Story Highlights

- Bitcoin Records Unprecedented Inflows Totaling $16.3Billion, Despite ETF Outflow.

- Nearly $900M Withdrawn, Reflecting Continual Decline in Grayscale Trust.

- Spot ETFs Fuel as Major Banks Witness Surge in Demand for BTC Investments.

Despite the recent outflows from US exchange-traded funds, Bitcoin aficionados remain resolutely undeterred, displaying a remarkable resilience as the largest cryptocurrency defiantly ascends once again above the prestigious $70,000 threshold. This resurgence not only underscores the unwavering confidence within the Bitcoin community but also serves as a testament to its enduring appeal and intrinsic value proposition.

Amidst this backdrop of unwavering optimism, the broader cryptocurrency landscape witnesses a profound upheaval, characterized by a surge in prices across various digital assets. Bitcoin, the undisputed leader of the pack, emerges as the primary beneficiary of this bullish sentiment, exhibiting an impressive gain of as much as 11.1%, propelling its valuation to an impressive $71,016.

This remarkable rally not only reflects the steadfast belief in Bitcoin’s long-term potential but also signifies a broader recognition of the transformative power of decentralized digital currencies. It demonstrates the growing acceptance and adoption of cryptocurrencies as legitimate assets within the global financial ecosystem, transcending mere speculative fervor to embody a paradigm shift in the way we perceive and interact with money.

Furthermore, the resurgence of Bitcoin serves as a poignant reminder of its resilience in the face of adversity, as it continues to defy skeptics and naysayers, reaffirming its status as a formidable force within the realm of finance and technology. With each new milestone reached and each obstacle overcome, Bitcoin reaffirms its position as a harbinger of change, driving innovation and reshaping the future of finance in its wake.

The resurgence of Bitcoin and the concurrent surge in cryptocurrency prices underscore the unwavering confidence and resilience of its supporters, while also highlighting the broader significance of digital assets in redefining the financial landscape. As Bitcoin once again crosses the $70,000 mark, it not only reaffirms its dominance but also heralds a new era of possibility and potential in the ever-evolving world of finance.

Unprecedented Capital Inflows

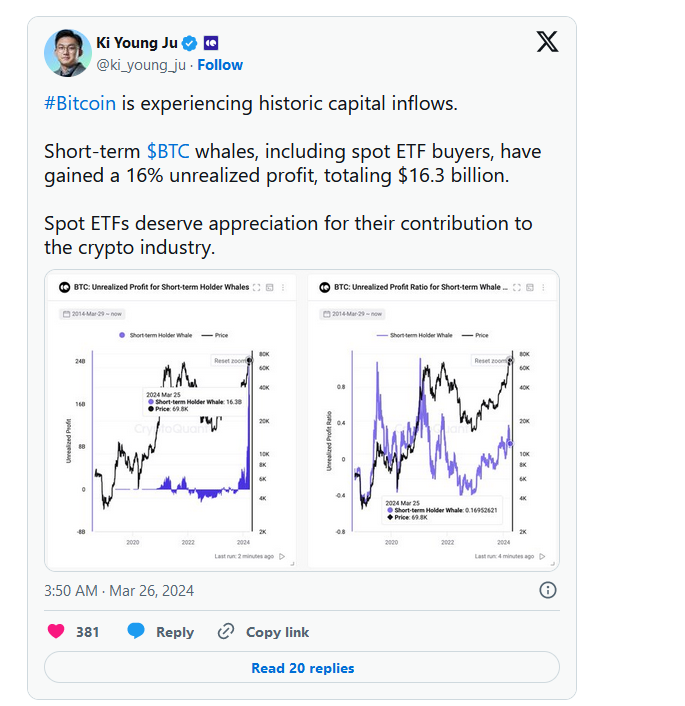

Bitcoin, the preeminent force in the world of cryptocurrencies, currently finds itself amid a remarkable surge in capital inflows, a momentous event underscored by the keen observations of Ki Young Ju, the esteemed CEO of CryptoQuant.

