IN BRIEF

- Paradigm seizes opportunity with proactive transfer of 3,718 ETH amid market surge.

- Ethereum’s prominence in Paradigm’s portfolio informs strategic maneuvers.

- ETH’s rally coincides with Paradigm’s trajectory for profit recovery.

Paradigm Capital’s recent transfer of 3,718 Ethereum (ETH) to Anchorage Digital marks a significant move for the investment dealer, particularly considering their absence from similar transactions over the past three months. This transfer, occurring against the backdrop of a dynamic cryptocurrency market, reflects Paradigm’s strategic approach to managing its digital asset portfolio.

The decision to transfer a substantial amount of Ethereum to Anchorage Digital underscores Paradigm’s confidence in the digital currency space and its commitment to optimizing its investment strategy. The timing of this transfer is particularly noteworthy, given the recent surge in the value of Ethereum and other cryptocurrencies. By capitalizing on this market momentum, Paradigm may seek to maximize returns and position itself for further growth in the digital asset market.

The ETH transfer by Paradigm

Paradigm Capital’s decision to transfer 3,718 ETH from its holdings to Anchorage Digital underscores its forward-thinking approach to cryptocurrency management. This move coincides with Paradigm‘s strategic decision, announced by one of Asia’s cryptocurrency media influencers, to re-enter the ETH market after a three-month hiatus. The transaction, valued at approximately $12 million at the time of execution, exemplifies Paradigm’s agility in responding to market dynamics and its commitment to maximizing returns for investors.

Paradigm transferred 3,718 ETH to Anchorage Digital: Custodian (0xd5…0191) today, worth approximately US$12 million. This was Paradigm’s first ETH transfer in three months. Currently, the Paradigm address still holds approximately $415 million in crypto assets, mainly 83.518k…

— Wu Blockchain (@WuBlockchain) April 28, 2024

In Arkham Intelligence’s troubled dataset, Paradigm stands out as a significant holder of LDO, the native cryptocurrency of Lido DAO. With a substantial stake of 70 million LDO, valued at $146.30 million, Paradigm demonstrates its strong presence in the cryptocurrency market. Additionally, the firm’s diverse portfolio includes other prominent coins such as OP, QWLA, INS, AAA, and BNB, showcasing its extensive investment strategy.

Paradigm’s anticipated revenue projections

In the ever-fluctuating landscape of the cryptocurrency market, Paradigm’s risk portfolio has notably stood out for its reliability and resilience. Despite the inherent volatility of the crypto space, Paradigm’s portfolio has consistently delivered, generating a substantial revenue of $26.53 million amidst the current market conditions. This achievement underscores the firm’s adept management strategies and ability to navigate through market uncertainties.

Since the commencement of the maintenance period in 2019, Paradigm’s economic performance has continued on a positive trajectory. Despite occasional downturns in the market, the firm has demonstrated resilience and adaptability, maintaining a steady course towards growth and profitability.

An analysis by Arkham reveals Paradigm’s notable success in November 2021, characterized by a headline-grabbing net profit of $919 million. While there may have been periods of decline in profit margins, particularly during the crypto winter, Paradigm’s portfolio has consistently rebounded, with its value reaching a noteworthy $9.1 million.

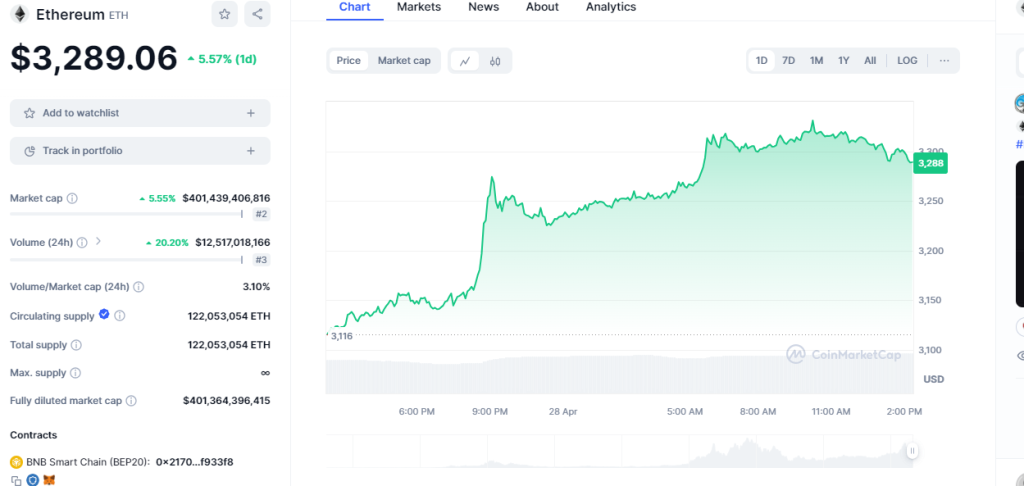

The surge in the value of Ethereum (ETH) has coincided with a significant increase in the total market capitalization of the cryptocurrency space. This upswing in ETH, coupled with favorable market conditions, has likely contributed to Paradigm’s impressive revenue generation and overall portfolio performance.

Source:coinmarketcap

Source:coinmarketcap

Paradigm’s latest ETH transaction coincides with a period of bullish sentiment in the Ethereumworld market. The opening figure for ETH stood at $3,258, and it surged by 2.14% to reach $3,312, as indicated by the provided data. This upward trajectory in ETH’s price during the mentioned period could potentially contribute to an improvement in Paradigm’s profitability, aligning with the company’s efforts towards recovery.

Paradigm Capital’s proactive approach to Ethereum (ETH)

Paradigm Capital’s transfer of 3,718 ETH to Anchorage Digital is emblematic of the company’s astute and business-oriented approach to managing its digital currency assets, particularly amidst the current market’s liquidity achievements. With Ethereum comprising a significant portion of its holdings and serving as a cornerstone for investing in a diversified portfolio of cryptocurrencies, Paradigm strategically leverages its position to extend its market presence.

By staying ahead of the curve in the ever-evolving crypto market, Paradigm demonstrates its agility and quick-witted responsiveness, which serve as key sources of competitive advantage. The company’s ability to navigate market dynamics with precision and deploy its balanced portfolio to maximize returns underscores its strategic prowess and commitment to delivering value to its stakeholders.

In light of the recent surge in ETH prices, Paradigm’s proactive measures further validate its commitment to sustained growth and leadership in the dynamic crypto sector. By capitalizing on market opportunities and leveraging its expertise, Paradigm cements its position as a frontrunner in the rapidly changing landscape of cryptocurrency investments.

READ MORE ABOUT: The parent company of Farcaster has reached a valuation exceeding $1 billion following a funding round led by Paradigm.