Over the past four days, the price of Bitcoin has surged to reach a new peak for 2024, tracing back to February 12th. This significant rise in value coincides with investors moving a staggering $1.6 billion worth of Bitcoin into long-term storage. The surge in buying pressure, particularly driven by investors flocking to newly launched spot ETFs, has propelled Bitcoin’s market capitalization by over $200 billion within the first half of February alone.

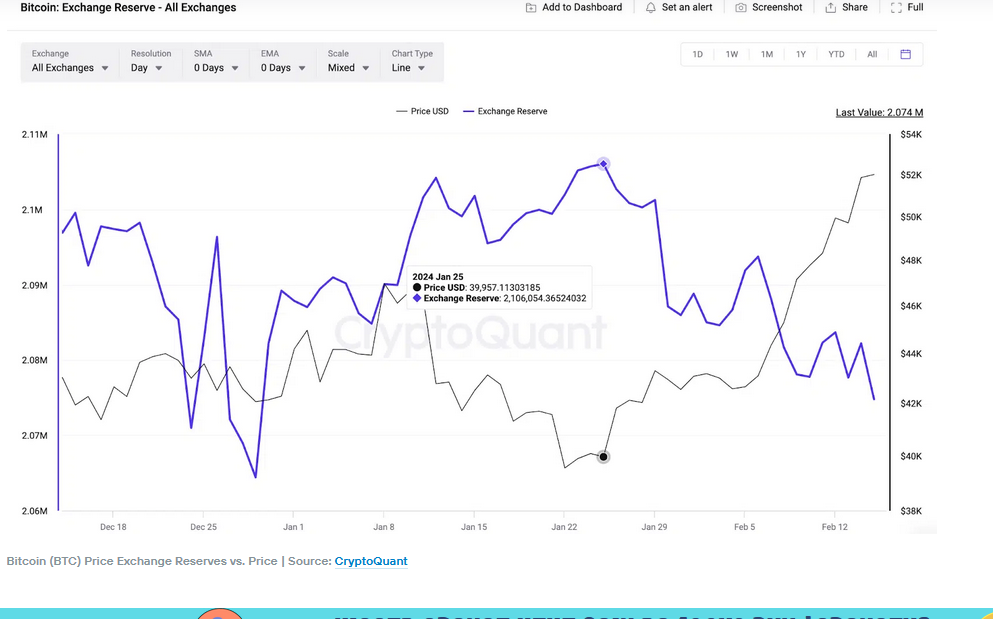

However, beyond the apparent excitement and record-breaking fund inflows, analyzing critical on-chain data trends suggests that the ongoing rally may have further room to grow. CryptoQuant’s exchange reserves metric, which monitors real-time changes in the number of BTC coins deposited on crypto exchanges and trading platforms, paints a revealing picture. On January 25th, Bitcoin exchange reserves stood at 2.1 million BTC. Yet, as of February 15th, this figure has dwindled by 31,255 BTC, indicating that just over 2 million BTC remain in exchange wallets. This translates to a disappearance of $1.6 billion worth of BTC from exchanges, with investors increasingly favoring long-term storage options.

Essentially, the significant decline in exchange reserves signifies a reduced supply of BTC available for trading on exchanges. While this situation may be temporary, it typically has a positive impact on short-term price action for various reasons. Firstly, it suggests that most investors are focusing on long-term investment strategies rather than seeking short-term gains by selling at current peak prices.

Furthermore, the relative scarcity resulting from the diminishing market supply tends to fuel an accelerated price upswing with each new wave of demand. Given the recent surge in buying activity from Bitcoin ETF sponsors, this bullish catalyst is likely to propel the BTC price towards the $60,000 milestone in the coming days.

Looking ahead, the market scarcity induced by the decline in exchange reserves positions the BTC price favorably for another upward movement towards $60,000. However, in the short term, bullish traders may encounter resistance around the $55,500 level.

IntoTheBlock’s in/out of the money (GIOM) data further sheds light on potential obstacles. It reveals that a significant cluster of BTC holders, totaling 462,640 addresses, acquired 228,000 BTC at a minimum price of $55,595. These holders may pose a roadblock if they decide to book profits as Bitcoin approaches its break-even price.

Nevertheless, if the bulls manage to overcome the $55,500 resistance, a retest of $60,000 could be on the horizon. On the downside, a dip below $45,000 could invalidate the bullish prediction. However, a support buy-wall may emerge from the 898,470 addresses that acquired 509,330 BTC at an average price of $46,400, potentially triggering a rebound in a bearish reversal scenario.