In a recent tweet that reverberated across the digital landscape, Ju shed light on the extraordinary ascent of short-term Bitcoin whales, a group that notably encompasses spot ETF buyers. Together, these formidable investors have orchestrated an awe-inspiring rise, amassing a collective unrealized profit of an astonishing 16%, an impressive feat that translates into a monumental $16.3 billion.

The significance of this surge becomes even more pronounced when considering the recent movement of funds within the cryptocurrency market. Over the course of the previous week, a formidable sum nearing $900 million has been extracted from these ETFs, a testament to a consistent pattern of funds migrating away from the once-revered Grayscale Bitcoin Trust. This trend, coupled with a palpable deceleration in subscriptions to offerings emanating from industry titans such as BlackRock Inc. and Fidelity Investments, serves as a compelling narrative of evolving investor sentiment and market dynamics.

But the narrative doesn’t end there. Delving deeper into the intricate fabric of Bitcoin’s market movements, data from Glassnode paints a vivid picture, revealing a net inflow of an astounding $4.4 billion in Bitcoin volume, further solidifying the notion of a burgeoning tide of capital flowing into the digital asset realm.

What emerges from this panorama is not merely a reflection of market metrics, but a profound testament to the resounding chorus of confidence that now resonates within the corridors of institutional and retail investors alike. Bitcoin, once viewed with skepticism by many traditional financial institutions, now stands as a beacon of opportunity, drawing the attention and investment of even the most discerning of market participants.

In this context, the surge in capital inflows serves as a clarion call, heralding a new era where Bitcoin, buoyed by growing interest and bolstered by institutional validation, ascends to even greater heights, reshaping the financial landscape and asserting its dominance as the cornerstone of the digital economy.

Spot ETFs: Empowering Investor Access

Ju’s insights into the impact of spot ETFs on the cryptocurrency industry are profound, shedding light on their pivotal role in democratizing access to Bitcoin and extending investment opportunities to a broader spectrum of investors. By facilitating easier entry into the crypto market, spot ETFs are instrumental in breaking down barriers and fostering inclusivity within the financial landscape.

Recent reports from QCP Capital further accentuate the significance of this phenomenon, revealing a remarkable surge in client demand for Bitcoin spot ETFs, particularly within the wealth management divisions of major banks. This surge is not confined solely to ETFs; there has also been a discernible uptick in requests for sophisticated structured products like Accumulators and FCNs. Such a surge underscores a burgeoning interest in cryptocurrency investments among institutional investors, signaling a shifting tide in the traditional finance sector towards digital asset adoption.

This surge in demand for BTC spot ETFs occurs amidst a backdrop of unprecedented institutional adoption and the gradual mainstream acceptance of cryptocurrencies as legitimate investment vehicles. Institutions are increasingly recognizing the potential of digital assets to diversify portfolios and generate alpha, prompting a strategic reevaluation of investment strategies.

The growing acceptance of BTC spot ETFs reflects a broader trend of convergence between traditional finance and the burgeoning crypto ecosystem. As institutional players seek exposure to digital assets, the demand for regulated and easily accessible investment vehicles like spot ETFs becomes increasingly pronounced. This trend not only validates the maturation of the crypto market but also signifies its integration into the broader financial ecosystem.

Furthermore, the rise of BTC spot ETFs is emblematic of a paradigm shift in investor sentiment towards cryptocurrencies. What was once perceived as a niche or speculative asset class is now gaining traction as a legitimate component of diversified investment portfolios. This shift in perception is fueled by increasing regulatory clarity, enhanced market infrastructure, and growing institutional confidence in the long-term viability of cryptocurrencies.

In essence, Ju’s insights underscore the transformative impact of spot ETFs on the crypto industry, highlighting their pivotal role in democratizing access to Bitcoin and catalyzing institutional adoption. As traditional finance continues to embrace digital assets, the demand for regulated investment vehicles like spot ETFs is poised to soar, further blurring the lines between conventional and digital finance.