Story Highlights

- Pike Finance, a lending platform, suffered two hacks in 3 days, totaling over $1.8 million stolen.

- trader lost nearly $70 million in Bitcoin by accidentally sending it to a scammer’s wallet disguised as a legitimate address.

- This highlights the importance of being cautious with crypto transactions and avoiding phishing scams.

29th April to 4th May 2024

This week has proven to be an exceptionally tumultuous period within the realm of cryptocurrency, as a series of significant breaches and security lapses have jolted the community to its core. The reverberations of these events have been keenly felt, casting a shadow over the otherwise dynamic landscape of digital assets.

One of the most striking occurrences amidst this whirlwind of chaos has been the unfortunate saga of Pike Finance, which has found itself embroiled in not just one, but two breaches within an alarmingly brief timeframe. This alarming recurrence has sent shockwaves throughout the crypto space, prompting introspection and raising questions about the efficacy of security measures employed by platforms operating within this volatile ecosystem.

But the woes don’t end there. In a narrative that reads like a cautionary tale, a hapless trader has fallen prey to the nefarious machinations of a phishing scam, suffering significant losses in the process. This serves as a stark reminder of the ever-present dangers lurking in the digital domain, where anonymity and decentralization, while heralded as virtues, also serve as fertile ground for malicious actors seeking to exploit vulnerabilities for personal gain.

As the dust settles on these unsettling events, it becomes abundantly clear that the issue of crypto security demands urgent attention and concerted action. The sanctity of digital assets, upon which countless individuals place their trust and financial well-being, hangs in the balance, threatened by the specter of unscrupulous entities and inadequate safeguards.

Yet, amidst the chaos and uncertainty, there exists a glimmer of opportunity – an opportunity to learn, adapt, and fortify defenses against future incursions. These incidents serve as poignant reminders of the importance of vigilance, education, and collaboration within the crypto community. Only by uniting in purpose and resolve can we hope to navigate the treacherous waters of the digital frontier and emerge stronger, more resilient, and better equipped to safeguard the future of finance in the digital age.

A Detailed Recap

Pike Finance Suffers Double Attack

Within the domain of decentralized finance (DeFi), Pike Finance, a prominent lending platform, found itself thrust into the spotlight once more as it grappled with its second exploit in a mere three-day window. The repercussions of this latest breach were profound, with a staggering $1.68 million in losses incurred across multiple blockchain networks, including Ethereum, Arbitrum, and Optimism.

The assailant behind this audacious attack exploited critical vulnerabilities embedded within Pike Finance’s smart contracts, effectively commandeering control over the protocol’s output address. This strategic maneuver facilitated the illicit transfer of assets, with approximately $1.4 million worth of Ethereum, $150 thousand of Optimism’s native token (OP), and over $100 thousand of Arbitrum’s assets (ARB) falling into the hands of the perpetrator.

Of particular interest is the timing of this incident, occurring in the wake of a prior breach on April 26th, wherein Pike Finance sustained losses totaling $300,000. This disconcerting pattern underscores glaring inadequacies in the platform’s security infrastructure, raising serious concerns about its ability to withstand and mitigate malicious attacks effectively.

Yield Protocol: Vulnerable and Exploited!

In a sobering narrative of digital vulnerability, the once-operational DeFi lending platform known as Yield Protocol became the target of nefarious actors who capitalized on weaknesses within the Arbitrum blockchain. Despite its cessation of operations in December 2023, Yield Protocol found itself thrust back into the limelight as it fell victim to a calculated heist, resulting in the loss of approximately $181,000 worth of cryptocurrency assets, all stemming from vulnerabilities within its smart contracts.Upon closer scrutiny, investigations uncovered the intricate tactics employed by the attackers, who exploited anomalies within the pool tokens through the utilization of flash loan assets. This sophisticated maneuver not only underscored the intricacies of blockchain security but also served as a poignant reminder of the ever-present threat posed by malicious entities lurking within the digital realm. The incident laid bare the critical importance of implementing robust security protocols and fortifying defenses against such exploits, especially within the rapidly evolving landscape of decentralized finance.Compounding the gravity of the situation was the unfortunate reality that attempts to recover the pilfered assets proved futile. With Yield Protocol having shuttered its operations months prior, the absence of ongoing support further exacerbated the challenges faced in rectifying the aftermath of the breach. This stark revelation serves as a stark cautionary tale for both developers and users alike, underscoring the imperative of maintaining vigilance and ensuring the resilience of platforms in the face of emerging threats within the crypto ecosystem.

