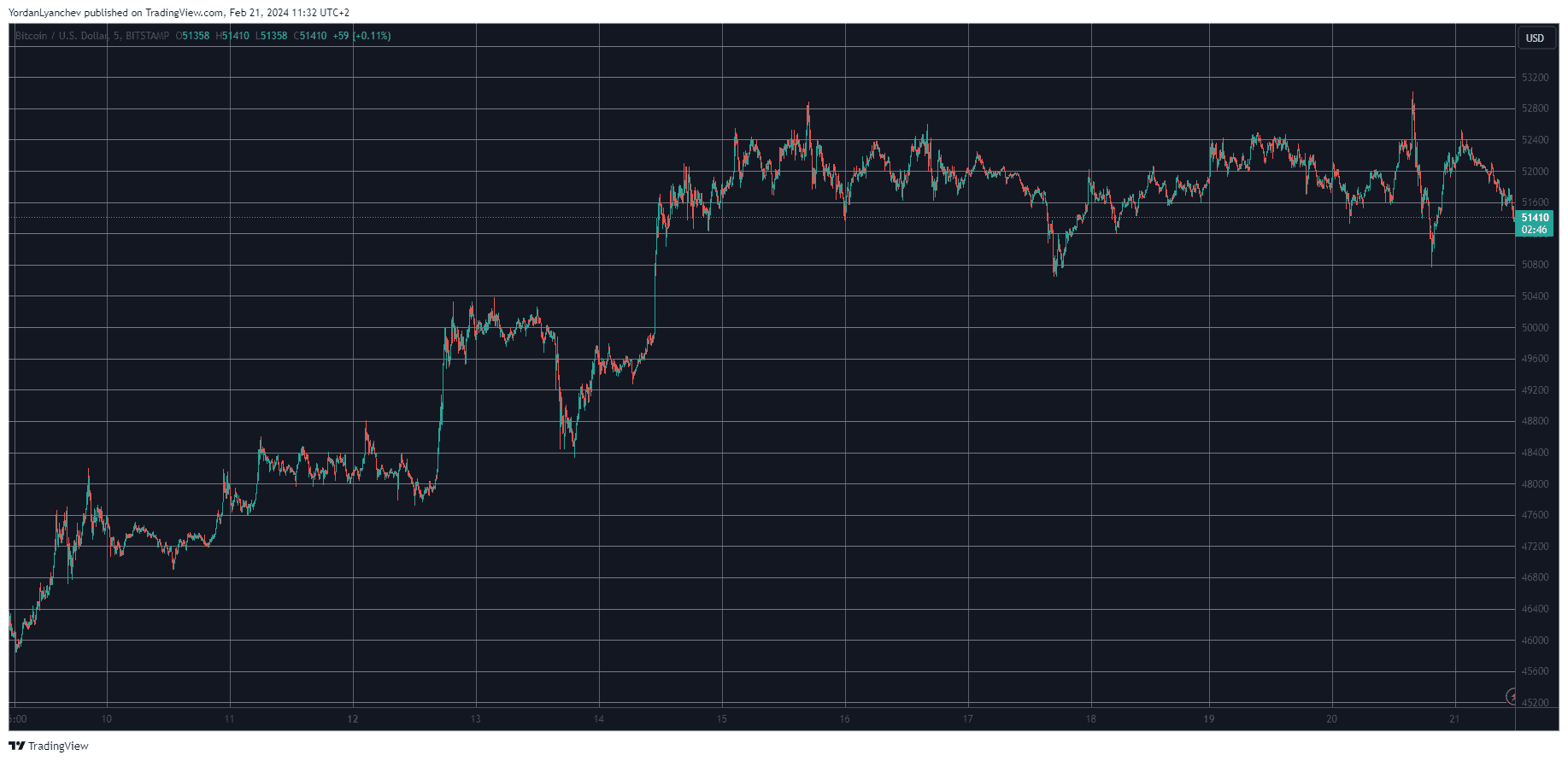

Yesterday, Bitcoin experienced a notable surge, climbing by several hundred dollars and reaching a milestone of $53,000, a level not seen in over two years. However, this achievement was short-lived as Bitcoin faced a sharp rejection at this crucial point, resulting in a significant pullback.

