Outline

- A strong weekly close

- $BTC crashes through top of bull pennant

- $BTC buyers outmatch the sellers

- Financial history being made

A strong weekly close

Bitcoin enthusiasts and analysts are eagerly eyeing a pivotal juncture in the cryptocurrency’s trajectory, one that could potentially set the stage for a momentous surge. The crux of this anticipation lies in the weekly candle close, a symbolic marker that carries profound implications for Bitcoin’s future trajectory. Should Bitcoin achieve a weekly candle close above the illustrious $69,000 mark, it would not only signal a significant milestone but also suggest a compelling narrative of bullish sentiment permeating the market.

Why is this particular threshold so crucial, you might wonder? Well, $69,000 holds special significance as it represents the zenith of the previous bull market—a point of reference imbued with historical resonance. Surpassing this level would not only signify a resumption of bullish momentum but also serve as a testament to Bitcoin’s resilience and potential for further appreciation. It’s akin to breaking through a psychological barrier, instilling renewed confidence among investors and enthusiasts alike.

But that’s not all; there’s another element to this unfolding narrative—one that involves a technical pattern known as the bull pennant. This formation, characterized by a period of consolidation followed by a breakout to the upside, has been garnering attention in recent weeks. Observers keenly await Monday’s trading session, as a breakout from this bull pennant could herald the beginning of a significant upward leg for Bitcoin. Imagine the excitement rippling through the community as traders monitor every tick, every fluctuation, in anticipation of a potential breakout.

Yet, amidst this anticipation, there lies a deeper undercurrent of significance—a fundamental belief in Bitcoin’s intrinsic value and its potential to reshape the financial landscape. For Bitcoin to truly ascend to new heights, it must not only conquer previous peaks but also establish a sturdy foothold above them. This brings us to the concept of holding above the all-time high set during the 2021 bull market—a feat that would solidify Bitcoin’s position and provide a robust foundation for future growth.

Picture this: Bitcoin hovering tantalizingly close to its previous peak, its price action oscillating within the confines of the bull pennant formation. Each candlestick, each tick of the price chart, imbued with potential and possibility. And then, the moment arrives—a decisive break from the pattern, accompanied by a surge in trading volume, signaling the commencement of a new chapter in Bitcoin’s journey.

It’s not merely about price speculation or short-term gains; it’s about a paradigm shift—a movement towards a decentralized financial future, driven by the transformative power of blockchain technology. Bitcoin, the king of cryptocurrencies, poised on the precipice of greatness, with the potential to usher in a new era of monetary sovereignty and economic empowerment.

So, as we await the unfolding of this narrative, let us not merely focus on the numbers or the charts but rather on the broader implications—the implications for the future of finance, for individual autonomy, and for the relentless pursuit of innovation. For in Bitcoin, we see not just a digital asset but a beacon of hope—a symbol of possibility in an ever-changing world. And perhaps, just perhaps, the best is yet to come.

$BTC crashes through top of bull pennant

In analyzing the 4-hour chart within the current short-term context, a significant development emerges: Bitcoin ($BTC) has forcefully breached the upper boundary of the bull pennant pattern, signaling a potential shift in market dynamics. This breakthrough carries considerable weight as it signifies the imminent challenge of a critical resistance level, positioned just a hair’s breadth below the psychological milestone of $74,000. The implications are profound, suggesting that if this resistance is convincingly surpassed, a swift and substantial surge in Bitcoin’s valuation could ensue, potentially catapulting it towards the $74,000 mark with remarkable speed and momentum.

Yet, amidst the excitement of this impending breakthrough, prudence dictates a tempered approach. While the prospect of a straight ascent to $74,000 is tantalizing, market dynamics often unfold with a degree of nuance. Thus, it’s prudent to entertain the possibility of a brief retrace. Such a retracement, should it materialize, could see Bitcoin revisiting the upper boundary of the triangle formation, hovering around the $70,000 range. However, far from signaling a reversal, this potential pullback serves a crucial purpose: to validate the authenticity of the breakout.

