In the ongoing XRP lawsuit involving Ripple Labs Inc. and the US Securities and Exchange Commission (SEC), both parties have jointly presented a sealing proposal to the United States District Court for the Southern District of New York. This proposal, crafted to address sealing matters pertaining to forthcoming remedies-related briefing, underscores the shared commitment to transparency while recognizing the necessity of maintaining confidentiality for certain sensitive information.

The joint communication, directed to Hon. Analisa Torres and dated March 19, 2024, delineates a schedule for the submission and public dissemination of court documents, emphasizing a systematic approach to sealing and redaction. The parties affirm their intention, noting, “The proposal will ensure prompt, public access to the Parties’ briefs (with anticipated minimal redactions), which aligns with the ‘strong presumption’ of public access.”

The Comprehensive Schedule of Remedies in the Ripple vs. SEC Lawsuit

March 22, 2024:The SEC is set to submit its initial remedies-related brief to the court, along with supporting declarations and exhibits, all of which will be filed under seal. This procedural move enables the parties to review the documents thoroughly and identify any confidential information that may require redaction before they are made available to the public.

March 25, 2024:Ripple and the SEC are scheduled to convene for a meeting to discuss and reach consensus on the redactions to be implemented in the SEC’s opening brief and its accompanying materials. This cooperative effort aims to pinpoint and reduce the number of redactions, thereby maximizing the amount of information accessible to the public.

March 26, 2024

After the meet and confer session, the SEC will proceed to submit a publicly available version of its opening brief, which will contain redactions agreed upon by both parties (and potentially third parties involved) during the meeting. This redacted version ensures that sensitive information is appropriately protected while still allowing for transparency in the legal proceedings.

Moreover, any supporting exhibits that are not categorized as Confidential or Highly Confidential under the Protective Order will also be included in the public docket. This inclusion serves to bolster the transparency of the entire process, providing stakeholders and the general public with access to relevant materials and a clearer understanding of the case.

April 22, 2024:

It is anticipated that Ripple will submit its opposition brief and accompanying documents. Should these materials not contain any information classified as Confidential or Highly Confidential by the SEC, they will be filed publicly with redactions. This approach safeguards the confidentiality of sensitive information while facilitating public access to the latest developments in the case.

April 23, 2024:

If Ripple’s materials encompass confidential information, a meeting has been arranged for the specified date to deliberate on the redactions pertaining to Ripple’s opposition brief and its supporting documents. This meeting serves as a forum for the parties involved to engage in discussions aimed at identifying and agreeing upon the necessary redactions to ensure that sensitive information is appropriately safeguarded. Through this collaborative process, both Ripple and the SEC endeavor to strike a balance between maintaining confidentiality and promoting transparency in the legal proceedings.

April 24, 2024:

Based on the discussions held the previous day, Ripple will submit a publicly available version of its opposition brief, which will be redacted as per the agreed-upon terms. This approach aims to safeguard sensitive information while upholding the commitment to transparency in the legal proceedings.

May 6, 2024:

In the final phase of the sealing and redaction process, the SEC will submit its reply brief under seal, marking a pivotal step in the progression of the legal proceedings. This submission underscores the culmination of extensive deliberations and negotiations between the parties involved, as well as their commitment to adhering to the protocols outlined for handling confidential information.

The decision to file the reply brief under seal reflects the necessity of safeguarding sensitive information while ensuring that the legal process proceeds smoothly and in accordance with established guidelines. By submitting the brief under seal, the SEC demonstrates its dedication to upholding the integrity of the legal proceedings and preserving the confidentiality of pertinent details.

This significant milestone signifies the conclusion of a meticulous and thorough process of sealing and redaction, wherein both parties have collaborated to ensure that sensitive information is appropriately protected. As the legal proceedings advance, the submission of the reply brief under seal sets the stage for further deliberations and actions, underscoring the importance of confidentiality and adherence to procedural requirements in complex legal matters.

