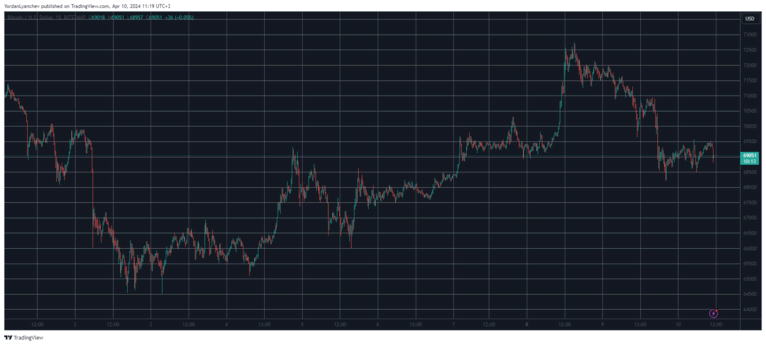

The upward trajectory of Bitcoin, which has captivated markets and investors alike, has encountered a formidable barrier within the past 24 hours. This unparalleled digital asset, revered for its meteoric rise, saw a significant reversal as its value plummeted below the psychological threshold of $70,000, subsequently descending even further, breaching the $69,000 mark.

This abrupt halt in Bitcoin’s rally has sent shockwaves through the cryptocurrency ecosystem, igniting speculation and analysis among traders and enthusiasts. The sudden downturn has prompted a flurry of discussions regarding the potential factors driving this downturn, ranging from market dynamics to regulatory developments and macroeconomic trends.

Adding to the intrigue, altcoins, the diverse array of cryptocurrencies beyond Bitcoin, have also found themselves caught in the undertow of this market correction. Notable among these are BCH (Bitcoin Cash), DOT (Polkadot), DOGE (Dogecoin), ICP (Internet Computer), RNDR (Render Token), WIF (Wrapped Bitcoin), and APT (Alpha Token), all witnessing substantial declines in value.

This retreat among altcoins serves as a stark reminder of the inherent volatility and interconnectedness within the cryptocurrency landscape. While Bitcoin often takes the spotlight, the movements of altcoins can provide valuable insights into the broader sentiment and direction of the market.

As traders and investors navigate these turbulent waters, attention turns to the underlying fundamentals and market dynamics that will shape the trajectory of cryptocurrencies in the days and weeks ahead. The resilience of Bitcoin and its counterparts will undoubtedly be tested as market participants assess the implications of this recent downturn and position themselves for potential opportunities that may arise amidst the volatility.

BTC Down to $69K

Last week, the cryptocurrency market experienced a seismic event as Bitcoin, the bellwether of digital assets, encountered a dramatic downturn. It plunged to a multi-day low, testing the nerves of investors as it hovered around the $64,500 mark. The volatility of the crypto space was on full display, with emotions ranging from panic to speculation running high.

However, just when it seemed like the bears had taken firm control, the bulls swiftly entered the fray, injecting a surge of optimism into the market. Their intervention sparked a remarkable turnaround, propelling Bitcoin on an impressive rally that saw it climb by a staggering $5,000 in a single day, a move reminiscent of the wild swings that have become synonymous with the cryptocurrency realm.

But the rollercoaster ride was far from over. Following this exhilarating ascent, Bitcoin encountered yet another bout of turbulence, experiencing a correction the very next day. Yet, resilience seemed to be the name of the game as the weekend approached. Despite the setback, BTC began to steadily regain its footing, clawing its way back to the $69,000 level once more, signaling a resurgence in confidence among investors.

As the weekend unfolded, Bitcoin faced a critical test. Would it be able to break through the psychological barrier at $70,000? Sunday brought anticipation, but ultimately fell short of this milestone. Yet, Monday ushered in renewed optimism as Bitcoin not only breached the $70,000 threshold but surged further ahead.

This bullish momentum propelled Bitcoin to tap into a four-week peak, reaching heights of over $72,500, defying expectations amidst a backdrop of weakening demand for spot ETFs. However, the euphoria was short-lived as the cryptocurrency market proved once again its propensity for volatility. Bitcoin struggled to maintain its upward trajectory, and as the day wore on, it began to gradually shed its gains.

Yesterday was a sobering reminder of the unpredictable nature of digital assets, as Bitcoin relinquished some of its recent gains. The early hours of today’s Asian trading session brought further disappointment for investors as another decline pushed BTC below the $68,500 mark, underscoring the ongoing turbulence in the market.

As of the latest update, Bitcoin finds itself trading around the $69,000 level, with its market capitalization experiencing a notable decline to $1.360 trillion. Despite the fluctuations, Bitcoin’s dominance over alternative cryptocurrencies remains just above 50%, a testament to its enduring significance within the broader crypto ecosystem.

The recent events in the Bitcoin market serve as a stark reminder of the inherent volatility and uncertainty that characterize the world of digital currencies. While moments of exhilarating rallies and soaring prices may capture headlines, they are often accompanied by sharp corrections and sudden downturns, highlighting the need for caution and resilience in navigating this ever-evolving landscape.

WIF Heads South

In today’s dynamic cryptocurrency landscape, the market paints a vivid picture of fluctuation and divergence, with only a select few defying the gravitational pull of the red. While the stalwarts like BNB, TON, and XRP carve their paths with gains hovering around the 1-3% mark, their counterparts seem to be engulfed in a sea of crimson.

The majestic Ethereum, often regarded as the beacon of decentralization, finds itself down by 2.5%, while SOL, AVAX, and SHIB follow suit, shedding a noticeable 1.5% each, as if dancing to the tune of market sentiment.

However, the symphony of losses crescendos with the likes of DOGE, ADA, DOT, and BCH, all registering declines of 3%, while BCH dares to plummet further, witnessing a significant 6% descent. Yet, the narrative does not end here; it delves deeper into the realms of price volatility, with the likes of WIF and APT taking the stage with staggering declines of 11% each, showcasing the fragility that sometimes lurks beneath the seemingly robust cryptocurrency ecosystem.

The haunting echoes of depreciation continue with RNDR and ICP, both echoing the same haunting melody of a 6.5% downturn, while STX and NEAR gracefully bow down to a 5% decline, as if paying homage to the fickle nature of market sentiment.

In the wake of this tumultuous performance, the cumulative market capitalization of all cryptocurrencies collectively retreats, relinquishing over $40 billion within a day. The air is thick with apprehension as this figure swells to more than $80 billion since the ephemeral peak witnessed on Monday, leaving investors grappling with uncertainty and volatility, the two constants in the ever-evolving saga of digital assets.