Story Highlights

- Some predict a doubling of the Bitcoin price by July, while others believe it could reach much higher in the long term.

- The upcoming Bitcoin halving, regulatory clarity, and the rise of Bitcoin ETFs are all seen as reasons for potential price increases.

- With the halving event approaching, there’s excitement and anticipation in the crypto market.

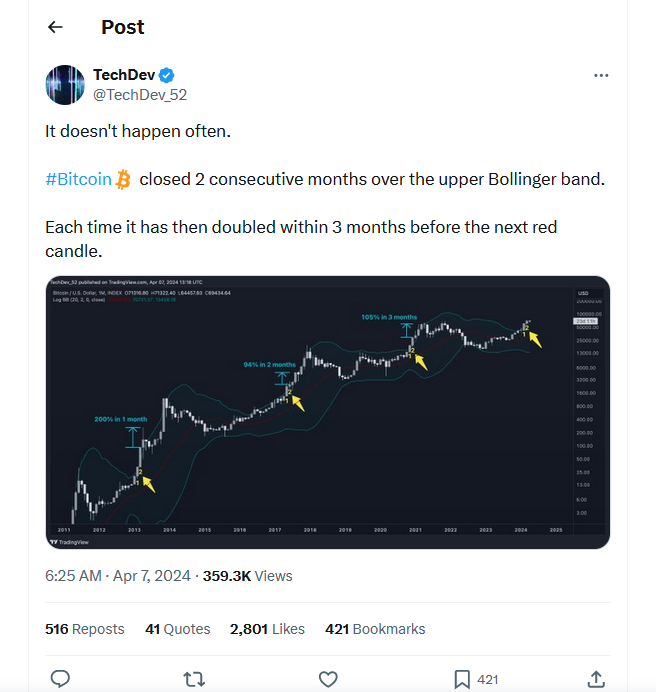

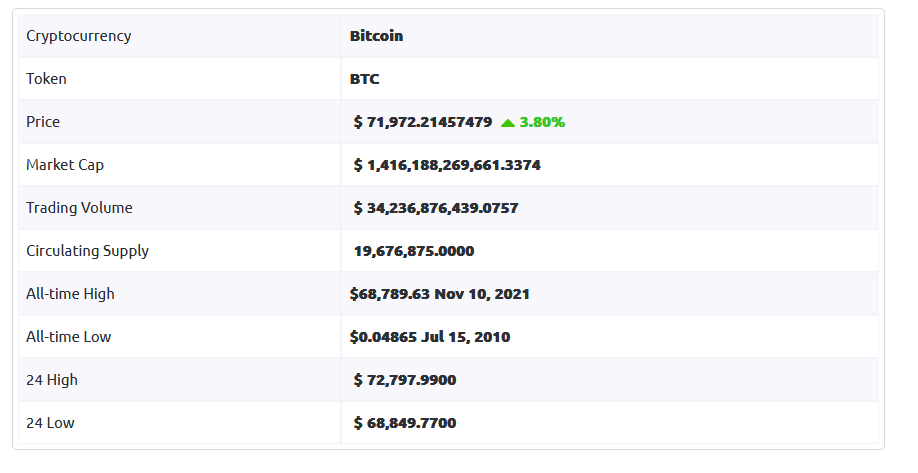

As Bitcoin prepares for its highly anticipated halving event, coupled with an increasing clarity on regulatory fronts and a Federal Reserve that is adopting a more bullish stance, the cryptocurrency market finds itself on the precipice of what could be a monumental surge. At the forefront of this speculation are analysts, with one particularly mysterious figure known as TechDev leading the charge. Their collective analysis paints a remarkably bright future for Bitcoin, projecting its value to potentially skyrocket from its current price point of $69,000 to an eye-watering $140,000 by the time July arrives.

The confidence behind this bold projection is underpinned by Bitcoin’s recent market behavior, especially its notable achievement of closing two consecutive months above the upper Bollinger Band. For those well-versed in technical analysis, this is a pivotal signal that suggests significant upward momentum and a strong bullish trend.

However, such a forecast isn’t merely based on a single indicator. It’s a culmination of various factors meticulously analyzed by TechDev and their team. These factors include but are not limited to the increasing adoption of Bitcoin by institutional investors, the growing acceptance of cryptocurrencies in mainstream financial circles, and the ongoing narrative of Bitcoin as a hedge against inflationary pressures.

TechDev’s analysis isn’t just about crunching numbers; it’s about interpreting the broader market sentiment and understanding the intricate interplay between various macroeconomic factors. It’s about deciphering the cryptic messages hidden within the volatility of the cryptocurrency market and identifying patterns that could potentially unlock unprecedented opportunities for investors.

