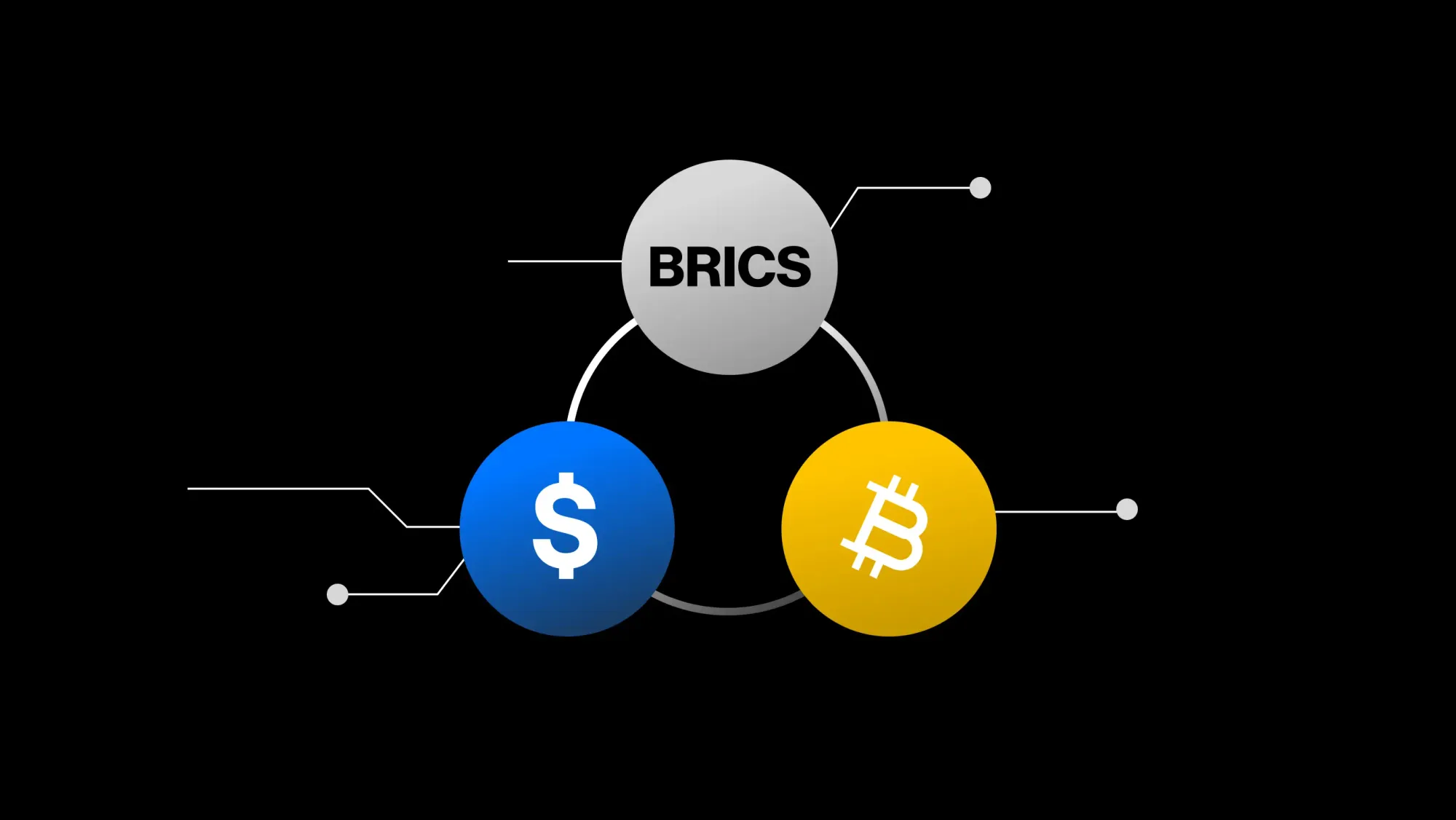

BRICS countries are poised to establish a self-reliant blockchain-driven payment platform, integrating digital currencies to facilitate seamless and economical international transactions.

