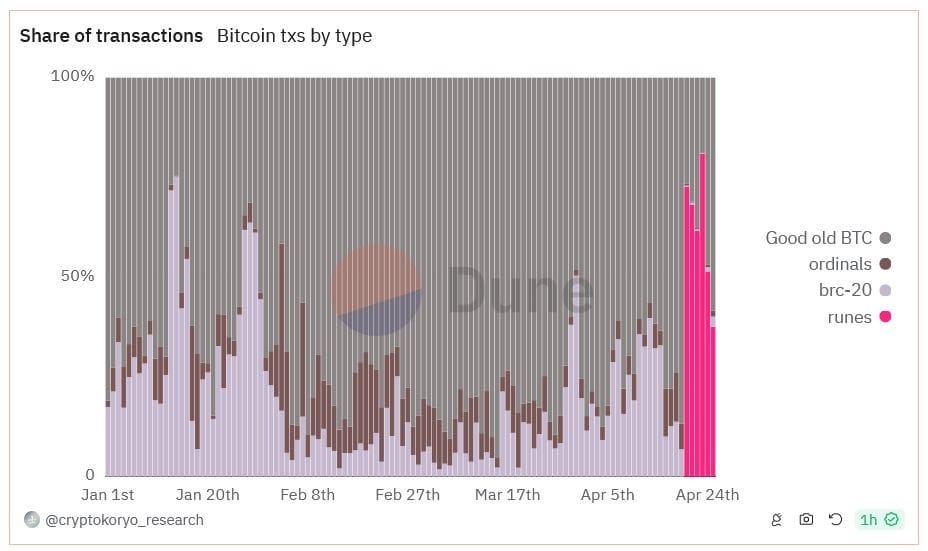

Since the halving, Runes have emerged as a dominant force, constituting a significant portion, up to 68%, of all Bitcoin transactions. However, amidst this surge in Runes activity, a concerning trend has emerged: the decline in fees earned by Bitcoin miners.

Similar to BRC-20s, Runes operates as a protocol leveraging the Bitcoin network, facilitating transactions and token generation. Unlike BRC-20s, however, Runes employs the Unspent Transaction Output (UTXO) model to create new tokens on the Bitcoin network. This stands in contrast to Ordinals’ “inscription” account model, as elucidated in a protocol explainer by Rodarmor.

The unique feature of the Runes protocol lies in its ability to “etch” new tokens onto the Bitcoin blockchain. This process involves embedding individual satoshis with distinctive identification numbers and associating them with arbitrary data directly within the Bitcoin blockchain.

Since its inception on April 20th, Runes has witnessed remarkable growth, processing over 2.38 million transactions, as revealed by data from a Dune Analytics dashboard shared by blockchain research firm Crypto Koryo.

As Runes continues to gain traction and shape the landscape of Bitcoin transactions, its impact on the broader cryptocurrency ecosystem, particularly in relation to miner fees and transaction volume, remains a topic of keen interest and scrutiny.

In a sweeping tide that reshaped the landscape of Bitcoin transactions, Runes emerged as a towering figure, commanding a staggering 68% share of all transactions when juxtaposed against Ordinary peer-to-peer Bitcoin transactions, BRC-20s, and Ordinals. This dominance not only underscored the protocol’s burgeoning influence but also signaled a paradigm shift within the cryptocurrency ecosystem.

April 23 marked a pivotal moment for Runes as it surged to unprecedented heights, witnessing a flurry of activity with over 750,000 transactions recorded. However, this zenith was followed by a precipitous decline the very next day, as the number of transactions plummeted to a mere 312,000. This rollercoaster of activity underscored the dynamic nature of Runes’ presence in the digital realm, marked by peaks and troughs that mirrored the ebb and flow of market sentiment and user engagement.

The genesis of this fervent demand can be traced back to the halving event at block 840,000, where Runes played a pivotal role in facilitating transactions as users vied for coveted spots on the most valuable piece of digital real estate in Bitcoin’s storied history. Leveraging the Runes protocol, users sought to etch “rare satoshis” onto this historic block, igniting a fierce competition for prominence and recognition within the blockchain.

The ramifications of this heightened activity reverberated throughout the cryptocurrency landscape, with Runes emerging as a driving force behind a staggering $2.4 million in miner fees on halving day alone. This accounted for over 70% of the total fees generated, underscoring the protocol’s pivotal role in shaping the economic incentives and dynamics of the Bitcoin network.

