Recent on-chain data indicates a significant buying spree by Bitcoin whales over the past week, signaling potential bullish momentum for the cryptocurrency’s value.

In recent times, Bitcoin whales have acquired over 100,000 BTC.

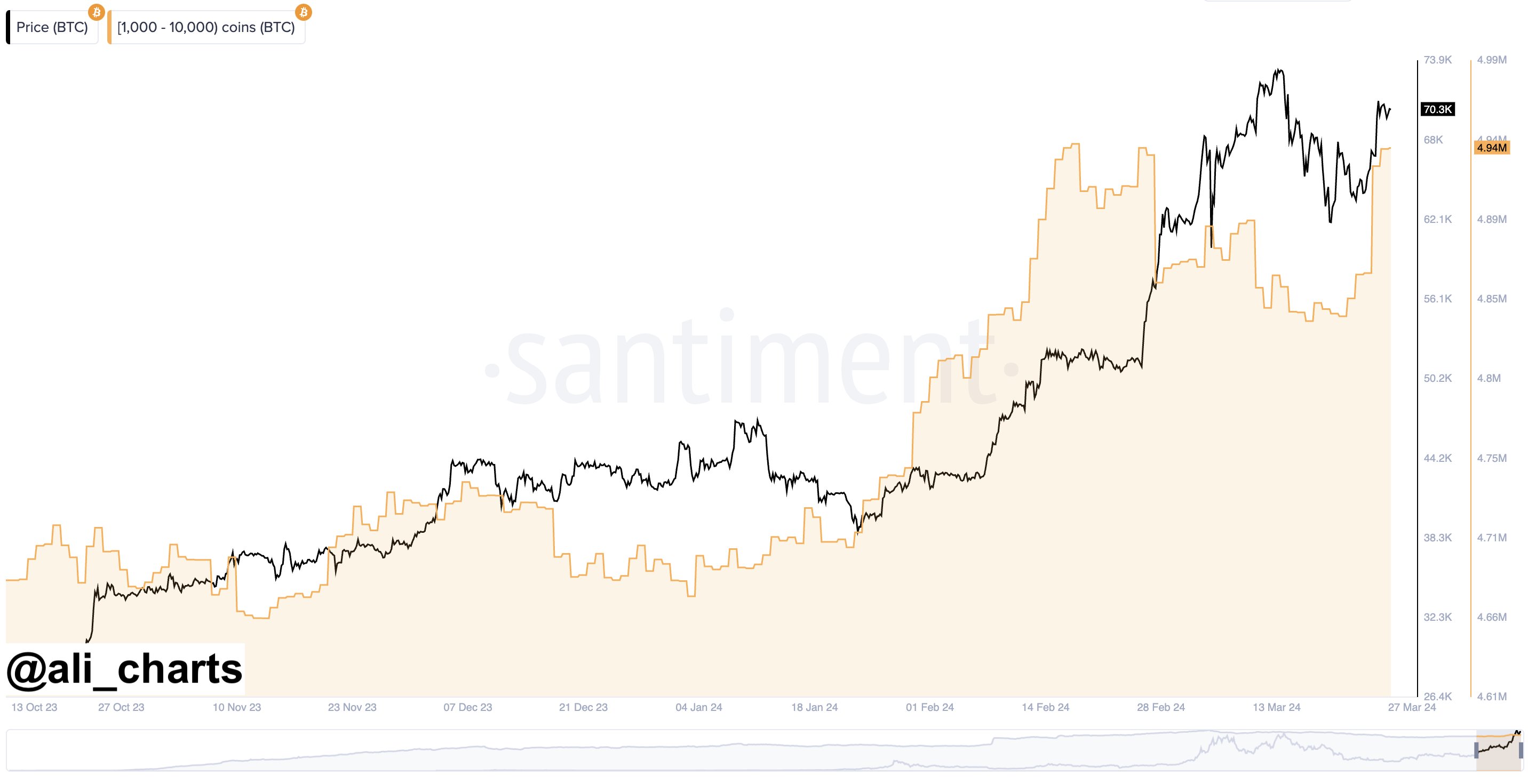

Analyst Ali, in a recent post on X, highlighted a significant trend regarding Bitcoin whales, who have collectively acquired more than 100,000 BTC within the last week. This observation is based on the “Supply Distribution” metric provided by the on-chain analytics firm Santiment. This metric offers insights into the total amount of Bitcoin held by various wallet groups within the market.

The “Supply Distribution” metric categorizes wallet addresses into different groups based on the quantity of Bitcoin they hold. For example, the 1-10 coins group comprises wallets holding between 1 and 10 BTC. However, the focus of attention in this context is on the whale cohort, which consists of entities possessing between 1,000 and 10,000 BTC.

The chart depicting the changes in the “Supply Distribution” for Bitcoin whales over recent months reveals a notable trend in their accumulation of BTC.

It appears that the metric’s value has surged in the past few days. (Source: @ali_charts on X)

The graph above illustrates a noteworthy increase in the total Bitcoin supply held by the group possessing 1,000 to 10,000 BTC over the past week or so. During this period of significant accumulation, Bitcoin whales have augmented their holdings by more than 100,000 BTC, equating to over $7 billion at the current cryptocurrency exchange rate.

This recent surge in whale accumulation commenced when Bitcoin was trading near recent lows, suggesting that these substantial investors perceived these price levels as opportune entry points, prompting them to make substantial purchases.

Coinciding with this accumulation, Bitcoin’s bullish momentum has been revitalized, propelling its price back above the $70,000 threshold. Given the proximity in timing, it seems plausible that whale accumulation played a role in driving this rally.

From the beginning of the year until the end of February, these massive holders had consistently increased their Bitcoin holdings, following an upward trajectory. However, as the rally progressed, these investors began succumbing to the temptation of profit-taking, transitioning toward a trend of net distribution instead.

However, with the recent surge in buying activity, not only has the trend of net distribution been reversed, but the Bitcoin whale supply has also reverted to levels reminiscent of those observed before the distribution initially commenced.

Should the Bitcoin whales maintain this buying momentum in the days ahead, it could potentially fuel further momentum in the ongoing rally, akin to earlier occurrences this year.

Subsequently, if the current trajectory persists, it could pave the way for a potential new all-time high, as Bitcoin is currently positioned close to achieving this milestone.

Bitcoin Price

As of the current moment, Bitcoin is hovering around the $71,000 threshold, marking an increase of over 11% over the past week.

The asset’s price seems to have been steadily rising in recent days. Source: BTCUSD on TradingView