Story Highlight

- BitMEX adds XRP for spot trading amid Ripple vs SEC lawsuit developments.

- BitMEX introduces XRP_USDT pairs, offering a seamless trading experience and free conversions.

- SEC faces a deadline on March 22 to submit the opening brief on remedies-related issues

In a strategic and noteworthy move that has sent ripples throughout the cryptocurrency landscape, BitMEX, widely regarded as a titan among cryptocurrency exchanges, has taken a bold and decisive step forward. It has made headlines by officially announcing the listing of XRP for spot trading, a move that reverberates with profound implications for both the exchange and the broader digital asset market.

This monumental decision by BitMEX comes at a pivotal moment, coinciding with a critical juncture in the long-standing legal battle between Ripple Labs and the formidable U.S. Securities and Exchange Commission (SEC). The timing of this announcement is particularly significant, as it underscores BitMEX’s confidence in XRP’s regulatory outlook and its unwavering commitment to providing its users with access to a diverse range of digital assets.

Meanwhile, all eyes are fixated on the SEC, which is poised to deliver a succinct but potentially game-changing opening statement regarding the proposed remedies on March 22. This eagerly anticipated event represents a pivotal phase in the ongoing legal saga, with the potential to reshape the regulatory landscape for XRP and other cryptocurrencies alike. The outcome of this statement could have far-reaching implications, not only for Ripple Labs and its XRP token but also for the broader cryptocurrency ecosystem as a whole.

The stakes are undeniably high, as investors, industry insiders, and regulatory observers alike await with bated breath to decipher the SEC’s stance and its potential impact on the market. Amidst this atmosphere of uncertainty and anticipation, BitMEX’s decision to list XRP for spot trading serves as a testament to the exchange’s confidence in the resilience and legitimacy of the digital asset.

As the cryptocurrency community braces itself for the unfolding developments, the significance of BitMEX’s move cannot be overstated. It symbolizes a pivotal moment in the maturation of the digital asset market, highlighting the growing acceptance and integration of cryptocurrencies within the mainstream financial ecosystem.

The convergence of BitMEX’s bold listing of XRP for spot trading and the impending statement by the SEC marks a watershed moment in the ongoing saga surrounding Ripple Labs and XRP. It is a testament to the dynamism and resilience of the cryptocurrency industry, as it navigates through regulatory challenges and strives towards greater mainstream adoption and acceptance.

BitMEX Listed XRP

In a recent groundbreaking update conveyed via an extensive blog post, BitMEX has unveiled its ambitious roadmap for expansion, poised to revolutionize the cryptocurrency trading landscape. At the heart of this strategic initiative lies the introduction of new spot trading pairs, none more eagerly anticipated than XRP_USDT. Commencing precisely at 04:00 UTC on March 20, BitMEX users will gain unprecedented access to a plethora of features, including seamless deposit, exchange, and withdrawal functionalities directly involving XRP within the platform’s ecosystem.

This bold integration of XRP into BitMEX’s comprehensive trading infrastructure represents a paradigm shift in the industry, promising unparalleled convenience and accessibility for traders worldwide. By seamlessly incorporating XRP into BitMEX’s user-friendly interface, traders can now navigate the volatile cryptocurrency markets with unprecedented ease, both on mobile and web platforms. Moreover, BitMEX’s commitment to democratizing access to digital assets is underscored by its provision of free conversion services, allowing users to effortlessly convert XRP into a diverse selection of over 30 cryptocurrencies.

This monumental announcement not only reflects BitMEX’s unwavering dedication to innovation but also signals a seismic shift in the cryptocurrency trading landscape. As the industry continues to evolve and mature, BitMEX’s pioneering efforts to integrate XRP into its ecosystem serve as a testament to its position as a trailblazer in the field. In an era defined by rapid technological advancement and transformative change, BitMEX’s bold move reaffirms its status as a leading force shaping the future of cryptocurrency trading.

