Bitcoin’s strong performance in the past year benefited holders who endured the 2022 bear market.

However, the current status of Unspent Transactions Output (UTXO) in Profit, discovered by AMBCrypto, suggests potential peril for BTC’s price.

UTXO in Profit indicates the percentage of coins whose current value surpasses their creation value, while UTXOs in Loss have a lower value. These metrics are vital for recognizing market peaks and troughs. As per CryptoQuant data at present, UTXO in Profit has risen to 88.63%.

Increasing Profits comes with a Corresponding Rise in Potential Downsides

Historically, when UTXO in Profit reaches 95%, Bitcoin prices tend to correct. Therefore, if the coin’s value continues to increase, leading to more UTXOs in gains, a significant drawdown is likely. This observation is supported by SimonaD, an on-chain analyst.

SimonaD, who shared her analysis on CryptoQuant, pointed out that:

“The previous instance of the metric indicating over 95% of UTXOs in profit was observed during the peak of the 2021 bull market. It is crucial to closely monitor this zone to determine if it will be reached and surpassed in the upcoming period.”

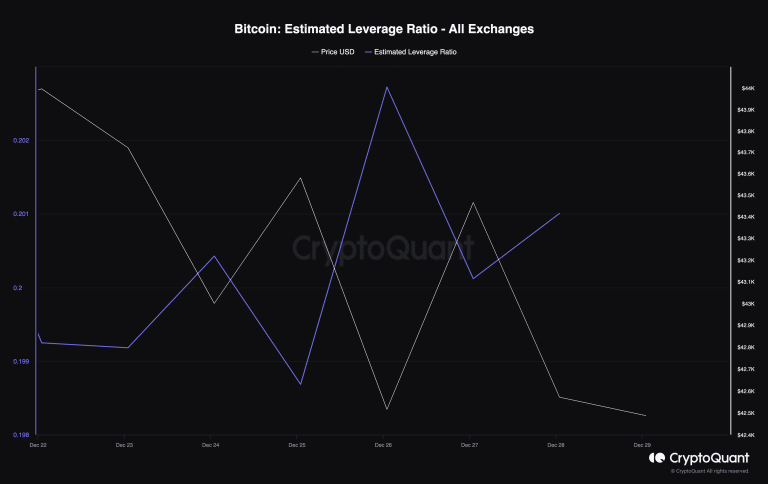

Following this, AMBCrypto investigated whether traders were exercising caution. Contrary to expectations, the Estimated Leverage Ratio (ELR), representing the average leverage used by traders, showed a rise.

A higher ELR suggests that traders were taking more significant risks, indicating a strong belief in the price movement.

Not the Right Time to Invest

However, the question remains: are these traders leaning towards long or short positions? Currently, the Long/Short Ratio stands at 1.08. According to this metric, 50.21% of Bitcoin traders have chosen to go long, anticipating a price rise.

Meanwhile, shorts account for 49.79% of the 24-hour open positions. This scenario suggests uncertainty among traders about Bitcoin’s future direction. The current situation raises the possibility of BTC trading sideways, posing a risk of liquidation for both longs and shorts.

What about Short-Term Holders (STH)? According to Glassnode data, Bitcoin’s STH-SOPR has climbed to 1.02.

The STH-SOPR gauges the behavior of short-term investors over a 155-day period. Readings below 1 suggest a favorable entry point for buyers. Currently, the Bitcoin STH-SOPR implies that it might be a suitable time to exit the market, potentially leading to a price drop to $42,000.

Despite this, there’s widespread anticipation of a 2024 bull market that could propel the price to a new All-Time High (ATH).

Image Source: CryptoQuant