So, as we embark on this journey of understanding TechDev’s analysis, it’s essential to recognize the depth of insight and expertise that underpins their forecasts. In a market as dynamic and unpredictable as cryptocurrencies, having such guidance can often mean the difference between seizing opportunities and missing out on potentially lucrative gains. Therefore, let’s dive deep into the nuances of their analysis and unravel the mysteries behind their seemingly audacious predictions.

Bollinger Band’s Bold Call

Excitement ripples through the financial sphere as the venerable Bollinger Band indicator sets tongues wagging about the potential for a seismic surge in Bitcoin’s value, poised to outstrip its prior historic zenith prior to the imminent halving event. This venerable tool, while offering invaluable insights, serves as merely one cog in the intricate machinery of technical analysis, characterized more by its reactive nature than its prophetic abilities. The upper echelon of these bands, when breached, typically signifies a market teetering on the edge of overindulgence, yet its reliability wavers, especially in the tempestuous seas of market volatility where certainty becomes an elusive specter. In this whirlwind of anticipation and speculation, the Bollinger Band stands as a stalwart sentinel, beckoning traders and enthusiasts alike to interpret its nuanced signals amidst the cacophony of market noise, navigating the tumultuous seas of cryptocurrency with a blend of cautious optimism and seasoned skepticism.

The Outlook? Optimistic!

In alignment with the prevailing positive sentiment surrounding Bitcoin, Anthony Scaramucci, the distinguished CEO of SkyBridge Capital, lends his influential voice to the chorus, painting a vivid picture of Bitcoin’s trajectory soaring to unprecedented heights of $170,000 within the current market cycle. Yet, Scaramucci’s vision stretches far beyond mere speculation; he boldly envisages a future where Bitcoin asserts its dominance, commanding a staggering fifty percent of the global gold market’s value, potentially catapulting its price to an astonishing $400,000 per BTC.

What fuels Scaramucci’s fervent optimism is not merely wishful thinking but a strategic analysis of recent developments, notably the groundbreaking approval of spot Bitcoin exchange-traded funds (ETFs). This regulatory green light is seen as a watershed moment, poised to ignite a surge in demand from both retail and institutional investors alike. Indeed, the initial inflow of over $12 billion into these ETFs serves as a resounding testament to the burgeoning interest in Bitcoin as a formidable asset class with immense potential for growth and value creation.

It is this convergence of visionary foresight and tangible market dynamics that underpins Scaramucci’s bold projections, positioning Bitcoin not just as a speculative asset but as a transformative force reshaping the global financial landscape. As the world increasingly recognizes Bitcoin’s intrinsic value and utility, fueled by its scarcity and decentralization, Scaramucci’s bullish stance serves as a rallying cry for investors to seize the opportunities presented by this digital revolution. In his eyes, Bitcoin isn’t just another investment; it’s a beacon of financial sovereignty and empowerment, poised to redefine wealth accumulation in the digital age.

Crypto’s Upcoming Boom

In a realm brimming with anticipation and fervent speculation, Ripple’s luminary CEO, Brad Garlinghouse, takes center stage, unfurling his grandiose vista of the impending explosion within the cryptocurrency domain. As illuminated by a recent exposé by CNBC, Garlinghouse unveils a sweeping prophecy: the entire cryptocurrency market poised for an astronomical doubling in valuation, potentially cresting a staggering $5 trillion zenith by the denouement of the calendar year.

Garlinghouse’s proclamation, akin to a symphony of optimism, finds its resonance in an intricate tapestry of compelling factors propelling this imminent ascent. Foremost among these is the looming specter of the halving event, an epochal milestone historically interwoven with a crescendo of demand surges and meteoric price escalations. With the cryptographic community poised at the precipice of this pivotal juncture, Garlinghouse posits, with resolute conviction, that the ensuing trajectory will be marked by an exuberant influx of capital and an electrifying surge in market dynamics.

Yet, amidst the nebulous realm of crypto, regulatory clarity emerges as a beacon of hope, heralding a new era of legitimacy and institutional endorsement. Garlinghouse, a stalwart advocate for regulatory clarity, underscores the profound implications of coherent regulatory frameworks, envisaging them as the linchpin for widespread adoption and mainstream acceptance of digital assets. As regulatory murkiness dissipates, he foresees a deluge of institutional capital cascading into the crypto ecosystem, propelling it to uncharted heights of prosperity.

Moreover, Garlinghouse casts his gaze upon the burgeoning prominence of Bitcoin exchange-traded funds (ETFs) as a transformative force driving crypto adoption into the mainstream. These innovative investment vehicles, lauded for their accessibility and liquidity, offer investors a gateway to Bitcoin’s potential without the exigency of direct ownership, thereby democratising access and broadening participation in the crypto market.