Ripple vs SEC Lawsuit Key Update

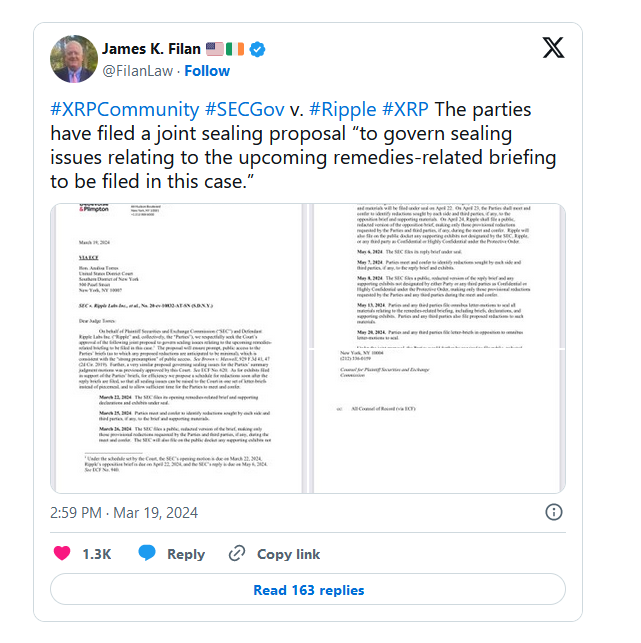

March 22 stands as a monumental date in the protracted legal showdown between the U.S. Securities and Exchange Commission (SEC) and Ripple Labs, as the SEC prepares to unveil pivotal opening briefs outlining proposed remedies in this fiercely contested case. Defense attorney James K. Filan has underscored the gravity of impending deadlines, with Ripple’s opposition brief due on April 22, followed by the SEC’s eagerly anticipated reply on May 6. Despite the ongoing legal wrangling, XRP’s trading volume has experienced a notable surge, though its overall performance has seen a 5.6% dip in the past 24 hours, echoing the broader downturn in the volatile cryptocurrency market.

In a development rife with implications, Filan has shared insights into a joint sealing proposal filed by both parties to address pressing sealing issues pertinent to the upcoming remedies-related briefing. This collaborative effort by the SEC and Ripple aims to expedite access to briefs while ensuring the requisite redactions are accommodated.

The courtroom drama between Ripple and the SEC now stands on the precipice of a pivotal phase, as the SEC is poised to lay bare its opening brief detailing remedies-related issues on March 22. Meanwhile, Ripple faces a tight deadline until April 22 to craft its opposition brief, with the SEC’s potential reply brief looming on May 6. This critical juncture in the legal proceedings holds immense weight, serving as a watershed moment in shaping Ripple’s defense strategy and the SEC’s relentless pursuit of remedies concerning alleged securities law violations.

Of paramount concern during this phase will be specific documents gleaned by the SEC through the discovery process, notably those concerning institutional sales contracts executed by Ripple post-lawsuit initiation. Ripple remains resolute in its preparedness to contest the SEC’s allegations, particularly challenging the classification of its transactions and vehemently asserting that its on-demand liquidity (ODL) transactions fall outside the purview of securities regulation.

Here’s the proposed schedule

- March 22, 2024: SEC files its opening remedies-related brief under seal.

- March 25, 2024: Parties meet to identify redactions needed.

- March 26, 2024: SEC files a public, redacted brief version.

- April 22, 2024: Ripple files a public, redacted version of its opposition brief unless it contains confidential information.

- May 6, 2024: SEC files its reply brief under seal.

- May 8, 2024: SEC files a public, redacted version of the reply brief.

In short, based on the timeline, parties and third parties will have ample opportunities to file motions and propose redactions. Ultimately, public, redacted versions of all documents must be filed within 14 days of the court’s rulings on sealing motions.

Market Response: XRP’s Price Movement

In response to recent shifts in the market, XRP has witnessed a notable surge in its trading volume, climbing by 138% amidst the broader downturn in market activity, ultimately reaching an impressive $3.96 billion. This surge has piqued the interest of investors, who are actively speculating on the underlying factors driving this substantial increase. Additionally, the emergence of XRP’s golden cross pattern has injected a sense of optimism into the market sentiment.

However, it’s crucial to approach these developments with caution, as XRP’s price has experienced a dip to $0.582 after reaching its recent highs, marking a decline of 4.59% within a 24-hour period. Investors are maintaining a vigilant stance, particularly as they monitor whether the price may weaken further, potentially dipping below the critical threshold of $0.57.

As of the latest update, XRP is currently trading at $0.5791, with a 24-hour trading volume totaling $3,989,148,687. Despite experiencing a slight decline of -0.87% over the past day, XRP continues to demonstrate resilience within the cryptocurrency market landscape.

Analyzing the relative strength index (RSI) provides further insight, with its current reading of 51.90 suggesting a state of neutrality, indicating no clear directional bias in XRP’s price trajectory. Given this scenario, it’s plausible that XRP could experience further declines in the near term, potentially revisiting the support level at $0.57. Investors are advised to closely monitor these developments as they unfold.