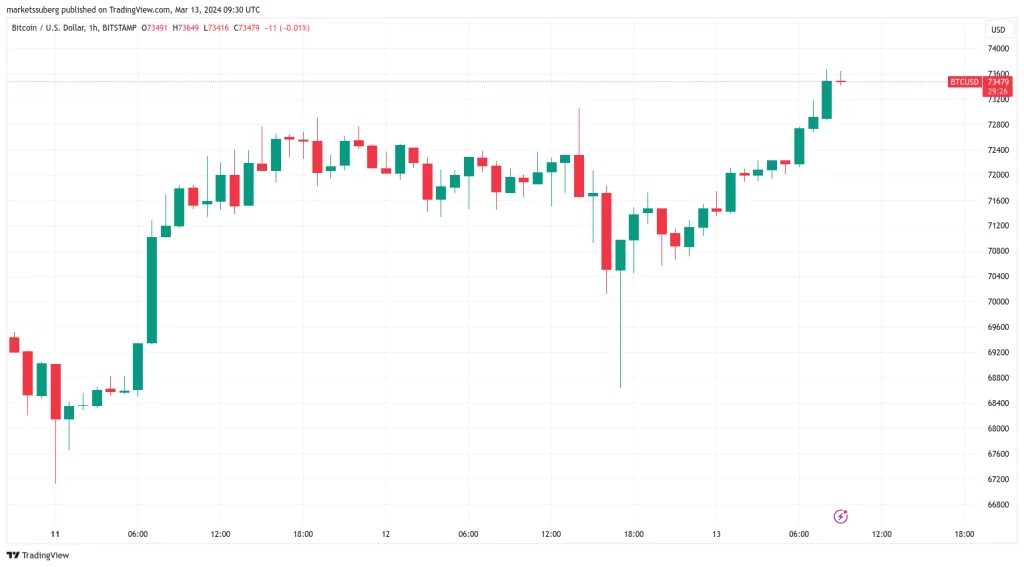

Bitcoin enthusiasts, known for their bullish sentiment, demonstrate little patience for extended pullbacks in the market. A brief dip in the price of BTC to $69,000 is quickly brushed aside as the cryptocurrency surges to new record highs. Just as the market seemed to falter momentarily, Bitcoin swiftly rebounds, with prices soaring to $73,283, once again entering the realm of price discovery. This resurgence occurs just before the Wall Street opening on March 13, as bullish investors overpower selling pressure, reaffirming their confidence in Bitcoin’s upward trajectory.

BTC price roars back after snap wick to $69,000

The latest data extracted from Cointelegraph Markets Pro and TradingView has unveiled an extraordinary milestone in the realm of cryptocurrency as Bitcoin surges to unprecedented heights, reaching a staggering $73,679 on the Bitstamp exchange.

In the intricate dance of market dynamics, Bitcoin’s resilience was tested the day before, as it paused momentarily, consolidating around the formidable $72,000 threshold. However, this tranquility was suddenly disrupted by a sharp and unexpected $4,000 downturn before Bitcoin swiftly regained its upward momentum, defying all expectations.

This sequence of events echoed the familiar pattern observed earlier in the week, where the market encountered resistance that temporarily impeded its ascent. Yet, as history repeated itself, the resilience of Bitcoin was once again on full display, demonstrating its ability to overcome obstacles with unwavering determination.