Kremlin aide Yury Ushakov, in an interview with the Russian News Agency TASS, revealed this initiative, emphasizing the coalition’s aim to bolster financial independence from the US dollar by leveraging state-of-the-art digital and blockchain innovations.

Exploring the Fundamentals and Advantages of Blockchain-Based Payment Systems

A payment system built on blockchain technology is fundamentally structured to utilize decentralized digital ledgers for conducting financial transactions. This innovative system differs from conventional centralized models by distributing transaction records across a network of interconnected nodes, ensuring transparency, security, and immutability.

In essence, blockchain-based payment systems operate by recording transactions in blocks, which are then linked sequentially to form an immutable chain. Each block contains a collection of transactions, and once validated by network participants through a process known as consensus, it becomes a permanent part of the blockchain. This feature ensures that all transactions are securely recorded and cannot be altered without consensus from the majority of network participants.

Furthermore, blockchain-based payment systems often incorporate digital currencies or cryptocurrencies, which serve as digital assets for facilitating transactions. These currencies utilize cryptographic techniques to secure transactions and regulate the creation of new currency units.

By harnessing the power of blockchain technology and digital currencies, payment systems can offer various benefits:

- Transparency: Transaction records stored on the blockchain are transparent and accessible to authorized parties, promoting accountability and reducing the risk of fraudulent activities.

- Security: The decentralized nature of blockchain technology enhances security by mitigating the risk of unauthorized access and tampering with transaction data.

- Efficiency: Blockchain-based payment systems streamline transaction processes, leading to faster settlement times and reduced transaction costs, particularly for cross-border payments.

- Financial Inclusion: Digital currencies can expand access to financial services, especially for underserved populations without access to traditional banking infrastructure.

Overall, blockchain-based payment systems represent a significant advancement in the realm of financial technology, offering the potential to transform the way transactions are conducted and financial assets are managed on a global scale.

BRICS Countries Seek to Decrease Reliance on the USD

Ushakov’s emphasis on reducing the BRICS nations’ dependence on the US dollar underscores a significant shift in global financial dynamics. By prioritizing this objective within the newly proposed payment system, BRICS aims to mitigate vulnerabilities associated with overreliance on a single currency and foster greater financial autonomy.

The Contingent Reserve Arrangement (CRA) serves as a pivotal component of this strategy, offering member countries a safety net against external economic shocks. Ushakov’s statement indicates a concerted effort to bolster the CRA’s effectiveness by diversifying its currency reserves, thereby reducing exposure to fluctuations in the value of the US dollar.

The evolution of BRICS from its original composition of Brazil, Russia, India, and China to include additional members such as South Africa, Egypt, Ethiopia, Iran, and the United Arab Emirates reflects the coalition’s growing influence and ambition on the global stage. This expansion not only broadens the geographical representation of BRICS but also brings together countries with diverse economic strengths and geopolitical interests, further enhancing the bloc’s collective bargaining power.

The reported acceptance of Saudi Arabia’s invitation to join BRICS by Bloomberg and BBC underscores the coalition’s appeal and potential for further expansion. Saudi Arabia’s inclusion could significantly bolster BRICS’ economic clout and diversify its membership base, paving the way for deeper collaboration in areas such as trade, investment, and infrastructure development.

However, the conflicting reports from Reuters regarding Saudi Arabia’s acceptance highlight the complexities involved in diplomatic negotiations and the cautious approach taken by countries when considering strategic alliances. While the prospect of Saudi Arabia joining BRICS holds immense potential, it also underscores the need for thorough deliberation and alignment of interests among member states.

Ushakov’s statement and the ongoing discussions surrounding Saudi Arabia’s potential membership underscore BRICS’ commitment to reshaping the global financial landscape and advancing its collective interests in an increasingly multipolar world. As the coalition continues to strengthen its cooperation and diversify its strategies, it is poised to exert greater influence on global economic governance and promote a more equitable and resilient international financial system.