As Runes continues to carve its path in the realm of cryptocurrency transactions, its impact transcends mere numbers and statistics, embodying a transformative force that reshapes the very fabric of digital finance. In its wake lies a landscape imbued with possibility and potential, where innovation and evolution converge to forge new pathways forward in the ever-evolving realm of blockchain technology.

Can Runes Rescue Miners Facing Hardship?

The Bitcoin Halving event, a cornerstone of the cryptocurrency’s protocol, dealt a significant blow to miners as it slashed mining rewards from 6.25 BTC to 3.125 BTC. This substantial reduction in rewards struck a formidable blow to the income streams of Bitcoin miners, leaving them in a precarious position, grappling with diminished profitability and heightened vulnerability in an already competitive landscape.

Enter Runes Protocol, initially heralded as a beacon of hope for miners teetering on the brink of financial instability. Positioned as a potential savior in the face of adversity, Runes Protocol aims to offer a lifeline to miners by presenting a novel source of income amidst the evolving dynamics of the cryptocurrency ecosystem.

Leonidas, the pseudonymous developer behind Ordinals and a key figure in the cryptocurrency community, articulated the significance of Runes Protocol in this context. With an air of anticipation and expectation, Leonidas hinted at the transformative potential of Runes Protocol as a means to alleviate the financial strain plaguing miners and provide them with a renewed sense of stability and sustainability in their operations.

“Runes degens have single-handedly offset the drop in miner rewards from the halving.”

Yet, the viability of this solution has come under scrutiny as daily total fees have oscillated between 33% and 69% in the aftermath of the halving.

Within the community, there exists a division of opinion regarding the potential of Runes to furnish Bitcoin miners with a dependable and enduring source of revenue.

JUST IN: Fees are back down into the 40s!

Is the runes spam losing steam? 👀 pic.twitter.com/fMx7qDUZXd

— Simply Bitcoin (@SimplyBitcoinTV) April 24, 2024

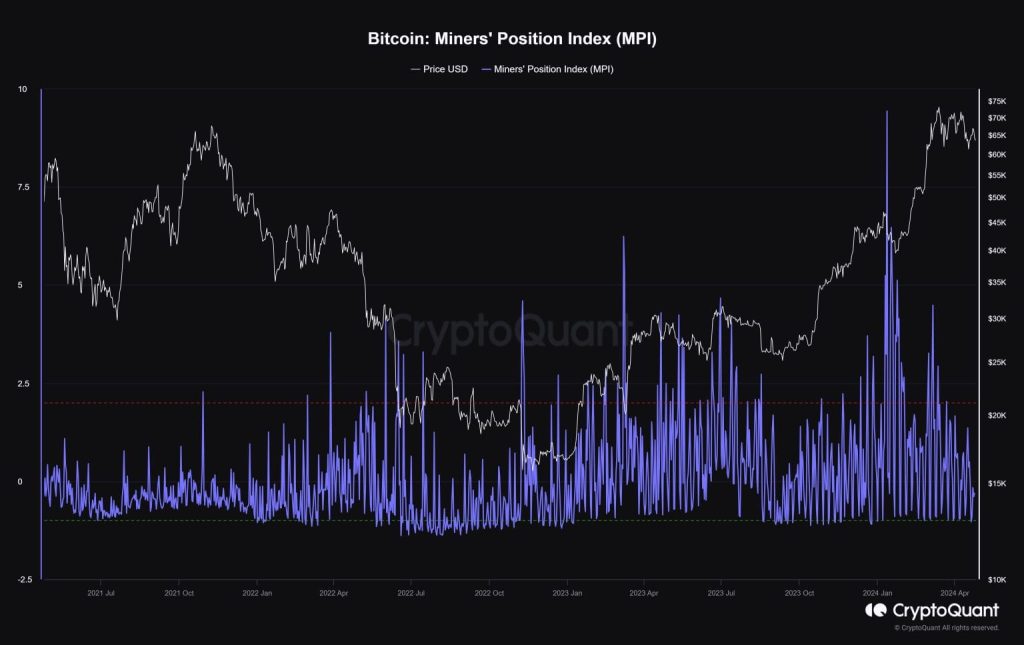

Despite these apprehensions, data from CryptoQuant reveals that the Bitcoin Miners’ Position Index (MPI) has fluctuated between -1 and -0.15 following the halving. This suggests that there has been minimal movement in miners’ Bitcoin holdings, indicating a lack of clear intent for a mass sell-off.

The landscape remains fluid, with the trajectory of Runes potentially waning, particularly as the initial excitement surrounding its launch dissipates.

Nevertheless, Runes is not the sole beacon of hope for miners. Recent groundbreaking advancements offer promising alternative revenue streams to offset the repercussions of the halving event.