Five days have passed since the fourth Bitcoin (BTC) halving, and the cryptocurrency market is still in a state of anticipation and uncertainty. Bitcoin finds itself locked in a sideways movement, with its price oscillating between the $60,000 and $74,000 range. However, beneath this apparent stagnation lies a subtle upward momentum, evidenced by Bitcoin’s gradual climb. During Wednesday’s mid-London session, Bitcoin was observed trading at around $66,377, indicating a positive trend amidst the sideways movement.

Despite the fluctuating prices, Bitcoin has managed to establish a strong support level at approximately $64,903. This support level is a testament to Bitcoin’s resilience, offering stability even when faced with sudden market shifts and volatility.

The market’s uncertainty is palpable, with investors eagerly watching Bitcoin’s movements for signs of direction. While some may interpret the sideways movement as a period of consolidation before another surge, others remain cautious, wary of potential downward trends.

This sideways movement is not unusual for Bitcoin following a halving event. Historically, Bitcoin has experienced periods of consolidation and sideways trading after each halving, before eventually embarking on significant bullish runs. The current sideways movement may simply be a precursor to a larger upward trend, driven by the supply reduction resulting from the halving.

Nevertheless, the current market conditions have investors on edge, with many closely monitoring Bitcoin’s price movements and analyzing market indicators for clues about its next move. Amidst the uncertainty, the $64,903 support level serves as a beacon of stability, providing reassurance to investors amidst the market’s turbulence.

In the coming days and weeks, all eyes will remain firmly fixed on Bitcoin as it navigates through this period of uncertainty. Whether the sideways movement will give way to a bullish rally or a bearish downturn remains to be seen. For now, investors must remain vigilant and adaptable, ready to adjust their strategies according to the evolving market conditions.

Insights from On-Chain Data and Market Activity

Recent on-chain data has uncovered a significant shift in the behavior of large investors towards Bitcoin. According to the latest report from CoinShare, there has been a notable decrease in Bitcoin accumulation among these investors, resulting in a net outflow of approximately $206 million from digital asset investment products. This trend is particularly evident in Bitcoin and Ethereum.

The implications of this shift are profound. Large investors, often considered key players in the cryptocurrency market, are reducing their exposure to digital assets. This departure from accumulation suggests a cautious approach and raises questions about the future trajectory of Bitcoin and other cryptocurrencies.

Despite these fluctuations, there is a glimmer of hope on the horizon. Anticipation is building around the potential for increased Bitcoin demand in the near future. One major factor driving this optimism is the imminent launch of spot Bitcoin ETF trading in Hong Kong by the end of the month. This development is expected to inject fresh capital into the market and stimulate demand for Bitcoin.

Additionally, market observers are eagerly awaiting the release of US federal funds rates in early May. This announcement will offer valuable insights into potential interest rate adjustments for the year. Any indication of a shift in monetary policy could have significant ramifications for Bitcoin and the broader cryptocurrency market.

The convergence of these factors underscores the dynamic nature of the cryptocurrency market and the multitude of factors influencing investor sentiment. While the recent decrease in Bitcoin accumulation by large investors may raise concerns, the impending launch of spot Bitcoin ETF trading and the upcoming release of US federal funds rates offer reasons for cautious optimism.

As investors navigate through these uncertain times, they are advised to stay informed, remain adaptable, and carefully consider the potential implications of market developments on their investment strategies. In a market as volatile and unpredictable as cryptocurrency, knowledge and foresight are invaluable assets.

Technical Signals In Focus

Confidence in Bitcoin’s upward trajectory remains robust, bolstered by recent approvals of BTC ETFs in both the US and Hong Kong. Currently, the cryptocurrency is revisiting its bullish breakout from 2021, with several indicators hinting at an imminent rally.

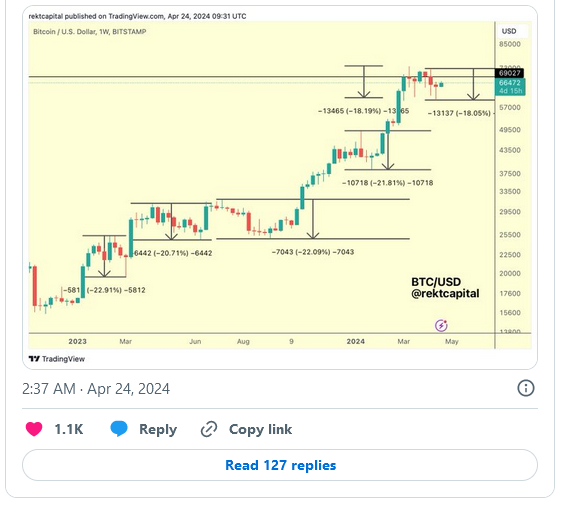

According to crypto analyst Rekt Capital, Bitcoin is currently undergoing an accumulation phase, setting the stage for a potential surge based on historical trends. This viewpoint is shared by many within the industry, who anticipate ongoing consolidation that could present opportunities for alternative cryptocurrencies.

However, analyst Ali Martinez offers a word of caution, noting that the 12-hour TD Sequential indicator has issued a sell signal. Traders are advised to stay alert, particularly if Bitcoin’s price dips below the support level of approximately $65,500, which might prompt a retreat to the $61,000 support threshold.