Story Highlights

- Analyst Rekt Capital Cautions of Bitcoin Entering into “Danger Zone” Before Halving.

- Historical pre-halving trend suggests Bitcoin to face pullback ahead of bitcoin halving.

- As Bitcoin stands just 32 days away the price of Bitcoin saw a significant pull back 11%, trading at $68,533.

With the highly anticipated Bitcoin halving event looming ever closer on the horizon, the cryptocurrency sphere finds itself at a critical juncture, poised on the precipice of what renowned crypto analyst Rekt Capital ominously dubs the “Danger Zone,” a foreboding moniker that encapsulates the precariousness of the current market situation. In his latest analysis, Rekt Capital issues a stark warning, suggesting that Bitcoin’s trajectory over the next forty-eight hours could potentially lead it into treacherous territory fraught with uncertainty and volatility.

However, amidst the apprehension surrounding Bitcoin’s immediate future, a deep dive into historical data reveals a compelling narrative of resilience and cyclical patterns. Historical precedents suggest that Bitcoin has often exhibited a propensity for significant pullbacks following periods of heightened anticipation and market euphoria, offering a sobering reminder of the inherent volatility that characterizes the cryptocurrency landscape.

Meanwhile, the palpable sense of unease gripping investors and analysts alike is further exacerbated by recent developments in Bitcoin’s price action. Following a meteoric ascent to its latest All-Time High (ATH), Bitcoin recently retraced to $64,533, signaling a retreat from its lofty peak and igniting concerns about the sustainability of its upward trajectory.

Against this backdrop of uncertainty and apprehension, the cryptocurrency community finds itself embroiled in a maelstrom of conflicting emotions, with sentiments oscillating between cautious optimism and looming dread. As the countdown to the halving event ticks inexorably closer, market participants brace themselves for a tumultuous ride, acutely aware of the potential risks and rewards that lie ahead in this high-stakes game of crypto speculation.

In the midst of swirling speculation and conjecture, one thing remains abundantly clear: the impending Bitcoin halving event has cast a long shadow over the cryptocurrency market, serving as a potent catalyst for both excitement and trepidation. As the crypto community collectively holds its breath in anticipation of what the future may hold, only time will tell whether Bitcoin emerges unscathed from the crucible of uncertainty or succumbs to the perils lurking within the “Danger Zone.”

Bitcoin’s Pre-Halving Retraces

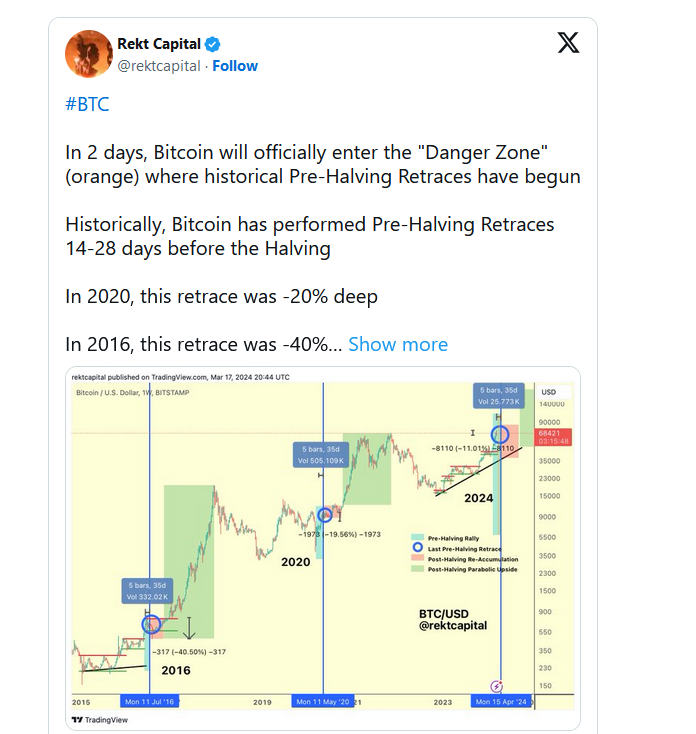

In a recent tweet, the esteemed crypto analyst Rekt Capital embarks on a deep dive into the intricate historical tapestry of Bitcoin’s behavior leading up to pivotal halving events, unveiling a discernible pattern that demands meticulous scrutiny and contemplation.

Across the annals of time, Bitcoin has woven a narrative characterized by a recurrent sequence of pre-halving retraces, typically manifesting within a nuanced temporal window spanning approximately 14 to 28 days preceding the onset of each halving epoch. These retracements, imbued with an air of significance and anticipation, have consistently presaged periods of substantial price corrections for the premier cryptocurrency, serving as an unmistakable omen heralding the imminence of the halving event itself.

