured its approval in November 2022, followed by OSL a month later in December 2022. Numerous other applicants have been awaiting approval, including HKVAEX, which has ties to Binance. However, the landscape changed recently when HKVAEX opted to withdraw its application.

- Source: sfc.hk

Reportedly sharing technical and other resources with Binance, HKVAEX submitted its license application on January 4, as per Chinese state media SCMP. However, the exchange is notably absent from the list of companies with pending applications on the Hong Kong Securities and Futures Commission (SFC) website, indicating that HKVAEX withdrew its application nearly three months after filing.

The SFC maintains a public list of licensed crypto platforms to inform the public about safe trading options. The reasons for HKVAEX’s withdrawal are unclear, with speculation ranging from a request to change audit companies to insufficient documentation or other factors.

The SFC required crypto trading platforms to apply for regional operational licenses by February 29, setting a May 31 deadline for non-compliant exchanges to cease operations. Consequently, HKVAEX is mandated to close its business in Hong Kong by May 31.

In addition to HKVAEX, three other virtual asset trading platforms withdrew their license applications in 2024, with reasons undisclosed. This group includes Huobi, a significant global crypto exchange.

Following its initial withdrawal, HTX, formerly recognized as Huobi, has reapplied for its license in Hong Kong.

In February, HTX, previously recognized as Huobi, engaged in a series of actions regarding its license application in Hong Kong. Initially, HTX submitted its application for an exchange license early in the month. However, just three days later, on February 23, the company withdrew its application, citing information provided by the Securities and Futures Commission (SFC) regarding the list of license applicants. Nevertheless, the company later reversed its decision and resubmitted the application on February 27, as confirmed by the SFC’s website.

Hong Kong’s approach to cryptocurrency regulation stands in contrast to the broader crackdown on crypto trading and mining witnessed in mainland China. In June 2023, Hong Kong embraced crypto firms by officially introducing its licensing regime for virtual asset trading platforms. This move enabled licensed exchanges to provide retail trading services, marking a significant step forward for the industry in the region. Consequently, numerous global exchanges, including HTX, have sought to obtain retail trading licenses in Hong Kong.

As of now, the financial regulator is actively reviewing applications from 19 crypto firms, which include well-known names such as OKX, Bybit, Bullish, and Crypto.com. To assist investors in making informed decisions, the SFC encourages individuals to verify trading platforms through its public register of licensed persons and registered institutions. Additionally, investors can consult the list of licensed virtual asset trading platforms for relevant information about licensed entities, including official website details.

According to a report, Ethena Labs’s counterfeit ENA token was exploited on Binance, resulting in a loss of $290K.

Just hours after its launch on Binance Launchpool, a counterfeit version of Ethena (ENA) was exploited, resulting in the loss of 480 BNB, equivalent to $290,000. According to a report from on-chain security firm PeckShield on Friday, the exploited token is a fraudulent version of ENA, sharing the same name as the legitimate one, as stated in an updated post on X (Twitter).

#PeckShieldAlert $ENA (Ethena Labs) on #BNBChain has been exploited, resulting in a loss of 480 $BNB (worth ~$290K)

*Note*: The token shares the same name as the legitimate ones

— PeckShieldAlert (@PeckShieldAlert) March 29, 2024

Binance, the leading cryptocurrency exchange globally in terms of market capitalization, has included Ethena in its Launchpool, marking the synthetic dollar protocol as the 50th project to be featured on the platform. As per the announcement made on Friday, this launch provides users with the opportunity to earn the token through staking BNB or FDUSD.

The incident involving the fake Ethena token highlights the critical need for stringent security protocols and thorough scrutiny of token transactions.

Following reports of the exploit, there was widespread bewilderment within the cryptocurrency community on X. PeckShield later affirmed in a separate statement that the token in question is counterfeit and has no association with the legitimate Ethena project.

“Clarification: The token mentioned below is not authentic and should not be linked to Ethena in any way.”

Clarification: The token mentioned below is not authentic and should not be linked to Ethena in any way. https://t.co/qxxKJfIe6n

— PeckShieldAlert (@PeckShieldAlert) March 29, 2024

The highly anticipated Ethena token airdrop is generating significant excitement.

The recent revelation of the fake Ethena token exploit arrives amidst a time of heightened anticipation within the crypto community surrounding the forthcoming token airdrop, which Ethena Labs had previously announced to occur on April 2nd. This airdrop represents a pivotal milestone in the company’s trajectory following the successful launch and adoption of its USDe synthetic stablecoin.

As part of its expansion strategy, the protocol has devised plans to distribute 750 million ENA tokens, constituting 5% of its overall token supply, through the airdrop initiative. Scheduled for April 2nd, this event will cater to eligible participants and will subsequently witness the ENA tokens being listed on centralized cryptocurrency exchanges (CEXs), further bolstering their accessibility and liquidity within the market.

Crucially, the allocation of tokens to individual participants will be determined based on the accumulation of “shards” throughout April 1st. These shards serve as digital metrics reflecting users’ engagement and interaction levels within the protocol, thereby ensuring a fair and equitable distribution process.

Moreover, the overwhelming success of Ethena’s USDe synthetic stablecoin is underscored by its remarkable achievement of amassing a supply exceeding $1.38 billion, as corroborated by DefiLlama data. This milestone serves as a testament to the platform’s burgeoning prominence and burgeoning adoption within the decentralized finance (DeFi) ecosystem.