Bitcoin (BTC) is currently displaying intriguing signs indicating a potential bullish trajectory, drawing insights from a historical trend, as highlighted by the comprehensive analysis from the esteemed market intelligence platform, Santiment.

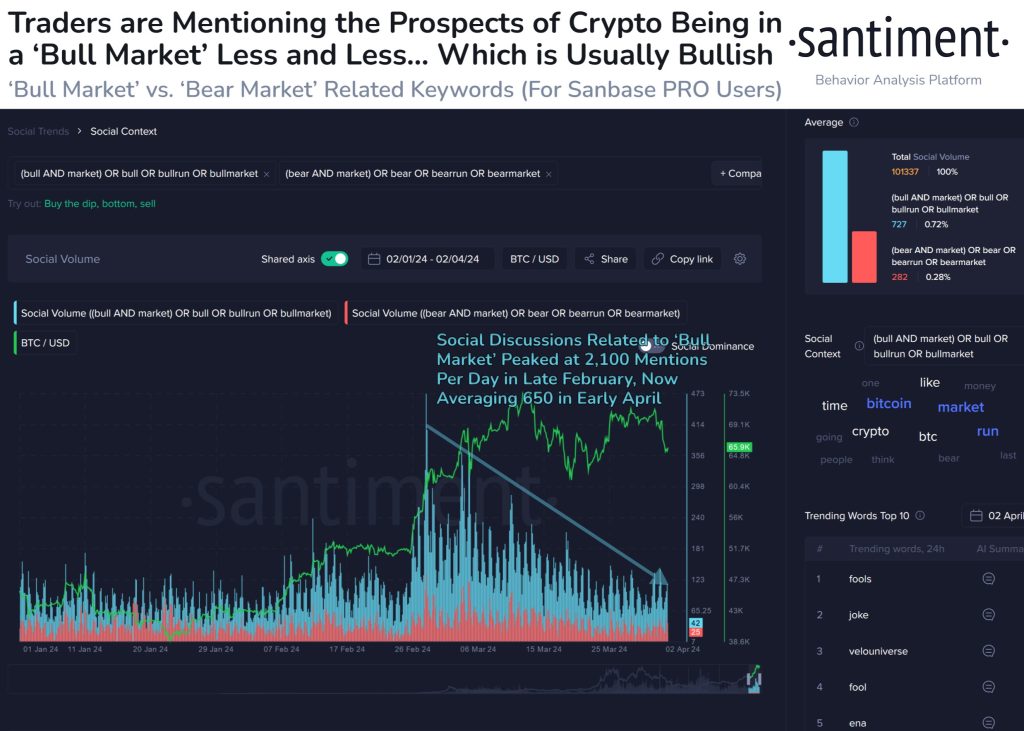

Despite its meteoric rise of nearly 150% since October, Bitcoin appears to be encountering a slight deceleration in its momentum, as observed by Santiment. However, amidst this apparent lull, Santiment astutely points out an intriguing historical pattern: a surge in concerns regarding Bitcoin’s long-term prospects often serves as a precursor to sustained upward movements in the market.

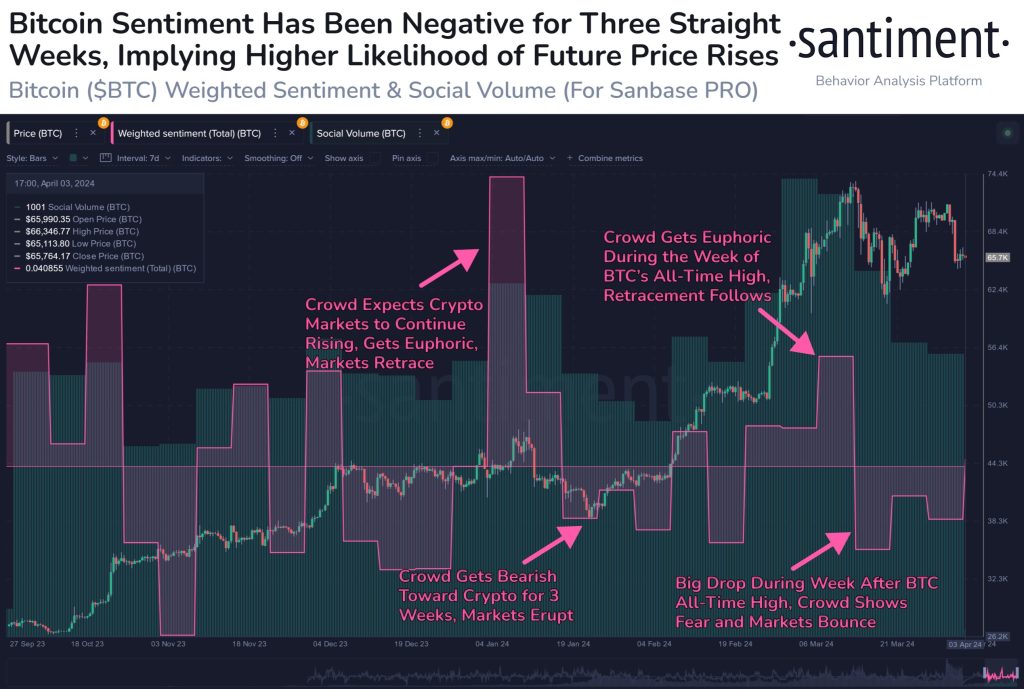

The shift in sentiment surrounding Bitcoin, with a notable increase in apprehension regarding its future performance, presents a fascinating opportunity for astute investors. Santiment posits that contrary to conventional wisdom, periods of heightened skepticism and negativity often pave the way for extended periods of market growth.

Therefore, in light of the prevailing negative sentiment, Santiment advises bullish investors to embrace this sentiment as a potential catalyst for further market gains. Their analysis underscores the counterintuitive nature of market dynamics, where movements frequently diverge from the expectations of the crowd, rendering periods of widespread doubt opportune moments for strategic investments.

Moreover, Santiment draws attention to recent market turbulence attributed to the sale of 10,000 BTC confiscated from Silk Road by US government authorities. This development has stirred significant apprehension among traders, raising concerns about its potential impact on Bitcoin’s price trajectory.

Interestingly, historical data reveals a compelling correlation between spikes in fear associated with Silk Road-related events and subsequent rapid price increases in the cryptocurrency market. This suggests that despite the prevailing uncertainties, such developments may serve as bullish indicators for Bitcoin’s future performance.

Given Bitcoin’s current trading price of $67,905, with a slight decline observed over the past day, Santiment’s meticulous analysis underscores the critical role of market sentiment in shaping the cryptocurrency’s trajectory. In this context, the ongoing sentiment surrounding Bitcoin emerges as a pivotal factor that warrants close attention from investors seeking to navigate the dynamic landscape of digital asset markets.