After the thrilling week of 2024, investors anticipated some selling, leading to Bitcoin dropping to $41,700. As of now, it has rebounded slightly to $42,400. What do the recent data suggest about the potential for another cryptocurrency upswing?

Is Bitcoin set to rise?

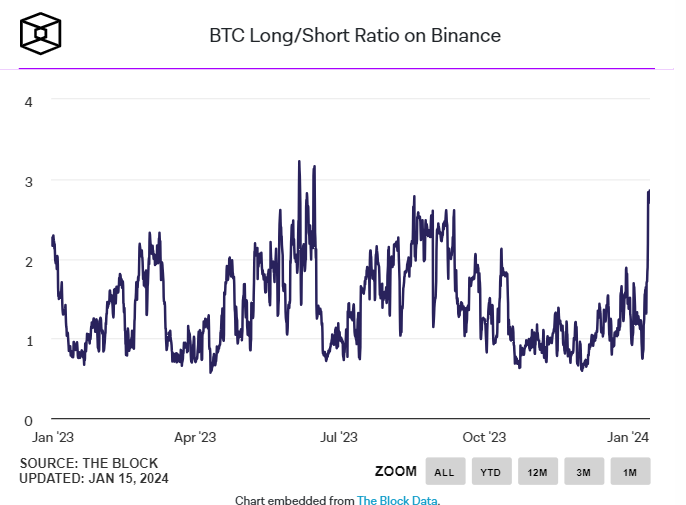

The spot price experienced notable fluctuations due to demand/sales in futures, and this trend is anticipated to persist. Presently, the long-short ratio in Binance Futures has reached its peak in recent months, indicating investor sentiment that a local bottom has been established post the recent decline. In essence, there’s an expectation of an upcoming increase.

The ratio, tracked by The Block’s Data Dashboard, has experienced a significant increase, accelerating to 2.86 after declining since the approval of various spot bitcoin exchange-traded funds. In a scenario with an equal number of investors in long and short positions, the baseline is 1. Therefore, a 2.86 ratio unmistakably indicates a robust anticipation of an upward movement.

Potential for an Increase in Cryptocurrencies Exists

The metric, having previously dropped to the 0.86 region, has now reached its highest level in recent months, signaling a promising recovery. Coinglass data supports this observation, with dominant long positions indicating a potential rise.

Coinglass’s current position data reveals a bullish stance from 42% of investors, while only 22% hold a bearish position, with the remaining percentage in neutral positions. However, caution is advised, as crowded market conditions sometimes lead to unexpected price movements contrary to expectations.

Speculative drops, driven by liquidation data attractive to market makers and large investors, have occurred before. Strong spot demand is crucial to counteract this trend. The possibility of ETFs gaining significant volume after the US stock markets open, coupled with potential positive news about ETF integrations and support, could offer essential spot support.

On the macro front, despite a negative outlook and a focus on profit-taking in the crypto market, a prevailing bullish trend in futures has not translated into a rise in BTC. While there are no major macro developments this week, attention is on a Fed meeting at the end of the month following unfavorable data.