Early in the day, the crypto sphere experienced a momentary disturbance with the false appearance of an approved spot Bitcoin ETF. Greeks.live, a prominent crypto data platform, highlighted the resulting heightened Bitcoin (BTC) volatility, clarifying that the purported impact of the fake ETF on Bitcoin was perceived as restricted.

The Counterfeit ETF Approval News Failed to Elevate the Anticipated Volatility as Expected

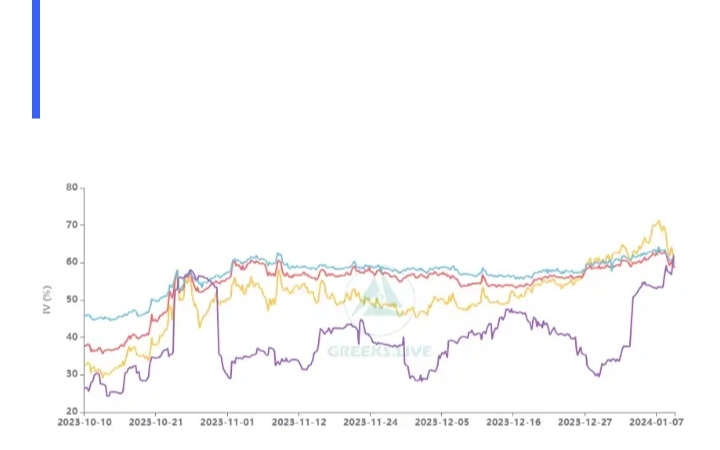

Greeks.live, a crypto data platform, analyzed market activity post the fictitious spot Bitcoin ETF approval. The platform observed, “The SEC’s false ETF approval created significant volatility in BTC,” underscoring that instead of rising, Predicted Volatility decreased.

The SEC’s false approval news for the ETF led to significant BTC volatility, with events unfolding in an even more peculiar manner than anticipated.

Despite the sharp movements boosting Realized Volatility (RV), Predicted Volatility (IV) saw a slight drop. This data defies the norm as the ETF had been priced for over a month, indicating a potential peak in short-term IV, especially given that investors recognized the limited impact of the ETF on Bitcoin.

Concurrently, the news drained the fragile strength of the market, prompting many investors to execute leverage and position reduction operations earlier than intended.

Understanding Realized Volatility and Predicted Volatility

Realized Volatility and Predicted Volatility, as highlighted by Greeks.live, serve as distinct indicators of volatility applicable in both traditional financial markets and the crypto market.

Realized Volatility involves calculating volatility based on historical price movements. It is typically measured through the standard deviation of price changes over a specific timeframe, providing insights into actual market conditions. This metric, also known as historical volatility, is a backward-looking measure.

Predicted Volatility, on the other hand, is a volatility measure derived from option prices. As option prices incorporate various factors, including volatility, Predicted Volatility is determined by extracting or deriving from these option prices. This metric signifies the level of uncertainty expected by market participants regarding future price movements, acting as an indicator predicting future volatility.

Both volatility measures play crucial roles in market risk management and pricing. Realized Volatility reflects historical performance, offering insights into the past, while Predicted Volatility expresses uncertainty about future market movements, contributing to forward-looking risk assessments.