One analyst suggests that Bitcoin ETFs are absorbing a significant portion of the available BTC for purchase, potentially leading to a critical shift in supply dynamics later this year. According to Ki Young Ju, the founder and CEO of CryptoQuant, if institutional inflows persist, Bitcoin could face a “sell-side liquidity crisis” by September, particularly as the demand from institutional investors outpaces the available supply. He made this prediction during a discussion on X on March 12, highlighting the possibility of a significant BTC supply watershed occurring within the next six months.

Ki: Bitcoin bears “can’t win” while ETF flows continue

In the realm of institutional investments, the utilization of Bitcoin is just beginning to unfold, marking a significant turning point in the financial landscape. Within this burgeoning landscape, the emergence of United States-based spot Bitcoin exchange-traded funds (ETFs) has captured the attention of industry participants. Their meteoric rise, now hovering around an impressive $30 billion, stands as a testament to their unprecedented success, shattering records as the most triumphant ETF launch in history.

However, beneath the surface of this remarkable achievement lies a looming concern—a concern that hints at a potential paradigm shift in the dynamics of Bitcoin supply and demand. As the momentum behind spot Bitcoin ETFs continues to surge, there arises the specter of an impending scarcity, a scenario where the available BTC may not be sufficient to meet the surging demand.

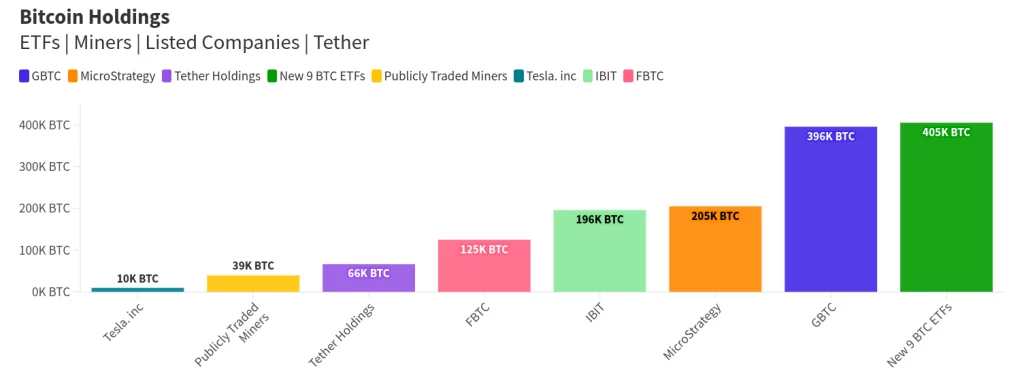

In deciphering the intricacies of this unfolding narrative, Ki, a discerning observer within the Bitcoin community, articulates a sobering realization. He contends that until the relentless influx into spot Bitcoin ETFs subsides, the bearish sentiments prevailing in certain quarters of the market will struggle to gain traction. The staggering figures speak volumes—ETFs devoured over 30,000 BTC in just the past week alone. This voracious appetite for Bitcoin underscores a critical imbalance when juxtaposed against the broader Bitcoin ecosystem, which encompasses approximately 3 million BTC held across exchange and miner wallets.

Against this backdrop of unprecedented accumulation, Ki paints a stark picture—a picture of a looming sell-side liquidity crisis, a scenario that could unravel within a mere six months if the current trajectory persists unabated.

Yet, the saga of Bitcoin’s institutional journey does not culminate with the rise of spot Bitcoin ETFs. Enter the Grayscale Bitcoin Trust (GBTC), a stalwart amidst the tumultuous seas of crypto investment vehicles. Despite its enduring prominence, GBTC grapples with its own set of challenges, most notably a daily exodus of funds averaging a staggering $500 million. This steady outflow, a reflection of investor behavior amidst Bitcoin’s meteoric ascent, presents a conundrum of its own.

WhalePanda, a luminary within the Bitcoin community, sheds light on this predicament. He underscores the paradoxical nature of GBTC’s plight, where despite the appreciating value of Bitcoin since the ETF’s inception in January, the dollar-denominated value of GBTC’s Bitcoin holdings remains eerily stagnant. This dissonance between price appreciation and dwindling BTC holdings amplifies concerns regarding GBTC’s ability to navigate the turbulent waters of institutional investment.