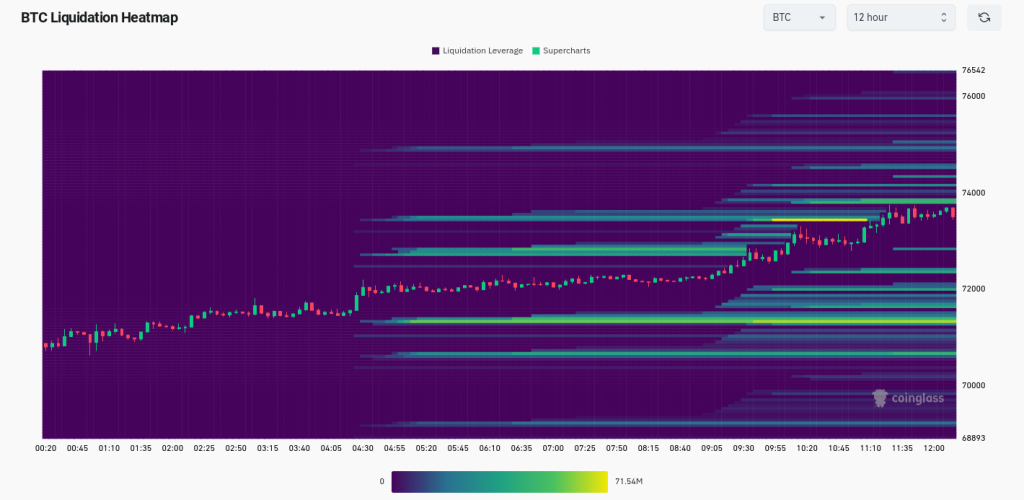

During the latest trading session, the market found itself confronted with a formidable resistance level at $73,800, serving as a temporary barrier to further price appreciation, as meticulously documented by monitoring resource CoinGlass. However, in the grand scheme of Bitcoin’s trajectory, this resistance appeared merely as a fleeting impediment, as the cryptocurrency remained steadfast on its trajectory towards uncharted territory.

What becomes strikingly apparent amidst these fluctuations is the absence of substantial liquidation levels, indicative of a market that is remarkably devoid of excessive leverage. This observation not only underscores the maturity and resilience of Bitcoin but also hints at the potential for sustained growth and stability in the future.

In the midst of this exhilarating journey, the sentiment among traders remains buoyant, with optimism prevailing as Bitcoin continues to chart its course towards greater heights. One prominent trader, Jelle, encapsulated this sentiment succinctly, noting how Bitcoin effectively purged overleveraged long positions, retested the pinnacle of the 2021 cycle, and resiliently bounced back to $72,000. With such favorable indicators in place, the stage is set for a continuation of the upward trajectory, fostering an environment ripe for further exploration and innovation within the cryptocurrency space.

Spot Bitcoin ETFs set record daily inflows

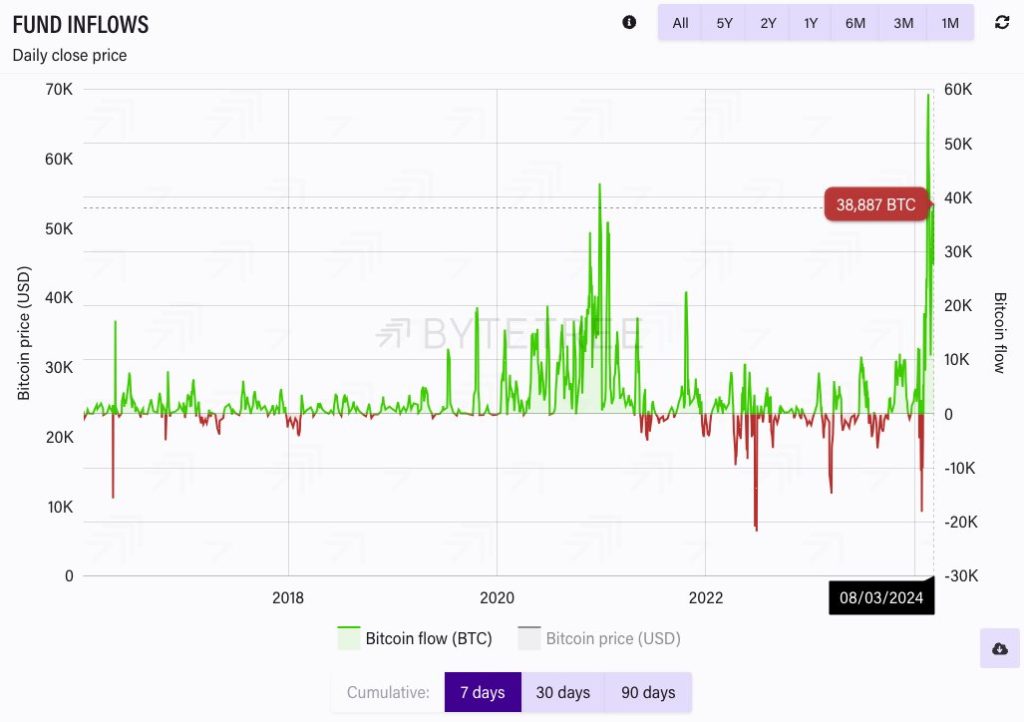

Renowned financial commentator Tedtalksmacro has drawn attention to a remarkable surge in institutional capital flowing into the cryptocurrency market, marking a watershed moment in the evolution of digital asset investment. This influx of funds has surged to unprecedented levels, eclipsing previous records and even dwarfing the impact of the introduction of new spot Bitcoin exchange-traded funds (ETFs) in the United States.