In the symphony of Garlinghouse’s vision, every note resonates with a palpable sense of exuberance and anticipation, underscoring the transformative potential of cryptocurrencies as a seismic force reshaping the contours of global finance. As the cacophony of skepticism gives way to a crescendo of optimism, Garlinghouse’s vision stands as a testament to the indomitable spirit of innovation, poised to usher in an era of unparalleled prosperity within the burgeoning landscape of digital assets.

Factors influencing Bitcoin price prediction

Various significant factors contribute to the intricate dance of Bitcoin price prediction:

- Supply and Demand Dynamics: At the heart of Bitcoin’s price volatility lies the interplay between its supply and demand. The occurrence of halving events, which halve the rate at which new Bitcoins are created, is a critical juncture. This reduction in the issuance rate can potentially amplify demand as scarcity increases, thus exerting upward pressure on prices.

- Inflation Hedging Properties: Bitcoin’s allure as a store of value and a hedge against currency inflation has garnered widespread recognition. With its fixed supply capped at 21 million coins, Bitcoin stands as a beacon of stability in times of monetary turbulence. Consequently, during periods of heightened inflation, Bitcoin often emerges as a preferred refuge for investors seeking to safeguard their wealth against the erosive effects of depreciating fiat currencies.

- Regulatory Landscape: The regulatory environment wields a formidable influence over Bitcoin’s trajectory. Actions taken by regulatory bodies, whether in the form of embracing or stifling cryptocurrency exchanges, possess the potency to sway supply and demand dynamics, thereby exerting a palpable impact on prices.

- Media Sentiment and Coverage: The pervasive reach of media channels can exert a profound sway over public perception and sentiment towards Bitcoin. Whether through glowing endorsements or scathing criticisms, media coverage plays a pivotal role in shaping the narrative surrounding Bitcoin, consequently influencing mass adoption levels and triggering corresponding fluctuations in demand and price.

- Whale Activity: Within the cryptocurrency ecosystem, the actions of large holders, colloquially termed “whales,” wield significant influence. Their substantial buy or sell orders possess the capacity to trigger waves of volatility, sending ripples coursing through the market and precipitating pronounced price oscillations.

- Technological Advancements and Upgrades: Bitcoin’s ongoing evolution, marked by a series of network upgrades and technological innovations, forms a linchpin of its enduring relevance and viability. Developments geared towards enhancing scalability, efficiency, and overall network robustness serve to bolster trader confidence and augur well for Bitcoin’s future price potential.

In concert, these multifaceted factors coalesce to sculpt the intricate tapestry of Bitcoin’s price trajectory, underscoring the complex interplay of economic, technological, and regulatory forces shaping the digital asset landscape. As Bitcoin continues to carve out its place in the annals of financial history, a nuanced understanding of these myriad influences is indispensable for discerning investors navigating the tumultuous waters of cryptocurrency markets.

Overview

The Anticipation is Higher Than Ever!

As the countdown ticks down to less than two weeks before the highly anticipated Bitcoin halving event, a palpable sense of excitement engulfs the cryptocurrency market. With each passing day, anticipation mounts as participants eagerly await the potential impact this event could have on the future of Bitcoin.

The looming halving has become the focal point of discussions among investors, analysts, and enthusiasts alike. It marks a significant milestone in the Bitcoin ecosystem, as the reward for mining new blocks is set to be halved, reducing the rate at which new Bitcoins are created. This mechanism, built into Bitcoin’s protocol, occurs approximately every four years and is designed to control inflation and ensure the scarcity of the digital asset over time.

As the halving draws nearer, speculation abounds regarding its potential effects on Bitcoin’s price dynamics, market dynamics, and overall ecosystem. Some predict that the reduced supply of new Bitcoins entering circulation could drive up demand, leading to a surge in prices. Others speculate about the potential impact on mining operations, with concerns raised about the profitability of mining post-halving.

Investors are closely monitoring these developments, adjusting their strategies and positions in anticipation of potential market volatility. Traders are preparing for potential price fluctuations, seeking to capitalize on opportunities that may arise in the wake of the halving event.

Beyond the immediate market implications, the halving event also serves as a reminder of Bitcoin’s resilience and the community’s unwavering commitment to its principles. It underscores the decentralized nature of Bitcoin, with its monetary policy determined by code rather than the whims of any central authority.

In the midst of this excitement and anticipation, discussions about the long-term implications of the halving event are widespread. Some see it as a validation of Bitcoin’s value proposition as a hedge against inflation and economic uncertainty, while others view it as a crucial test of its ability to maintain its position as the leading cryptocurrency in the face of growing competition.

Regardless of the differing opinions and interpretations, one thing is certain: the Bitcoin halving represents a significant moment in the history of the cryptocurrency, with far-reaching implications for its future trajectory. As the clock ticks closer to the event, the excitement and anticipation continue to build, underscoring the dynamic and ever-evolving nature of the cryptocurrency market.