In essence, the narrative of Bitcoin’s ascent as an institutional investment asset is a tale of unprecedented triumphs and looming tribulations. It is a narrative that underscores the transformative power of cryptocurrency within the traditional financial landscape—a power that promises to reshape the contours of global finance for generations to come.

1.4 million BTC to go?

As we stand on the precipice of a monumental shift driven by the escalating demand for ETFs, Ki’s prognostication unveils a profound revelation—a revelation poised to reverberate across the Bitcoin (BTC) market with seismic intensity. His foresight transcends mere speculation, suggesting that the impending surge in demand could precipitate a cataclysmic shift in BTC prices—a shift so profound that it eclipses the most optimistic projections of market pundits.

In Ki’s narrative, the looming specter of a sell-side liquidity crisis emerges as the harbinger of this transformative event. With a scarcity of sell-side liquidity and a precarious thinness characterizing the order book, the stage is set for an upheaval of unprecedented proportions. Ki’s thesis posits that this crisis, when unleashed upon the market, will serve as the catalyst propelling BTC prices to stratospheric heights—a scenario that defies the confines of conventional wisdom and challenges the very limits of expectation.

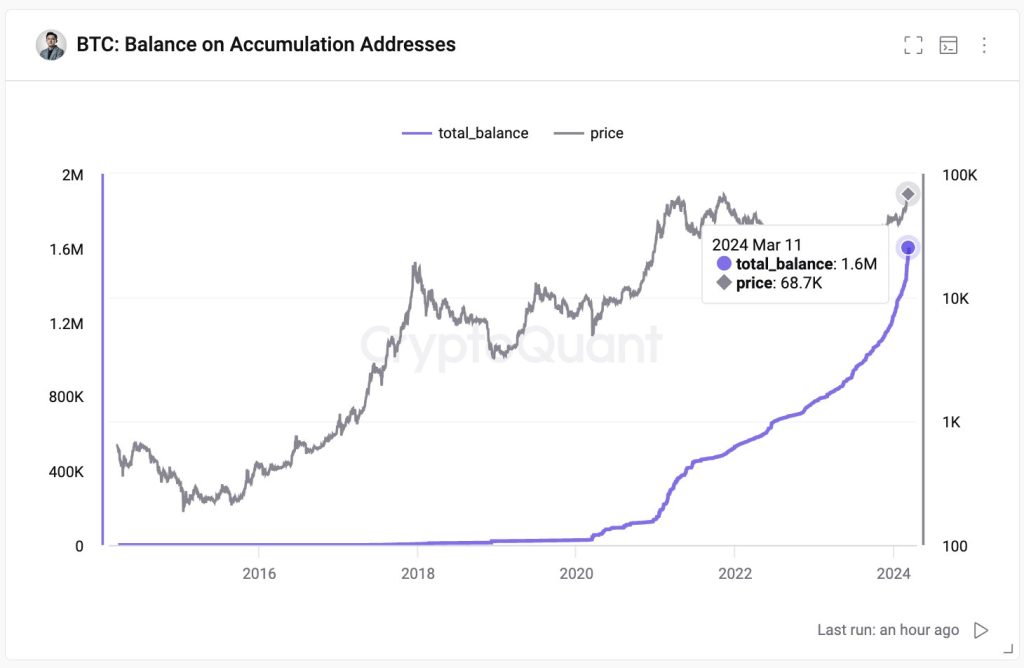

Yet, amidst this foreboding prophecy, Ki offers a glimmer of hope—a beacon of insight illuminating the path forward. He underscores the pivotal role played by “accumulation addresses”—wallets distinguished by a relentless influx of inbound transactions—in shaping the trajectory of BTC holdings. Despite the ongoing ascent of BTC holdings within these addresses, Ki cautions that the crisis looms ominously, necessitating a doubling of these holdings to reach its apogee.

The narrative finds resonance in the annals of cryptocurrency discourse, as documented by Cointelegraph, where the ebbs and flows of accumulation address holdings serve as a barometer of market sentiment. Recent observations indicate a cooling off in these holdings, coinciding with Bitcoin’s meteoric ascent to new all-time highs. This synchronicity underscores the intricate dance between market dynamics and the evolving landscape of cryptocurrency accumulation strategies—a dance poised to intensify as we traverse the uncharted terrain of institutional investment in the realm of digital assets.