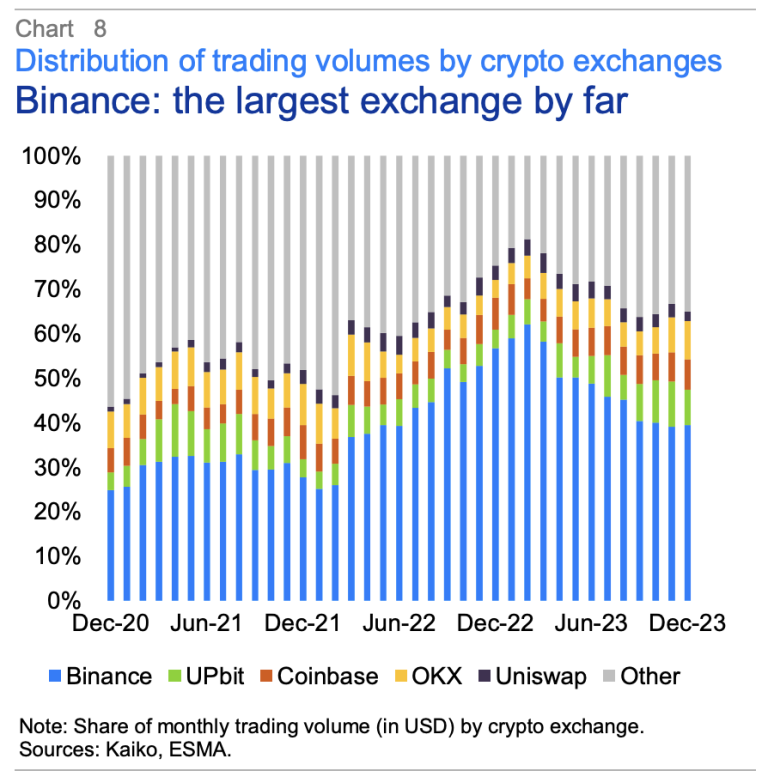

The securities regulator of the European Union (EU) has issued a cautionary statement regarding the substantial concentration of trading activity observed across a select few cryptocurrency exchanges. Specifically, the report highlights Binance as a singular platform controlling approximately half of the entire market, as disclosed on Wednesday.

According to analysis conducted by the European Securities and Markets Authority (ESMA), a mere 10 exchanges facilitate around 90% of all cryptocurrency transactions. Moreover, the report underscores notable disparities in market liquidity, with larger exchanges demonstrating higher levels of liquidity.

The ESMA expressed concerns regarding the potential ramifications of a failure or malfunction at a major asset or exchange on the broader cryptocurrency ecosystem, despite the potential efficiency benefits attributed to such concentration, stemming from economies of scale.

The adoption of the Euro in the cryptocurrency space has yet to see a significant boost from MiCA regulation.

An analysis of the fiat currencies utilized within the cryptocurrency market reveals a notable disparity in their prominence. While the USD and the South Korean won stand out as dominant currencies, the Euro’s role remains relatively modest, representing approximately 10% of all transactions.

Furthermore, despite the introduction of Markets in Crypto Assets (MiCA) regulation, there has been little observable change in the utilization of the Euro within the cryptocurrency market thus far.

Despite the current lack of impact, the European Securities and Markets Authority (ESMA) anticipates that the implementation of MiCA in 2024 could potentially serve as a catalyst for growth. This expectation stems from MiCA’s emphasis on bolstering investor protection measures within the market, suggesting that the regulation may gradually increase the appeal and adoption of the Euro among cryptocurrency users and investors.

ESMA Challenges Cryptocurrency’s Safe-Haven Status

Additionally, the European Securities and Markets Authority (ESMA) scrutinized the idea that crypto assets serve as a haven of safety during times of widespread market turmoil. In its report, the ESMA pointed out a certain level of correlation between crypto assets and equities, indicating that they often move in tandem. Moreover, the report underscored the lack of a consistent relationship between crypto assets and gold, which is typically regarded as a safe-haven asset.

Exchanges with Licenses, Ambiguous Locations

The regulatory body further emphasized the inherent difficulty in determining the exact origins of cryptocurrency transactions due to their opaque nature. Despite this challenge, it was noted that a notable number of cryptocurrency exchanges are located in jurisdictions commonly classified as tax havens.

According to insights from the European Securities and Markets Authority (ESMA), approximately 55% of crypto transactions are facilitated through exchanges licensed under the EU’s Virtual Asset Service Providers (VASP) framework. However, a considerable portion of these transactions is believed to occur beyond the geographical boundaries of the European Union.

Bitcoin, Ether, and Tether Reign Supreme in the Cryptocurrency Market

Furthermore, the report observed that despite the proliferation of actively traded cryptocurrencies since 2020, there has been little reduction in the market’s notable concentration. As of December 2023, a mere trio of cryptocurrencies – Bitcoin (BTC), Ether (ETH), and the stablecoin Tether (USDT) – collectively represent a sizable 74% of the total market capitalization and command 55% of the annual trading volume. This dominance underscores the enduring influence and significance of these three assets within the broader cryptocurrency landscape, despite the increasing diversity of available options.

READ MORE ABOUT: A company based in Myanmar fraudulently obtains over $100 million in cryptocurrency.