Overview

- Ethereum gas fees are at a 6-month low, coinciding with a rise in Ether price.

- The decrease in fees is likely due to less network traffic and recent upgrades. However, there’s a slight uptick in circulating ETH supply.

- Despite the supply increase, Ethereum remains deflationary overall, with more ETH burned than issued since the Merge.

Amidst the ever-fluctuating landscape of cryptocurrency, enthusiasts are celebrating a significant development: Ethereum gas fees have plummeted to their lowest point in six months. This dramatic reduction in transaction costs has sparked optimism among market participants and analysts alike, particularly as it coincides with a robust 4.3% increase in the value of Ether.

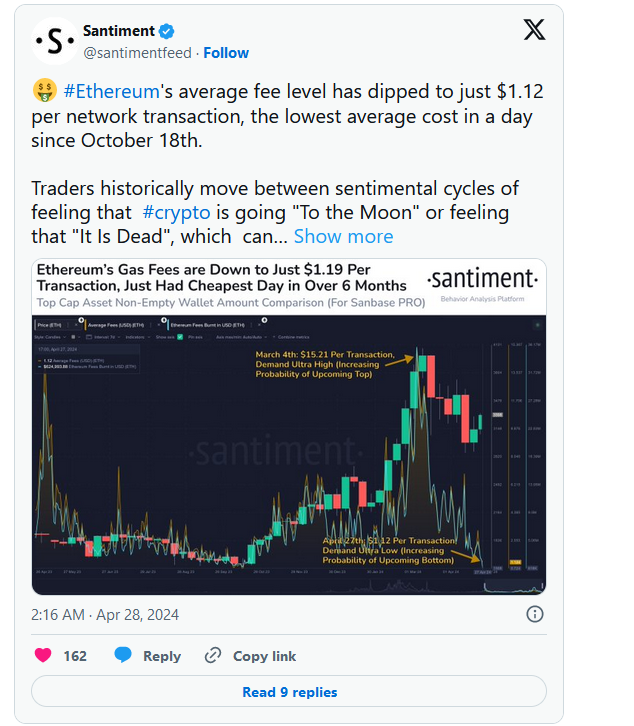

Insights gleaned from Santiment reveal that the average gas transaction fee experienced a precipitous drop, bottoming out at a mere $1.12 on April 27. This seismic shift has reverberated throughout the cryptocurrency ecosystem, eliciting particular interest in alternative cryptocurrencies, or altcoins, which stand to benefit from the newfound affordability of Ethereum transactions.

However, amidst the jubilation, a pertinent question arises: What are the broader implications of this development? This calls for a comprehensive analysis that delves into the underlying factors driving this trend and its potential ramifications for the cryptocurrency market as a whole.

Why the Fee Drop?

The reduction in Ethereum gas fees can be partially attributed to a decrease in network congestion. This correlation follows a simple principle: when there are fewer transactions occurring, the fees tend to be lower. Additionally, recent enhancements in Ethereum’s infrastructure, notably the latest Dencun, have played a pivotal role in streamlining network operations, leading to smoother functionality overall.

Historical data underscores a compelling connection between declines in gas fees and subsequent periods of heightened activity and price appreciation in altcoins. Santiment’s analysis highlights that these fee reductions often coincide with market bottoms, suggesting a potential shift in sentiment and the initiation of an altcoin rally. This observation gains added credence from Ethereum’s sustained deflationary trajectory post-Merge, wherein more ETH has been burned than issued over the past five months, effectively reducing the overall supply.

Understanding the Market Sentiment

Despite the drop in gas fees and the tantalizing prospect of an impending altcoin resurgence, recent data unveils a notable uptick in Ethereum’s circulating supply. Within the past month alone, a staggering 74,458 new ETH has entered circulation, surpassing the 57,516 ETH that were burned during the same period. While this surge in supply may raise concerns among investors, it’s imperative to contextualize it within Ethereum’s enduring deflationary trend post-Merge.

Indeed, since the Merge, Ethereum has exhibited a consistent pattern of more ETH being burned than issued, underscoring its deflationary trajectory. Despite the recent influx of new ETH into circulation, the cumulative amount of burned ETH since the Merge remains significant. This phenomenon serves as a testament to the sustained network activity and ongoing demand for Ethereum, despite short-term fluctuations in supply dynamics.

In essence, while the recent increase in circulating supply may give pause for thought, it does not diminish the broader positive sentiment towards Ethereum. The continued prevalence of burned ETH underscores the robustness of the network and the enduring confidence of market participants in its long-term viability and utility.

Ethereum Technical Analysis

From a technical standpoint, Ethereum seems to be on the cusp of a significant breakthrough, with the potential to surpass the $3,300 threshold. The prevailing market sentiment towards ETH remains decidedly bullish, buoyed by recent whale activity that has captured the attention of investors. Notable among these activities is James Fickel’s conspicuous acquisition of ETH, which serves as a compelling indicator of confidence and optimism within the investor community.

This positive outlook for Ethereum is further bolstered by a confluence of factors, including favorable market conditions, growing institutional interest, and a vibrant ecosystem of decentralized applications (DApps) and DeFi protocols built on the Ethereum blockchain. As Ethereum continues to solidify its position as the backbone of the decentralized finance (DeFi) space and a key player in the broader cryptocurrency market, investors are increasingly drawn to its potential for growth and innovation.

Moreover, Ethereum’s imminent transition to a proof-of-stake (PoS) consensus mechanism through the Ethereum 2.0 upgrade is anticipated to unlock a new era of scalability, security, and sustainability for the network. This fundamental shift, coupled with ongoing developments such as the implementation of Ethereum Improvement Proposals (EIPs) and the integration of layer 2 scaling solutions, further augurs well for Ethereum’s long-term prospects.

In summary, Ethereum’s technical outlook remains robust, with the potential for a breakthrough beyond the $3,300 milestone. The recent influx of whale activity, exemplified by James Fickel’s acquisition of ETH, underscores growing confidence and optimism in Ethereum’s future trajectory. As the cryptocurrency ecosystem continues to evolve and mature, Ethereum stands poised to lead the charge towards a more decentralized and inclusive financial future.

Also Read on Ethereum’s Dencun fuels 5x hike over $25 billion – All you need to know