May 7, 2024:

A meeting is scheduled to take place to deliberate and identify the requisite redactions for the SEC’s reply brief and any accompanying exhibits, with the aim of ensuring the proper protection of any sensitive information contained therein.

May 8, 2024:

The SEC is to file a public, redacted version of its reply brief along with any supporting exhibits not classified as Confidential or Highly Confidential. This step marks the culmination of the scheduled submissions and emphasizes the ongoing effort to balance confidentiality with the public’s right to access.

May 13, 2024:

In a comprehensive approach to managing sensitive information within the case, both parties, along with any involved third parties, will submit omnibus letter-motions to seal materials pertaining to the remedies-related briefing. These materials encompass the briefs, declarations, and supporting exhibits, along with proposed redactions to such content.

This process signifies a concerted effort by all parties involved to ensure the appropriate protection of confidential information while facilitating the legal proceedings. By filing omnibus letter-motions, the parties demonstrate their commitment to transparency and adherence to established protocols for handling sensitive materials.

Furthermore, the inclusion of proposed redactions underscores the meticulous attention given to safeguarding sensitive details while still allowing for the effective exchange of information among the parties and the court. This collaborative approach emphasizes the importance of maintaining confidentiality in legal matters while striving to uphold the principles of fairness and transparency.

May 20, 2024:

The parties, as well as any third parties involved, are slated to submit letter-briefs in opposition to the omnibus letter-motions to seal. This process enables a discussion regarding the need and scope of sealing specific documents and information, fostering an open discourse on confidentiality matters within the legal proceedings.

Insights Will Be Kept Hidden from the XRP Community.

The intricately outlined timeline serves as an official display of the parties’ dedication to transparency, guaranteeing that the public is kept abreast of the case’s advancements while also protecting confidential information. Nonetheless, Bill Morgan, who closely tracks the case from the standpoint of the XRP community, holds a divergent viewpoint:

For all those that thought the SEC succeeding earlier this year in its motion ordering disclosure of Ripple post-complaint contracts with institutions meant disclosure to the world it didn’t. It meant disclosure to the SEC subject to a protective order, and there is likely a lot of commercially sensitive material Ripple will seek to have redacted and sealed in the SEC brief and reply brief.

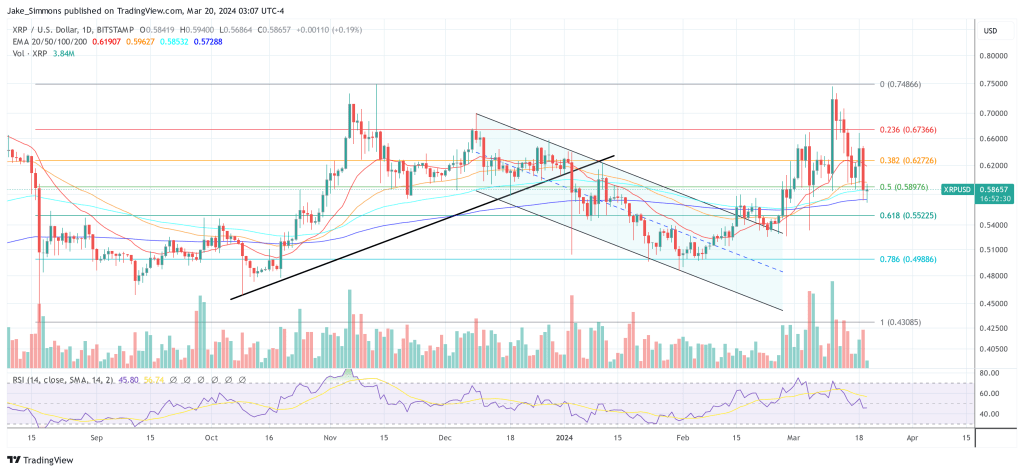

As of the current moment, XRP is trading at $0.58657.