In a statement addressed to his followers, Tedtalksmacro emphasized the magnitude of these fund inflows, highlighting how they far exceed the levels witnessed in 2020, a period widely regarded as pivotal for cryptocurrency adoption. He expressed strong conviction that the price of Bitcoin would continue its upward trajectory in the coming months, propelled by this influx of institutional capital.

Furthermore, Tedtalksmacro outlined his anticipation of a steadfast ascent towards the coveted $100,000 milestone for Bitcoin, characterizing this phase as the commencement of a “steady grind” towards unprecedented valuation levels. Drawing from historical patterns, he provided a cautionary note, suggesting that investors should be prepared to exit the market within a window of 2-3 months once these inflows reach their peak.

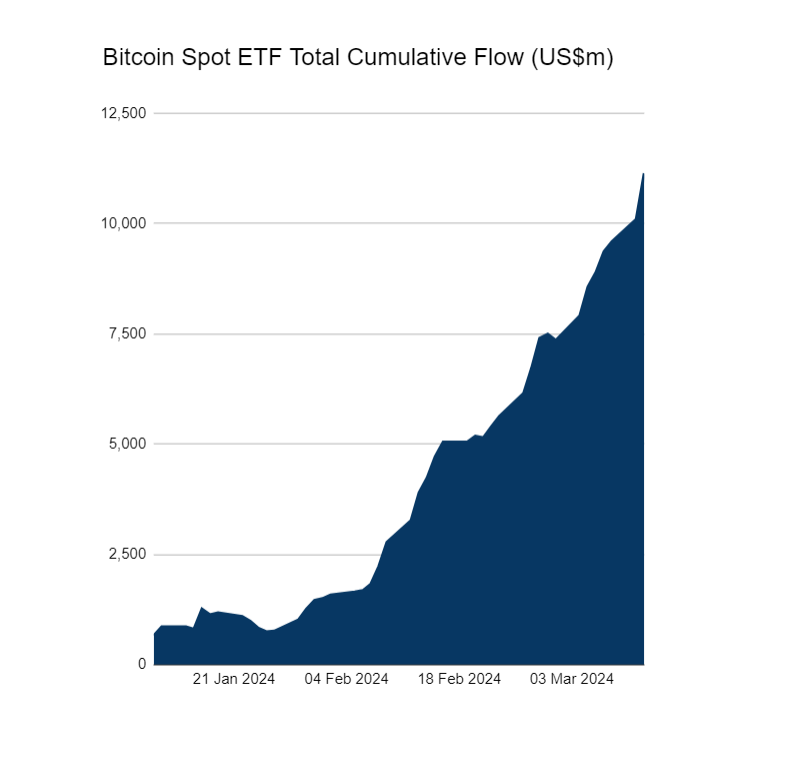

The pivotal role played by ETFs in facilitating this surge of institutional investment was further underscored by the staggering $1 billion in net inflows recorded on March 12, as confirmed by final data. Notably, BlackRock’s iShares Bitcoin Trust (IBIT) emerged as a frontrunner, capturing the lion’s share of these inflows, signaling a growing acceptance of Bitcoin among traditional institutional investors.

BitMEX Research echoed these sentiments, shedding light on a record inflow of 14,706 BTC on March 12, 2024, underscoring the insatiable appetite for Bitcoin among institutional investors. This substantial influx constitutes a significant portion of the total newly-mined supply for the year, further highlighting the seismic shift in the composition of Bitcoin ownership.

The scale of institutional participation in the cryptocurrency market was further illuminated by the holdings of the two largest ETFs, managed by BlackRock and Fidelity Investments, which collectively possessed over 330,000 BTC as of March 13. This staggering accumulation of Bitcoin by institutional investors underscores their growing influence in shaping the market landscape and reinforces Bitcoin’s status as a mainstream investment asset class.