Summary

- Central Bank of Nigeria denies freezing accounts of Bybit, KuCoin, OKX, and Binance users.

- Regulatory environment for cryptocurrencies in Nigeria faces scrutiny amid shifting policies.

- Nigerian government’s crackdown on platforms like Binance adds to regulatory complexities and uncertainties.

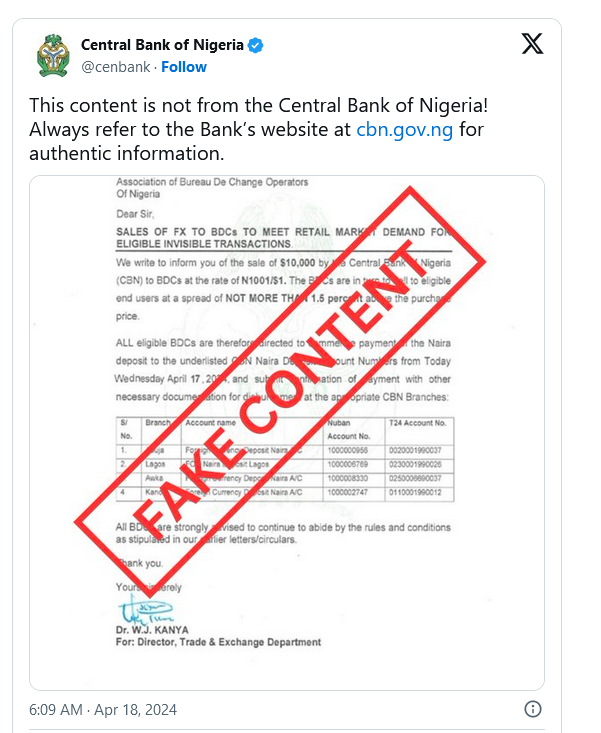

The Central Bank of Nigeria (CBN) has found itself embroiled in a maelstrom of controversy amid reports indicating that it directed banks to freeze accounts associated with cryptocurrency transactions. However, the CBN has vehemently refuted these allegations, creating a fog of uncertainty surrounding the nation’s position on digital currencies.

This contradictory narrative has left many stakeholders bewildered, unsure of the regulatory landscape governing cryptocurrencies within Nigeria. The conflicting signals emanating from the CBN have only served to exacerbate confusion and fuel speculation within the cryptocurrency community and broader financial circles.

The lack of clarity from the CBN underscores the complexities and challenges inherent in regulating emerging technologies such as cryptocurrencies, which often straddle the intersection of financial innovation, regulatory oversight, and economic policy. Moreover, it highlights the need for clear and consistent communication from regulatory authorities to provide market participants with the confidence and certainty necessary to navigate this rapidly evolving landscape.

As stakeholders await further clarification from the CBN, the uncertainty surrounding Nigeria’s stance on digital currencies serves as a poignant reminder of the ongoing dialogue and debate surrounding the regulation and adoption of cryptocurrencies on a global scale. In the absence of clear guidance, market participants must exercise caution and remain vigilant to navigate the shifting regulatory landscape effectively.

Understanding the Debate

The Central Bank of Nigeria (CBN) has found itself embroiled in a maelstrom of controversy amid reports indicating that it directed banks to freeze accounts associated with cryptocurrency transactions. However, the CBN has vehemently refuted these allegations, creating a fog of uncertainty surrounding the nation’s position on digital currencies.

This contradictory narrative has left many stakeholders bewildered, unsure of the regulatory landscape governing cryptocurrencies within Nigeria. The conflicting signals emanating from the CBN have only served to exacerbate confusion and fuel speculation within the cryptocurrency community and broader financial circles.

The lack of clarity from the CBN underscores the complexities and challenges inherent in regulating emerging technologies such as cryptocurrencies, which often straddle the intersection of financial innovation, regulatory oversight, and economic policy. Moreover, it highlights the need for clear and consistent communication from regulatory authorities to provide market participants with the confidence and certainty necessary to navigate this rapidly evolving landscape.

As stakeholders await further clarification from the CBN, the uncertainty surrounding Nigeria’s stance on digital currencies serves as a poignant reminder of the ongoing dialogue and debate surrounding the regulation and adoption of cryptocurrencies on a global scale. In the absence of clear guidance, market participants must exercise caution and remain vigilant to navigate the shifting regulatory landscape effectively.

Confusion and Contradictions

The confusion surrounding the Central Bank of Nigeria (CBN) deepened as it initially refuted allegations of instructing banks to freeze accounts tied to cryptocurrency transactions, only to later acknowledge the claims as false. Despite the denial, apprehensions persist regarding the regulatory landscape governing cryptocurrencies in Nigeria, particularly concerning the CBN’s supervision and enforcement mechanisms.

The lifting of the cryptocurrency ban in 2023 signified a notable departure in Nigeria’s stance toward digital assets, recognizing the burgeoning global demand and adoption of cryptocurrencies. However, apprehensions regarding the devaluation of the naira and inflation rates have reignited scrutiny of platforms offering crypto services.

This renewed scrutiny reflects the delicate balance between fostering innovation and safeguarding financial stability within Nigeria’s evolving regulatory framework. As policymakers grapple with these complexities, stakeholders are left to navigate a landscape characterized by uncertainty and shifting regulatory dynamics. The ongoing dialogue surrounding cryptocurrencies underscores the need for robust oversight and clear regulatory guidance to ensure the integrity and resilience of Nigeria’s financial ecosystem amidst the growing influence of digital assets.

Binance Under Scrutiny

The recent crackdown by the Nigerian government on platforms providing cryptocurrency services highlights the intricate challenges of regulating this burgeoning sector.

Among the platforms under scrutiny is Binance, a prominent cryptocurrency exchange, which has encountered regulatory hurdles in Nigeria. The Central Bank of Nigeria (CBN) expressed concerns regarding suspicious financial activities on Binance Nigeria, alleging that $26 billion in unidentified funds flowed through the platform in 2023.

Tigran Gambaryan, an executive at Binance, is facing charges associated with money laundering, while another executive, Nadeem Anjarwalla, is being pursued for extradition.