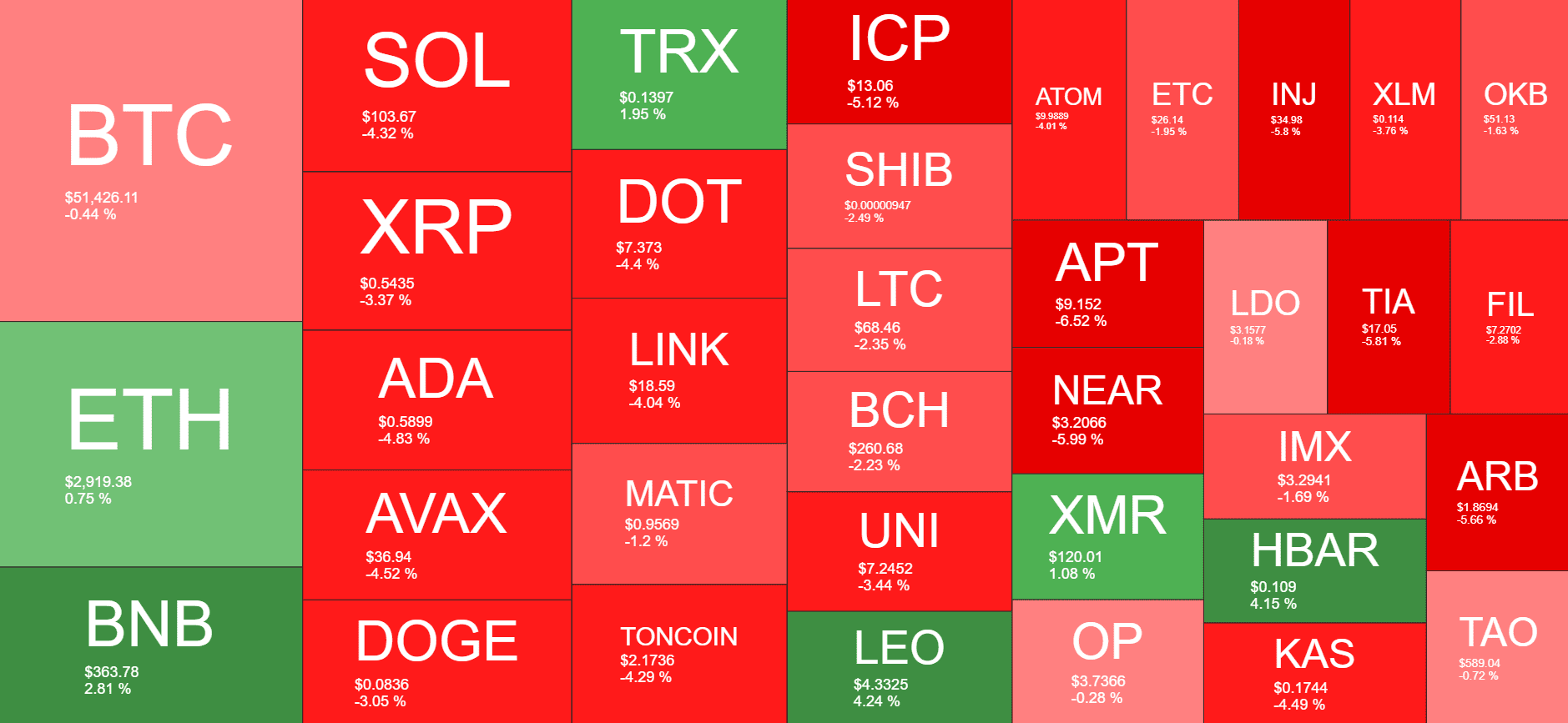

In tandem with Bitcoin’s volatile movement, many altcoins also witnessed declines on a daily basis. Notably, altcoins such as ADA, AVAX, SOL, ICP, APT, and others experienced substantial retracements, contributing to the overall downward trend observed across the cryptocurrency market.

Bitcoin Touched But Failed at $53K

Over the past few weeks, the leading cryptocurrency has showcased an impressive upward trend, surging from under $40,000 to surpassing $50,000. This surge coincided with the approval of spot Bitcoin ETFs in the United States, which attracted billions of dollars within the initial weeks of trading.

Despite multiple attempts, Bitcoin’s price struggled to sustain levels above $52,000 until recently. However, yesterday marked a significant breakthrough as the bulls initiated another rally, propelling Bitcoin’s price to touch $53,000 and marking a new high since late 2021.

However, this upward momentum was short-lived as bears swiftly intervened, resulting in a sharp decline in Bitcoin’s price by over $2,000 within a short span. Consequently, the cryptocurrency fell below the $51,000 mark.

Following unsuccessful attempts to recover losses, Bitcoin is currently hovering just above $51,000. The heightened volatility, coupled with the performance of alternative cryptocurrencies (altcoins), has led to nearly $300 million in liquidations within the past day, with long positions accounting for two-thirds of the total.

Furthermore, Bitcoin’s market capitalization is on the verge of dropping below the $1 trillion level, while its dominance over the altcoins remains steady at approximately 49.2%.

Alts in Retrace Mode

Yesterday, many alternative cryptocurrencies, or altcoins, experienced brief surges, including Ethereum. Ethereum, the second-largest digital asset, surged to just above $3,000 for the first time since April 2022. However, it has since retraced nearly $100 and is currently trading around $2,900. Meanwhile, Binance Coin has sustained its upward trajectory, witnessing a 2.4% increase to reach $362.

However, the majority of other major altcoins are currently facing losses. Cardano (-5%) has recorded the most significant decline among this group of assets. This is followed by declines in SOL, AVA, DOT, LINK, TON, ICP, APT, NEAR, and several others.

The total cryptocurrency market capitalization has also experienced a slight decline overnight and now stands at $2.050 trillion according to CoinGecko.