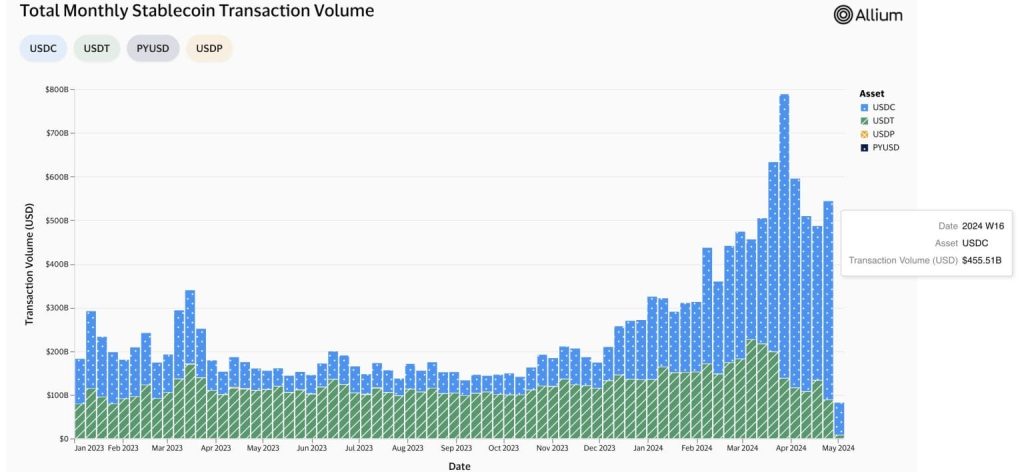

In a significant development within the stablecoin market, Circle’s stablecoin, USDC, has reached a significant milestone by surpassing Tether’s USDT in transaction volume. This noteworthy achievement was unveiled through data released by Visa on April 29, made possible by a partnership with Allium Labs.

The emergence of USDC as a leading player in the stablecoin arena marks a notable shift in the dynamics of the cryptocurrency landscape. With its transaction volume eclipsing that of USDT, USDC has solidified its position as a formidable contender in the stablecoin market.

This milestone underscores the growing prominence and adoption of USDC, reflecting its increasing utility and trust among users and institutions alike. As a stablecoin pegged to the US dollar, USDC offers stability and reliability, making it an attractive choice for various financial transactions and applications within the digital asset space.

The collaboration between Visa and Allium Labs has provided valuable insights into the transactional activity surrounding USDC and USDT, shedding light on the evolving dynamics of the stablecoin market. This data serves as a testament to the maturation and expansion of the stablecoin ecosystem, with USDC emerging as a frontrunner in transactional volume, rivaling and even surpassing established players like USDT.

The transaction volume of the USDC stablecoin reached $456 billion.

he latest adjusted stablecoin metric data provides compelling insights into the evolving landscape of the digital asset market, particularly highlighting the impressive performance of Circle’s USDC stablecoin. According to recent statistics, USDC has been steadily gaining market share, with its transaction volume reaching a staggering $456 billion in the previous week. This figure stands in stark contrast to Tether’s USDT, which recorded a transaction volume of $89 billion during the same period.

The substantial difference in transaction volumes between USDC and USDT underscores the growing prominence and adoption of USDC within the stablecoin ecosystem. This significant increase in transaction volume reflects the growing trust and utility of USDC among users and institutions alike, positioning it as a formidable competitor to established stablecoins like USDT.

Furthermore, the data reveals that USDC stablecoin has consistently maintained a significant market share, accounting for approximately 50% of total transactions since the beginning of the year. This remarkable achievement underscores the widespread acceptance and usage of USDC across various digital asset transactions, including payments, remittances, and decentralized finance (DeFi) activities.

The surge in USDC transaction volume and market share signifies its increasing role as a preferred choice for users seeking stability, transparency, and reliability in their digital asset transactions. As the digital asset market continues to mature and evolve, USDC is poised to play a pivotal role in facilitating seamless and efficient transactions within the global digital economy.

The report did not elaborate on the factors driving the surge in USDC transaction volume.

Although USDC transaction volume has risen, Tether remains the predominant player in the stablecoin arena, commanding a market share exceeding 68% and boasting a market capitalization exceeding $100 billion.

Crypto analyst Noelle Acheson provided Bloomberg with an exclusive analysis of USDC’s remarkable surge in transaction volume. Acheson pointed out that while USDT is predominantly utilized outside the United States as a dollar-denominated store of value, USDC stablecoin is primarily employed within the US as a medium of exchange.

Despite setbacks in US banking regulations in 2023, USDC’s growth is rebounding.

The surge in USDC volumes is part of a broader trend of increased adoption of stablecoins. This momentum was further bolstered by recent announcements from major players in the digital payments industry. Stripe, a prominent player in the realm of online payments, made headlines by reintroducing cryptocurrency payments, with a particular emphasis on USDC stablecoin. The planned integration of USDC payments into Stripe’s platform is scheduled for the summer of 2024.

Stripe’s move is just one example of the growing acceptance and adoption of USDC and other stablecoin assets in mainstream transactions. This trend was further underscored by PayPal’s recent launch of its stablecoin, PYUSD, and Shopify’s decision to embrace stablecoin payments.

In addition to these developments, Binance made waves in the cryptocurrency space by converting its $1 billion Secure Asset Fund for Users (SAFU) to USDC stablecoin on April 18th. This strategic move was aimed at enhancing the reliability of the fund and ensuring that the SAFU balance remains unaffected by market volatility.

These developments come at a pivotal moment as the US Congress deliberates on legislation pertaining to stablecoins. Many cryptocurrency enthusiasts see the potential for stablecoin adoption to pave the way for blockchain technology to revolutionize financial systems. By providing a stable and efficient means of value transfer, stablecoins have the potential to unlock new opportunities for innovation and growth in the financial sector.

READ MORE ABOUT: FDUSD stablecoin now integrates the Sui Blockchain after Ethereum and BNB chains.