Indeed, this momentary pause, characterized by a retest of the breakout level, aligns with established market patterns and could serve as a confirmation signal for further upward momentum. In essence, it represents a moment of validation, affirming the newfound bullish sentiment and paving the way for a sustained upward trajectory.

Thus, while the journey to $74,000 may encounter brief detours, the overarching trajectory remains resolutely bullish. Investors and traders alike are advised to maintain a watchful eye on key support and resistance levels, recognizing that in the ever-evolving landscape of cryptocurrency markets, opportunity often arises amidst volatility. With careful analysis and strategic positioning, one can navigate these fluctuations with confidence, poised to capitalize on the unfolding narrative of Bitcoin’s ascent.

$BTC buyers outmatch the sellers

The daily momentum of enthusiastic buying in the bitcoin market persists, illustrating a sustained trend of robust investment sentiment. This resolute optimism is exemplified by the recent developments surrounding the Blackrock Spot Bitcoin ETF (IBIT) and the Grayscale ETF (GBTC).

On a noteworthy Friday, IBIT experienced a substantial influx of more than $309 million, showcasing a remarkable display of investor confidence. This surge not only counterbalanced the $199 million outflow from the Grayscale ETF (GBTC) but also underscored a prevailing bullish sentiment in the market.

Adding to the fervor, Blackrock’s announcement regarding the inclusion of five prestigious companies as Authorized Participants in its Bitcoin ETF has generated considerable excitement. Among these esteemed participants are financial giants such as Goldman Sachs, Citigroup, and UBS, renowned for their substantial financial prowess. Their involvement is expected to catalyze a veritable cascade of investment into IBIT, amplifying its attractiveness to potential investors.

Moreover, the recent completion of Genesis’s monumental $2.1 billion sell-off from its Grayscale ETF holding represents a significant milestone. This strategic move not only underscores market dynamics but also underscores a strategic reallocation of assets within the crypto sphere.

In a parallel development, the US government’s decision to sell an additional 31,800 BTC from its Silk Road confiscations last week has captured widespread attention. Despite the considerable volume, this supply was swiftly absorbed by eager buyers, reaffirming the enduring demand for bitcoin and highlighting its status as a coveted asset in the global financial landscape.

Collectively, these events paint a vivid picture of a market characterized by unwavering enthusiasm and robust demand for bitcoin. As institutional players increasingly enter the fray and regulatory uncertainties are navigated, the trajectory of bitcoin’s ascent appears poised for further growth and innovation.

Financial history being made

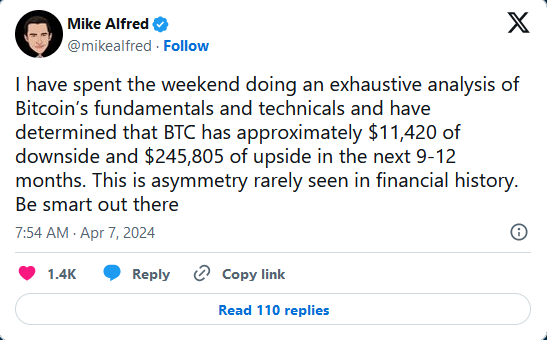

Investor and tech entrepreneur Mike Alfred recently took to his social media platform to express a compelling perspective:

Alfred’s commentary resonates with a growing consensus regarding the extraordinary “asymmetry” intrinsic to Bitcoin ($BTC). He emphasizes the stark difference between the potentially limited downside risk and the substantial upside potential of this digital asset. While acknowledging the possibility of being mistaken, Alfred underscores the unparalleled opportunity to align oneself with a financial phenomenon that is rewriting the rules of the game.

As the latest reports indicate, Bitcoin has broken through resistance barriers, surging to an impressive $72,000 and inching closer to establishing a new all-time high. This milestone serves as a potent reminder of Bitcoin’s relentless ascent and the profound implications it carries for the financial world.