Story Highlights

- Analyst Tony Severino Foresees Altcoin Season Amid Rising Bitcoin Dominance.

- 57.30% threshold crucial for interpreting market shifts, indicates potential altcoin surge.

- Bitcoin dominance nearing “invalidation level,” potential altcoin market takeover at 36.60% dominance.

Renowned cryptocurrency analyst Tony “The Bull” Severino has ignited a fervent debate within the crypto community with his latest insights into Bitcoin dominance. Despite Bitcoin’s ongoing dominance soaring to new heights, Severino’s perspective introduces an intriguing concept: the inception of an “Altcoin season.” This notion implies a significant paradigm shift in the cryptocurrency landscape, one that presents a compelling array of alternative investment avenues beyond the realm of Bitcoin. Severino’s viewpoint challenges conventional wisdom, sparking intense deliberation and speculation among crypto enthusiasts worldwide.

Shift in Market Dynamics

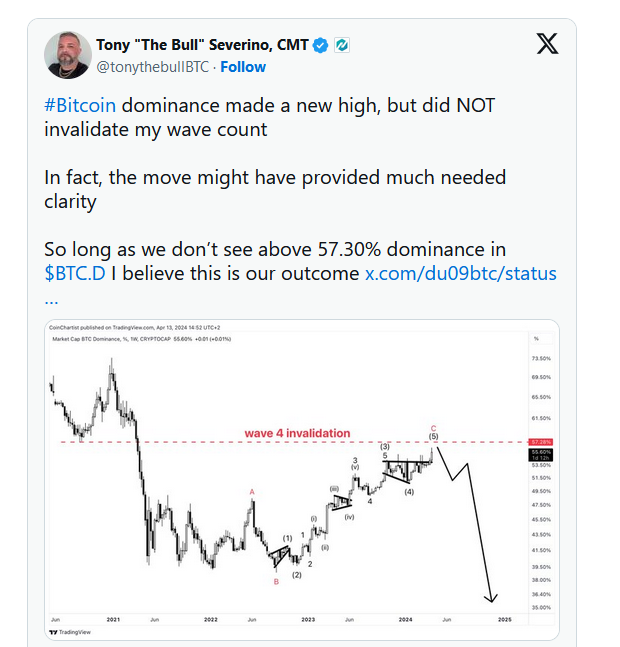

Severino, the esteemed cryptocurrency analyst, has meticulously delved into the recent surge in Bitcoin dominance, unearthing intriguing insights that hint at a potential wave 4 invalidation. This profound observation not only shines a spotlight on the current market dynamics but also unveils a wealth of untapped opportunities for investors to explore within the vast crypto ecosystem. Despite the complexity of the terrain, Severino remains unwaveringly optimistic, emphasizing the paramount importance of key thresholds in deciphering the intricate tapestry of market sentiment.

One such critical threshold that Severino meticulously highlights is the 57.30% mark in Bitcoin dominance. With unwavering conviction, Severino underscores the pivotal role of this threshold in assessing potential shifts in the market landscape. As long as Bitcoin’s dominance steadfastly remains below this crucial threshold, Severino maintains that the envisioned market outcomes will steadfastly align with his meticulous analysis.

Severino’s analytical arsenal is not merely confined to traditional tools; it encompasses a harmonious amalgamation of sentiment analysis and Elliott Wave patterns. These revered methodologies, revered in the annals of technical analysis, serve as the bedrock of Severino’s comprehensive approach. By adeptly leveraging these analytical tools, Severino not only discerns market sentiment with unparalleled precision but also uncovers latent opportunities and identifies potential price movements across an array of cryptocurrencies. His exhaustive analysis stands as a beacon of enlightenment, guiding investors through the labyrinthine depths of the ever-evolving crypto landscape with consummate ease and clarity.

Altcoin Overtaking BTC.Dominance

In a recent tweet, Severino, a prominent figure in the cryptocurrency world, drew attention to a critical juncture in Bitcoin dominance, dubbing it the “invalidation level.” Through a meticulous examination of a shared chart, Severino highlighted a noteworthy surge in Bitcoin dominance, currently hovering at a formidable 55.60%. This surge underscores Bitcoin’s burgeoning influence and reaffirms its dominance within the volatile cryptocurrency market.

Severino went on to impart a compelling insight: should Bitcoin’s dominance falter and plummet below a specific threshold, roughly pegged at 36.60%, it could herald a seismic shift in market dynamics favoring altcoins. This potential transition carries profound implications, heralding both fresh opportunities and formidable challenges for investors to grapple with.

With the prospect of altcoins assuming a more prominent role, investors are urged to recalibrate their strategies and adopt a forward-thinking approach to capitalize on the evolving landscape of the crypto sphere. This juncture marks a pivotal moment in the market’s trajectory, wherein astute investors stand poised to navigate the emerging opportunities with sagacity and foresight.