A Costly Mistake

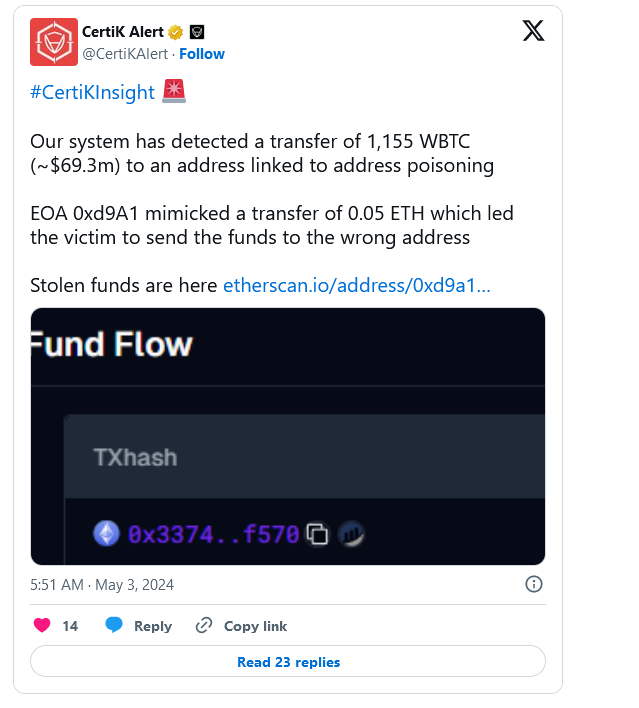

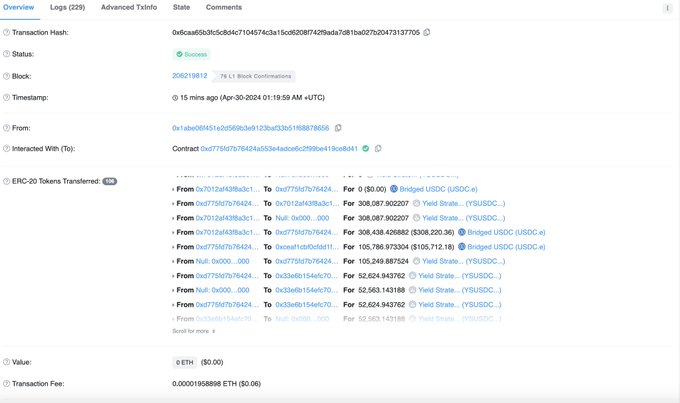

A particularly intricate case underscores the risks inherent in the cryptocurrency realm, as a user inadvertently transferred 1,155 WBTC (Wrapped Bitcoin) tokens to a malicious actor’s wallet, resulting in a staggering loss of $68 million. The aftermath of this grave error left the user’s wallet depleted, with over 97% of its holdings drained. What remained was a mere $13.56 worth of Ethereum, a fraction of the wealth once held.

The vulnerability exploited in this scenario was as cunning as it was devastating. By masquerading as a routine Ethereum transfer of 0.05 ETH, the attacker manipulated the victim into unwittingly dispatching a substantial quantity of WBTC tokens instead. This deception was made possible through the infiltration of the victim’s transfer history, allowing the perpetrator to convincingly present their wallet address as legitimate.

This sophisticated method of address poisoning, verified by esteemed blockchain security firms like CertiK, serves as a stark reminder of the critical importance of safeguarding cryptocurrency transactions against increasingly sophisticated phishing attacks. The incident underscores the necessity for users to exercise utmost caution and diligence in verifying the authenticity of recipient addresses, as well as implementing additional layers of security measures to mitigate the risk of falling victim to such nefarious schemes. In an environment where digital assets are constantly targeted by malicious actors, vigilance and proactive defense mechanisms are paramount in safeguarding one’s financial holdings from exploitation.