Drawing upon a rich tapestry of historical data, Rekt Capital adeptly illuminates the landscape, casting a discerning eye upon pivotal junctures of past pre-halving retraces as instructive guideposts for the present. For instance, casting our gaze back to the fateful year of 2020, Bitcoin bore witness to a retracement of approximately 20% in the lead-up to the halving, a palpable correction that reverberated throughout the market, signaling the onset of heightened volatility and uncertainty.

Similarly, the halving event of 2016 bore witness to an even more pronounced retracement, with Bitcoin navigating a tumultuous path marred by a staggering correction of around 40%. This seismic retracement served as an indelible testament to the capricious whims of the market, offering a poignant reminder of the ebbs and flows that characterize the cryptosphere during such pivotal junctures.

In essence, Rekt Capital’s erudite analysis serves as a beacon of enlightenment amidst the tempestuous seas of market speculation, offering invaluable insights gleaned from the annals of Bitcoin’s storied past. As the cryptocurrency community braces itself for the imminent arrival of yet another halving event, the lessons distilled from these historical retracement patterns serve as a poignant reminder of the importance of remaining ever-vigilant and attuned to the nuances of market dynamics. For in the cryptosphere, where uncertainty reigns supreme, knowledge and foresight are the steadfast allies that guide us through the mists of uncertainty towards the shores of prosperity and enlightenment.

Bitcoin Current Scenario

With the countdown to the upcoming halving event ticking relentlessly, Bitcoin finds itself entrenched in a tempest of market movements that have sent shockwaves reverberating through the cryptocurrency landscape. As the halving event looms a mere 32 days away, recent fluctuations in the market have cast a pall of uncertainty over Bitcoin’s trajectory, intensifying concerns among investors and analysts alike.

In a stark testament to the volatile nature of the cryptocurrency market, Bitcoin has weathered a significant pullback of -11% in just the past week. This abrupt downturn has left market participants grappling with heightened levels of anxiety and apprehension, as they endeavor to decipher the underlying factors driving these tumultuous fluctuations.

At present, Bitcoin is trading at $68,533, a figure that underscores the profound impact of recent market movements on the cryptocurrency’s valuation. Against the backdrop of mounting uncertainty, stakeholders are left to navigate through a landscape fraught with volatility, where each price swing carries profound implications for the broader cryptocurrency ecosystem.

As Bitcoin hurtles towards the impending halving event, the stakes have never been higher. With every passing moment, the anticipation mounts, amplifying the significance of each market movement and setting the stage for a pivotal juncture in Bitcoin’s evolutionary journey.

Indeed, the countdown to the halving event serves as a poignant reminder of the relentless march of time and the ever-shifting dynamics of the cryptocurrency market. As investors and analysts brace themselves for the unknown, the resilience of Bitcoin and its ability to weather the storm of market volatility will undoubtedly be put to the test.

In essence, as Bitcoin stands on the precipice of a historic moment, the recent pullback in price serves as a sobering reminder of the fragility of market sentiment and the need for vigilance in navigating the turbulent waters of the cryptocurrency landscape. With each passing day, the countdown to the halving event continues, marking the inexorable march towards a future that remains shrouded in uncertainty yet brimming with potential.

Looking Ahead

Rekt Capital’s stark warning regarding the impending “Danger Zone” for Bitcoin serves as a poignant reminder of the intricate interplay between historical patterns and market behavior, encapsulating the gravity of the situation at hand. As Bitcoin teeters on the precipice of this potentially perilous territory, the significance of drawing insights from past precedents cannot be overstated, for it is through the lens of history that we may glean invaluable wisdom in navigating the uncertain terrain ahead.

The question looms large: will Bitcoin adhere steadfastly to the well-trodden paths delineated by historical patterns, or will it carve out a new trajectory, charting unexplored courses in the ever-evolving landscape of the cryptocurrency market? The answer remains shrouded in ambiguity, subject to the caprices of market sentiment and the unpredictable forces that shape it.

Yet, amidst the uncertainty that pervades, one immutable truth emerges: the impending days hold profound implications not only for Bitcoin itself but also for the broader cryptocurrency market ecosystem. The convergence of pivotal factors, combined with the looming specter of the “Danger Zone,” amplifies the urgency for stakeholders to exercise heightened vigilance and strategic foresight in navigating the tumultuous waters that lie ahead.

As Bitcoin stands at the nexus of history and possibility, the coming days will serve as a crucible in which its mettle will be tested, its resilience measured against the backdrop of unfolding events. With each passing moment, the stakes heighten, the tension mounts, and the trajectory of Bitcoin and the broader cryptocurrency market hangs in the balance.

In essence, while the future remains veiled in uncertainty, one certainty endures: the imminent days will be of paramount significance, shaping the course of Bitcoin’s journey and leaving an indelible imprint on the fabric of the cryptocurrency market for years to come. As we stand on the cusp of a defining moment in the annals of cryptocurrency history, let us heed the lessons of the past, navigate the challenges of the present, and chart a course towards a future defined by resilience, innovation, and possibility.